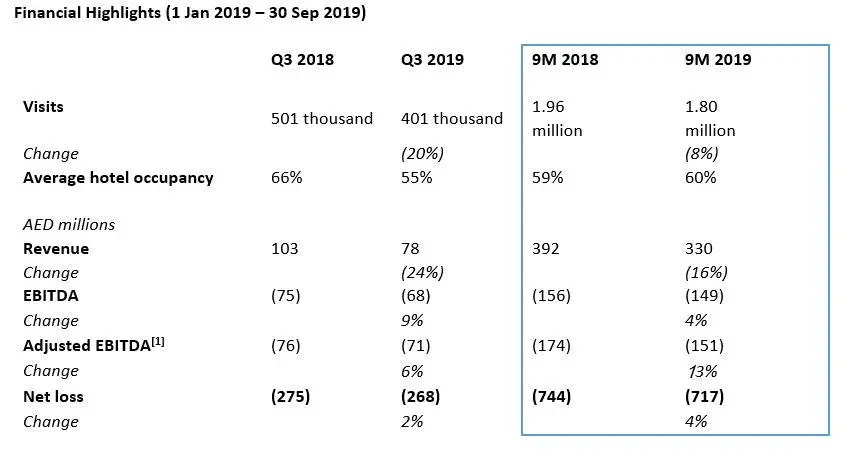

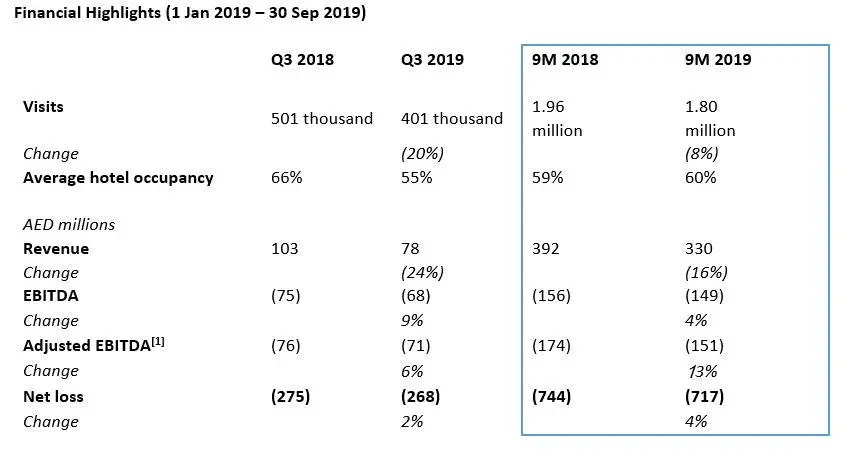

- 9M 2019 visitation was 1.8 million and Lapita hotel occupancy was stable at 60%

- Good progress towards delivering EBITDA breakeven with further operational efficiencies implemented in Q3 2019

9M 2019 Highlights

- 13% year-on-year improvement in 9M 2019 adjusted EBITDA loss due to the impact of cost optimisation initiatives and excluding a one-time gain of AED 17 million in relation to the contribution of land to the LEGOLAND® Hotel which was reported in the 9M 2018

- 9M 2019 operating costs (2) of AED 449 million, compared to AED 530 million in the 9M 2018, an improvement of 15%

- 9M 2019 revenue of AED 330 million, compared to AED 392 million in the 9M 2018, mainly due to lower visitation from the resident market

- Total visits in the 9M 2019 were 1.80 million, compared to 1.96 million in the same period last year; international visitors represent 42% of the visitor mix

- Strategic review of cost base concluded with further operational efficiencies implemented in Q3 2019. Full impact to be realised in the coming year and in support of the strategy to deliver EBITDA breakeven during H2 FY2020

[1] EBITDA adjusted to exclude one-time and non-recurring charges and income

2 Operating costs comprise salaries and other employee benefits, marketing and selling costs and other expenses including but not limited to utilities, operator and intellectual property costs. Operating costs exclude depreciation and amortisation.

DXB Entertainments PJSC (DFM: DXBE) announced today its financial results for the nine months ended 30 September 2019, reporting AED 330 million in revenues, 1.80 million visits and 60% occupancy at the Lapita™ Hotel.

Adjusted EBITDA loss of AED 151 million shows an improvement of 13% for the first nine months of 2019, compared to the same period last year, a reflection of the company’s efficiency programme with further cost savings identified and implemented during the third quarter of 2019. Operating costs for the 9M 2019 period were AED 449 million, compared to AED 530 million in the 9M 2018, an improvement of 15%.

Theme park revenue during the third quarter was AED 49 million with a revenue per capita of AED 122. Hospitality revenue totalled AED 15 million during Q3 2019 at an ADR of AED 421 reflecting summer yields.

Commenting on the 9M 2019 financial results, Mohamed Almulla, CEO and Managing Director, DXB Entertainments PJSC, said: “We have made good progress in further optimising our cost structure and creating a leaner and more efficient business. Consequently, adjusted EBITDA loss improved by 13% to AED 151 million for the first nine months of 2019, which is in line with our EBITDA breakeven strategy.

“We are on track with the enhancement works at MOTIONGATE™ Dubai and Bollywood™ Parks Dubai, which are expected to be completed in H1 2020. The enhancements will benefit our visitors by offering a broader choice of entertainment and thrill rides and are expected to increase dwell times and drive repeat visitation.

“We are ramped up for a busy Q4, with a great line up of activities and special promotions to celebrate the holidays.”

During the year MOTIONGATE™ Dubai was awarded the best theme park and LEGOLAND® Water Park was awarded the best water park in the UAE at the Time Out Kids Awards 2019.

For further information, please contact:

Abdul Rahman Al Suwaidi, Investor Relations Manager, DXB Entertainments PJSC

+97148200820

IR@dxbentertainments.com

Anca Cighi, Senior Director, FTI Consulting

+97144372111

anca.cighi@fticonsulting.com

DXB Entertainments PJSC

DXB Entertainments PJSC is the Dubai-based owner and operator of Dubai Parks and Resorts, the region’s leading integrated leisure and entertainment destination. The Company is traded on the Dubai Financial Market (DFM) under the trading symbol “DXBE”. We bring together a portfolio of world-class brands to offer entertainment in the areas of theme parks, retail and hospitality.

For more information, go to: www.dxbentertainments.com

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.