PHOTO

- FY25 revenue up 36.9% to AED 3 billion, with EBITDA up 23.5%

- Q425 delivered Presight’s strongest fourth quarter organic revenue growth to date and the second highest quarterly organic growth rate since IPO

Abu Dhabi, UAE: Presight AI Holding PLC (“Presight” or the “Company”; ADX: PRESIGHT) today announced its financial results for the full year ending 31 December 2025, reflecting a year of strong growth in scale, international reach, and strategic impact, as the Company continued to apply intelligence across sovereign and enterprise deployments to support long-term growth.

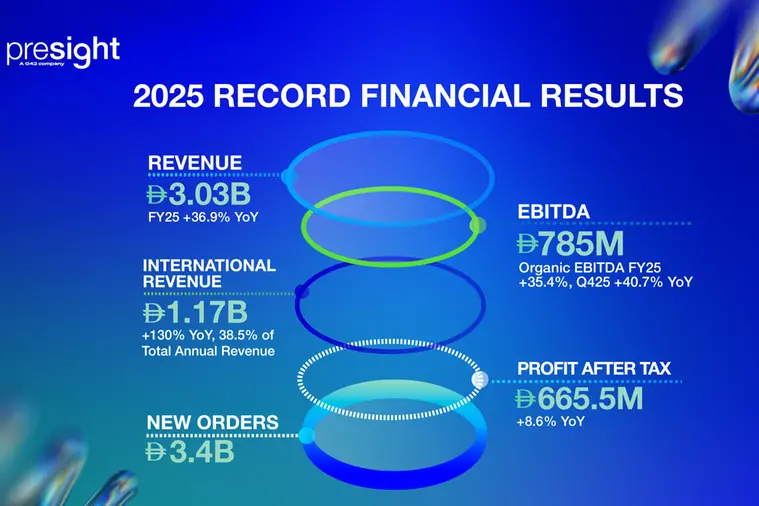

Presight reported revenue of AED 3.03 billion for FY25, representing growth of 36.9% year-on-year and exceeding company-compiled analyst consensus. Organic revenue grew 25%, reflecting continued execution across international multi-year deployments and sectoral diversification.

EBITDA rose 23.5% to AED 785 million, while profit after tax increased 8.6% to AED 665.5 million, despite the full-year impact of the UAE’s 15% corporate tax. On a like-for-like basis applying the prior-year 9% tax rate, profit after tax would have grown 16.7% year-on-year.

The fourth quarter capped a strong year, with revenue of AED 1.29 billion, up 23.6% year-on-year, and EBITDA of AED 407.6 million, up 11.3%, supported by a favourable organic deployment mix, continued international momentum, and disciplined execution across major programs.

International markets were an increasingly important driver of Presight’s growth in 2025. Revenue from markets outside the UAE increased 130% year-on-year to AED 1.17 billion, accounting for 38.5% of total annual revenue, compared with 23% in 2024. In the fourth quarter alone, international revenue rose 55% year-on-year and represented 46.5% of quarterly revenue, reflecting the strong demand for Presight’s sovereign AI deployment model across high-growth emerging markets.

His Excellency Dr. Sultan Al Jaber, UAE Minister of Industry and Advanced Technology, and Chairman of the Board of Directors of Presight, commented:

“Presight’s outperformance in 2025 shows what happens when clear strategy is matched by strong execution. As the UAE builds intelligence as national infrastructure, Presight is turning advanced AI into scalable systems that drive long-term growth and competitiveness.

The progress made this year, at home and abroad, lays a solid foundation for sustained growth and lasting value for shareholders, governments, and society.”

Thomas Pramotedham, Chief Executive Officer of Presight, said:

“This marks 12 consecutive quarters of strong growth for Presight since our IPO in 2023, a reflection of our robust business strategy, proven ability to deliver intelligence-led infrastructure at scale, and growing international presence.

“Looking ahead, we remain focused on scaling responsibly, deepening sovereign partnerships, and applying intelligence to deliver real and measurable outcomes for government and enterprise clients. With a strong backlog and balance sheet, we are well positioned to deliver future growth.”

Since its IPO in 2023, Presight has delivered sustained and profitable growth, notwithstanding significant greenfield expansion and strategic investment in innovation and talent. Over the past three years, Presight has achieved compound annual growth in revenue of 25%, with an average EBITDA margin of 27.7%.

Organic performance remained strong throughout the year. FY25 organic EBITDA increased 35.4% year-on-year, while Q4 organic EBITDA grew 40.7%, marking the strongest quarterly organic EBITDA performance since the Company’s IPO. Growth was supported by the execution of multi-year deployments across Jordan, Kazakhstan, and Albania, alongside continued expansion into emerging markets with strong demand for sovereign AI solutions.

Presight secured AED 3.4 billion in new orders during FY25, including AED 979 million in the fourth quarter. Closing backlog at the end of December 2025 was AED 3.4 billion, a 13% increase YoY and an 85.1% increase over the past three years.

The Company ended FY25 with a strong, debt-free balance sheet, providing financial flexibility to support continued investment in innovation, talent, and selective expansion opportunities.

Presight’s majority-owned subsidiary AIQ contributed materially to FY25 performance following a full year of consolidation. AIQ continued to strengthen its position in the energy sector, which remains a growth sector for the Company.

With a diversified international footprint, a growing base of multi-year contracts, and a strong innovation pipeline, Presight enters its next phase of growth with increased confidence in the durability and visibility of its earnings profile.

Building on its FY25 performance, Presight extended and upgraded its medium-term guidance for the period 2025 to 2029, targeting revenue CAGR of 20–25%, EBITDA CAGR of 23–28%, and profit after tax CAGR of 21–26%, reflecting confidence in the company’s growth model, backlog depth, and international momentum.

For more information about Presight please go to the investor relations section of the Presight website at https://www.presight.ai/ir/

About Presight

Presight is an ADX-listed public company with Abu Dhabi based G42 as its majority shareholder and is a leading global big data analytics company powered by AI. It combines big data, analytics, and AI expertise to serve every sector, of every scale, to create business and positive societal impact. Presight excels at all-source data interpretation to support insight-driven decision-making that shapes policy and creates safer, healthier, happier, and more sustainable societies. Today, through its range of GenAI-driven products and solutions, Presight is bringing Applied AI to the private and public sector, enabling them to realise their AI strategy and ambitions faster.

For further information, please contact Presight@edelman.com or media@presight.ai