PHOTO

Abu Dhabi: Abu Dhabi Islamic Bank, a leading Islamic financial institution, has announced the release of its second ESG report emphasising the progress made on the bank’s Environmental, Social, and Governance (ESG) goals and commitments for the year 2022. The report also highlights a new three-year ESG strategy to integrate ESG risks considerations into the banking framework and support the UAE’s efforts to achieve the transition towards a more sustainable economy.

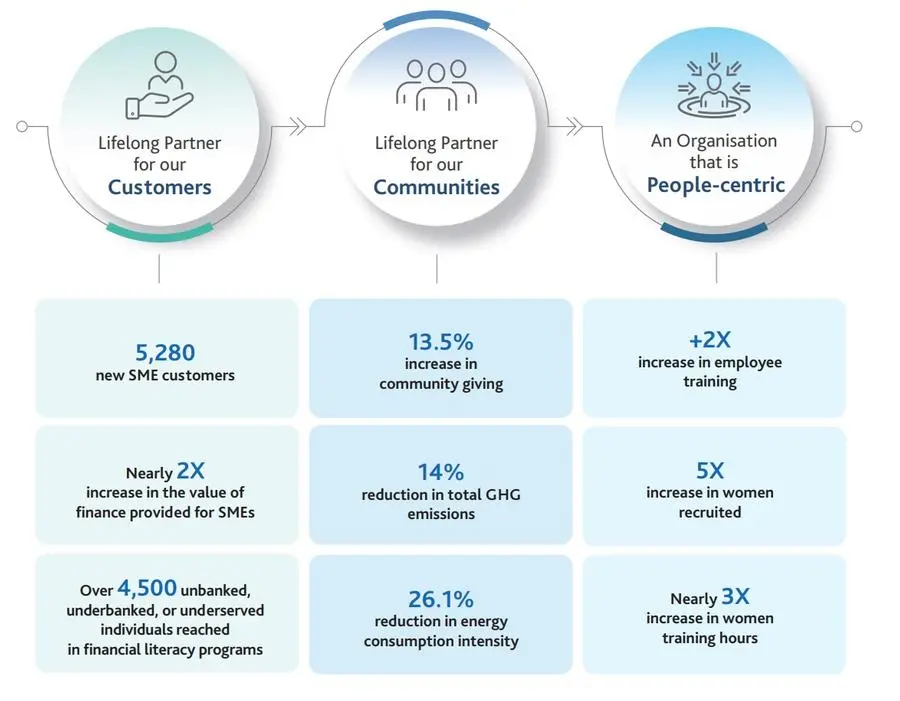

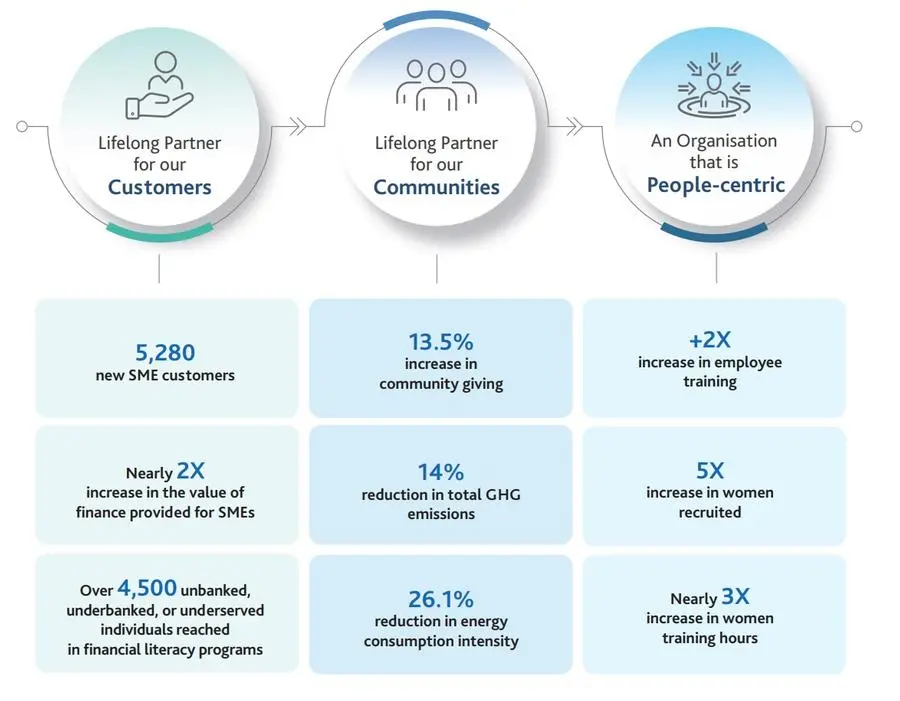

ADIB's sustainability journey is an integral part of its bank-wide strategy, and the 2022 ESG report provides a comprehensive evaluation of the progress made in various environmental, social, and governance related metrics, highlighting significant improvements made over the past year.

ADIB, in keeping with its pledge to support the local community and promote economic growth in the UAE, invested AED 23 million in community development initiatives, and provided an impressive AED 1 Billion in SME financing in 2022. Around 60% of the bank's funding portfolio was low or medium risk according to ESG standards, maintaining a stable and secure financial position. Additionally, in accordance with the UAE's nationalisation strategy, the bank maintained one of the highest Emiratisation ratios, now rising to 45%. This was coupled with steady progress in strengthening women’s representation in executive roles, where women now represent 39.4% of ADIB’s entire workforce. To further assist UAE nationals and provide young people with greater access to essential financial services, ADIB continued to focus on the younger generation through its Amwali product, making ADIB the first Islamic digital bank targeting youth from 8 to 18 years old, resulting in around 13.5 thousand new youth accounts being opened in 2022.

Nasser Al Awadhi, Group Chief Executive Officer at ADIB said: “As a leading Islamic bank, our commitment to a sustainable future is embedded in our strategy and plans. There is an inherent link between sustainability and Islamic finance, as both share the fundamental principle of promoting ethical and responsible financial practices.”

“Our adherence to Islamic finance principles aligns with the core values of sustainability, promoting ethical and responsible financial practices, transparency, accountability, and risk management. We are proud to present our second edition of the ESG report, outlining our three-year ESG strategy integrated into the banking framework, and supporting the UAE's transition towards a more sustainable economy. This report reflects our commitment to enhancing our social and environmental impact and ensuring continued success as a responsible and ethical financial institution." he added.

The new three-year ESG strategy prioritises accelerating ADIB’s Green Financing and Investing initiatives. The bank has already made significant strides in this area, having allocated $1.7 billion towards sustainable project financing under green financing. Additionally, ADIB has obtained six LEED green building certificates and saved an impressive five million papers through its Al Ghaf paperless program in 2022. The bank has made significant progress in reducing its carbon footprint, reporting a 26% reduction in energy consumption intensity last year.

ADIB has been rated A by the MSCI ESG index and was most recently recognized as the best Islamic bank for ESG by Global Finance magazine. The bank’s commitment to sustainability is deeply rooted in the bank's Islamic finance principles, which promote ethical and responsible financial practices, transparency, accountability, and risk management. By prioritising sustainability principles, ADIB aims to further enhance its social and environmental impact, align its operations with global sustainability standards, and ensure its continued success as a responsible and ethical financial institution.

-Ends-

About ADIB

ADIB is a leading bank in the UAE with more than AED 169 billion in assets. The bank also offers world-class online, mobile and phone banking services, providing clients with seamless digital access to their accounts 24 hours a day. ADIB provides retail, corporate, business, private banking and wealth management solutions. The bank was established in 1997 and its shares are traded on the Abu Dhabi Securities Exchange (ADX).

ADIB has presence in six strategic markets: Egypt, where it has 70 branches, the Kingdom of Saudi Arabia, the United Kingdom, Sudan, Qatar and Iraq.

Named World’s Best Islamic Bank by The Financial Times’ The Banker publication, ADIB has a rich track record of innovation, including introducing the award-winning Ghina savings account, award-winning co-branded cards with Emirates airlines, Etihad and Etisalat and a wide range of financing products.

For media information, please visit www.adib.ae or contact:

ADIB Edelman

Lamia Khaled Hariz Simon Hailes

Head of Public Affairs Director of Financial Communications