PHOTO

Beirut:

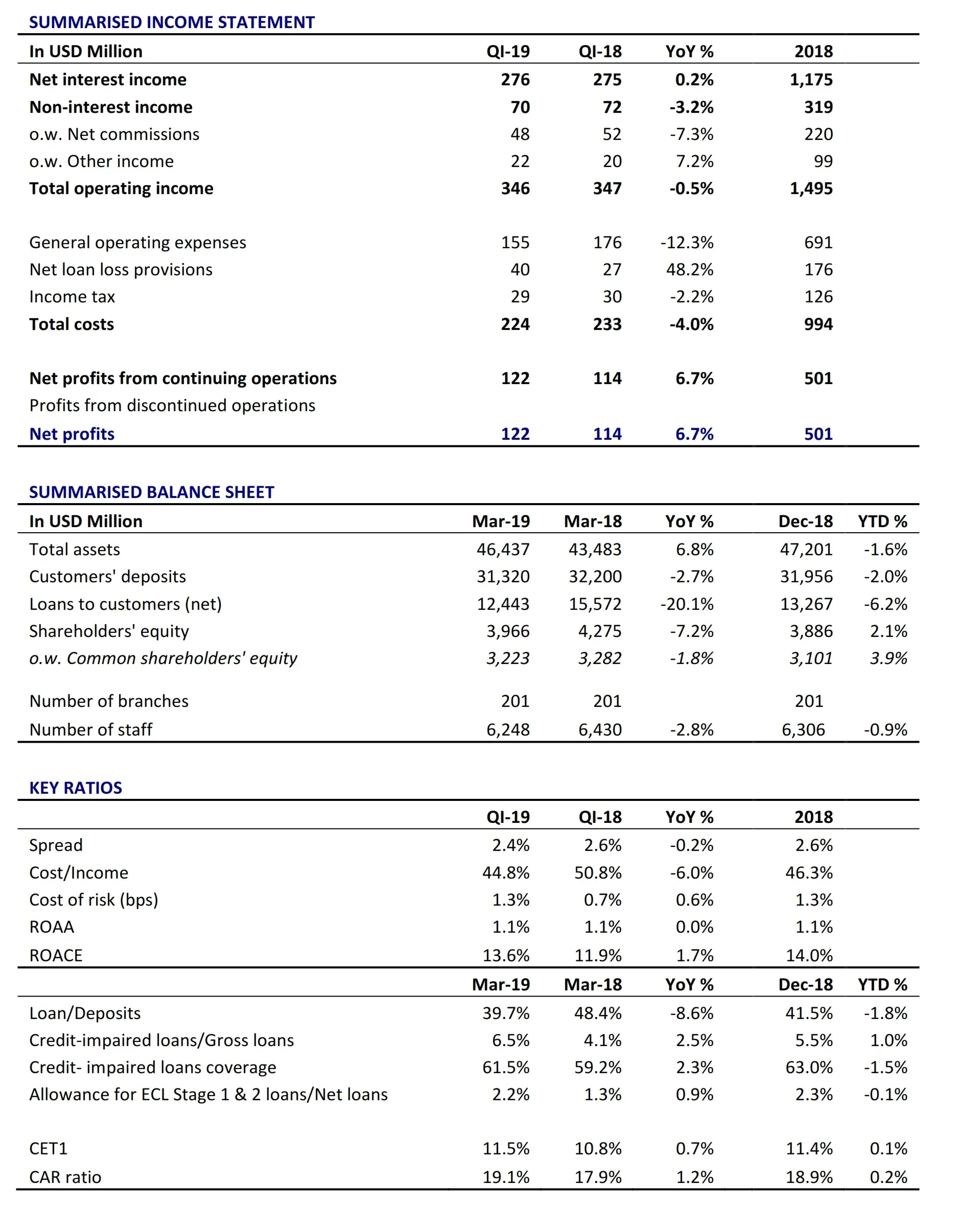

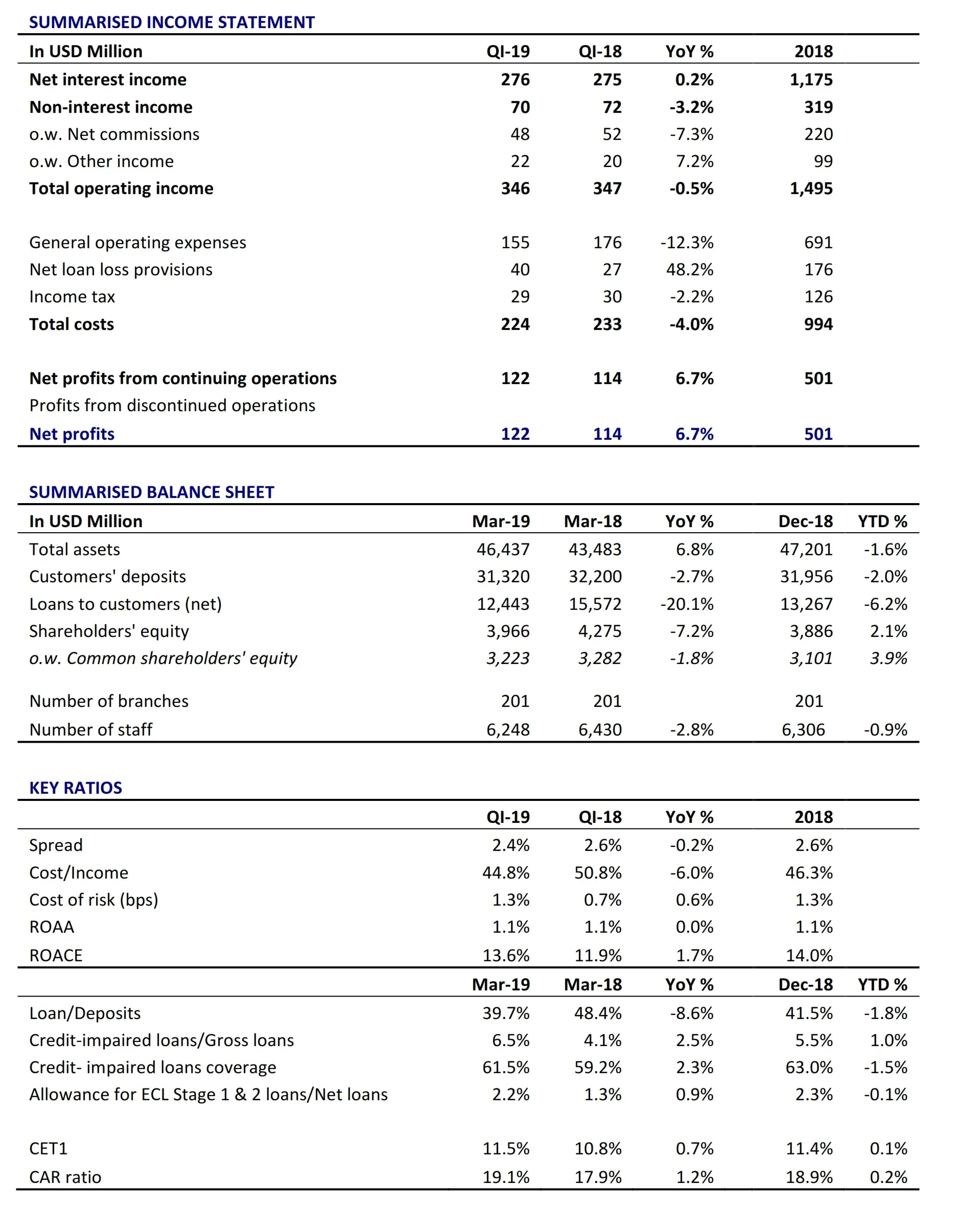

Key balance sheet metrics

- USD 46.4 billion of consolidated assets

- USD 31.3 billion of consolidated customers' deposits

- USD 12.4 billion of consolidated net loans

- USD 4.0 billion of total shareholders' equity, of which USD 3.2 billion of common shareholders' equity

- USD 122 million of net profits in the first quarter of 2019, of which USD 35 million of net profits generated from entities abroad

Financial Standing Indicators

- 6% of primary liquidity to customers' deposits ratio

- 1% of total capital adequacy ratio as per Basel III, of which 11.5% of CET1 ratio

- 5% of gross credit-impaired loans to gross loans ratio, covered up to 104% by specific provisions and real guarantees

- 2% of allowances for expected credit losses on performing loans (Stage 1 & 2) to net loans ratio post adoption of IFRS 9

- 6% of return on average common equity

The Lebanese economy has witnessed increasing pressure in the first quarter of 2019 mirrored at the level of banking activity

- Out of 11 real sector indicators, 7 have been on the decline in the first quarter, suggesting growing sluggishness in the real economy, with the real GDP growth outlook for 2019 standing at 1.3% as projected by the IMF.

- In turn, the evolution of banking aggregates followed the same trend due to the strong interlinkages with macro-economic indicators.

The MENAT region is further slowing down, with a 10-year growth bottom in Middle East and North Africa and a recession in Turkey, but Egypt remains booming driven by ambitious reforms and improving risk fundamentals

- Economic growth in the MENA region, which is largely shaped by the outlook for fuel prices, is expected to decline further to a 10-year low of 1.3% in 2019, as projected by the IMF.

- Strong economic momentum is continuing in Egypt on the back of a more attractive business and investment environment, enhanced external competitiveness and improved risk profile with better macro fundamentals, which augurs well for monetary and financial conditions.

- While Turkey tipped into recession this year to record a negative real output growth driven by its recent currency crisis, a recovery is expected in 2020, with real GDP growth forecasted at 2.6% as per IMF’s recently released Global Economic Outlook, which is expected to translate in a more positive outlook at the level of banking sector activity.

Sustained leadership in Lebanon and among the top 20 Arab banking groups

Consolidated assets of Bank Audi reached USD 46.4 billion as at end-March 2019, translating in Bank Audi sustaining its leading positioning among Lebanese banking groups and among the top 20 Arab banking groups. In parallel, consolidated assets under management, encompassing assets under management, fiduciary deposits and custody accounts, rose from USD 12.2 billion as at end-December 2018 to USD 12.5 billion as at end-March 2019, raising total consolidated assets and assets under management to USD 58.9 billion as at end-March 2019.

Continued consolidation policy in the Group's main markets of presence dictated by challenging conditions

Consolidated customers’ deposits amounted to USD 31.3 billion at end-March 2019, of which 32% accounted for by entities outside Lebanon. In parallel, consolidated loans to customers stood at USD 12.4 billion at the same date, of which 54% accounted for by entities outside Lebanon. Accordingly, those aggregates registered decreases relative to end-December 2018, due in particular to the adopted policy revolving around activity consolidation in main markets of presence, in particular in Turkey and Lebanon within challenging and deteriorating operating conditions domestically and regionally.

Asset quality

In the first quarter of 2019, the ratio of gross credit- impaired loans to gross loans moved from 5.5% as at end-December 2018 to 6.5% as at end-March 2019. Over the same period, Management allocated USD 40 million of net provisions for credit losses on loans, whereby the coverage ratio of credit-impaired loans by specific provisions and real guarantees reached 104% (of which 62% coverage by specific provisions). Allowances for expected credit losses (ECL) on performing loans (Stage 1 & 2) post adoption of IFRS 9 amounted to USD 272 million at end-March 2019, representing 2.2% of net loans. Total allowances for ECL Stage 1 & 2 assets as per IFRS 9 amounted to USD 344 million, representing 1.8% of consolidated credit risk-weighted assets and rising to 2.5% when accounting the excess provisions booked under provisions for risk and charges.

Improved financial flexibility in terms of liquidity and capital adequacy

Total shareholders' equity increased to USD 4 billion as at end-March 2019, of which USD 3.2 billion of common shareholders' equity. In parallel, the Bank's capital adequacy ratio as per Basel III further reinforced from 18.9% as at end-December 2018 to 19.1% as at end-March 2019, of which 11.5% of core equity Tier One ratio (CET1). Primary liquidity including placements with central banks and correspondent banks abroad sustained its high level, representing 81.6% of customers' deposits as at end-March 2019.

USD 122 million of net profits in the first quarter of 2019

Consolidated net profits of Bank Audi after provisions and taxes reached USD 122 million in the first quarter of 2019 compared to USD 114 million in the corresponding period of 2018, i.e. a growth of 7%. This performance is attributed to an optimisation of resources deployed and a reinforcement of the overall efficiency amid stable operating income generation.

This performance is in line with the adopted budget for the period encompassing reinforcing the performance of the various entities of the Group in the overall, while sustaining interest margin and generating savings in operating expenses. In the first quarter of 2019, consolidated general operating expenses decreased year-on-year by USD 21.6 million, with those savings generated across all entities of the Group. This translated in a net improvement in the Bank's consolidated cost to income ratio by 6% from 50.8% in the first quarter of 2018 to 44.8% in the first quarter of 2019.

1.06% ROAA and 13.6% ROACE

The ratio of return on average assets stood at 1.06% as at end-March 2019 while the ratio of return on average common equity reached 13.6%. In parallel, the earnings per common share on annual basis reached USD 1.14 while the book per share stood at USD 8.09.

Within the context of persisting tough economic conditions in Lebanon and the region, the main objective of Bank Audi remains to sustain the strong fundamentals and the financial flexibility of the Group. This should foster the Group’s ability to reap, with the prospective improvement of the overall conditions, opportunities for activity development in a manner to ensure value added for its various stakeholders, entailing both shareholders and customers (individuals and corporates) in the different countries of presence.

-Ends-

For more information:

Tamer Ghazaleh

Tel: +961 1 964 064

Group Chief Financial Officer

Email: tamer.ghazaleh@bankaudi.com.lb

Stay connected:

https://www.bankaudigroup.com

https://www.facebook.com/BankAudiLebanon

https://www.youtube.com/BankAudiGroup

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.