PHOTO

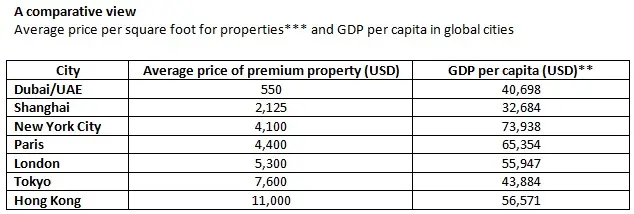

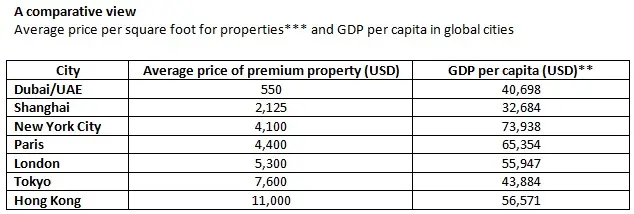

- With GDP per capita of US$40,698, cost of residential real estate in Dubai’s premier locations are extremely competitive compared to global city hubs; cost of Dubai’s prime real estate is also lower than most other global cities

Dubai, UAE: With its high gross domestic product (GDP) per capita and ambitious investments in building a world-class infrastructure, investing in premium residential real estate in Dubai guarantees strong returns for international investors, according to market experts.

A comparative study on the cost of residential real estate versus the GDP per capita in key city hubs globally has revealed that Dubai offers one of the most attractive value propositions for investors, who are seeking stable and growing returns. This is further underpinned by Dubai’s status as one of only 20 metropolitan areas* in the entire Middle East and Africa compared to 51 metro areas in the US, 43 in Western Europe, 25 in Advanced Asia Pacific, 20 in Emerging Asia-Pacific, and over 103 in China.

Between 2014 and 2016, the 300 largest metro areas identified by Brookings, accounted for 36% of global employment growth and 67% of global GDP growth. Further, about one-third of large metro areas in MENA are expanding employment and GDP per capita faster than their respective nations, highlighting the growth potential offered by metro areas such as Dubai.

With the cost of residential property in premier locations such as Dubai Creek Harbour and Downtown Dubai estimated at about US$550 (AED 2,020) per square foot, and the GDP per capita in the UAE at US$40,698**, analysts point out that the potential for growth for Dubai is significantly higher than other major city hubs.

Where will most of the growth happen?

Clearly, Dubai – despite its high GDP per capita – offers the most competitive residential real estate in its most premium destinations. This has further catalysed interest by high net worth individuals in investing in Dubai’s prestigious developments such as Dubai Creek Harbour, Downtown Dubai, Dubai Hills Estate, Dubai Marina and Emaar Beachfront, among others. This year, all residential destination launches in these developments recorded strong investor response, especially from international investors.

Dubai’s appeal for investors is also driven by its improvement in the ranking in terms of cost of living. According to Mercer's annual cost of living survey, Dubai no longer features in the world's 25 most expensive cities – having dropped from 19th to 26th position. Meanwhile, Hong Kong, Tokyo, Zurich, Singapore, Seoul, Shanghai and Beijing – cities that have high residential property rates – feature in the top 10 most expensive cities in the world.

Further, a report by New World Wealth analysing the top prime property hotspots as part of their Global Wealth Migration Review highlighted that the average cost of Dubai’s' prime real estate is among the lowest in the world, ranking at 34.

International and regional investors have a winning investment proposition in Dubai Creek Harbour, a one-of-a-kind modern master-planned destination located along the historic Dubai Creek in the heart of the city, and anchored by the new global icon, Dubai Creek Tower. It is only 10 minutes from the Dubai International Airport and the iconic Burj Khalifa by Emaar in Downtown Dubai, and next to the Ras Al Khor Wildlife Sanctuary, home to migratory birds including hundreds of pink flamingos.

Dubai Creek Harbour has over 7.3 million sq m of residential space, and nearly 940,000 sq m of retail space – including Dubai Square, the retail metropolis of the future also featuring the Middle East’s largest Chinatown. When completed, Dubai Creek Harbour will be home to over 200,000 people, a thriving economy that drives the tourism, retail and hospitality sectors of the city.

Downtown Dubai is another sought after destination underlined by icons such as Burj Khalifa, The Dubai Mall, The Dubai Fountain and Dubai Opera. The Dubai Mall welcomed over 80 million visitors for the fourth consecutive year establishing Downtown Dubai as the world’s most visited lifestyle destination.

-Ends-

For more information:

Kelly Home | Nivine William

ASDA’A BCW

+9714 4507 600

kelly.home@bm.com

nivine.william@bm.com

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.