PHOTO

The UAE non-oil private sector economy saw a rise in business activity in December, supported by a faster upturn in sales and a strong increase in export demand. Nevertheless, job numbers continued to fall and at an accelerated rate, as backlogs declined, according to IHS Markit.

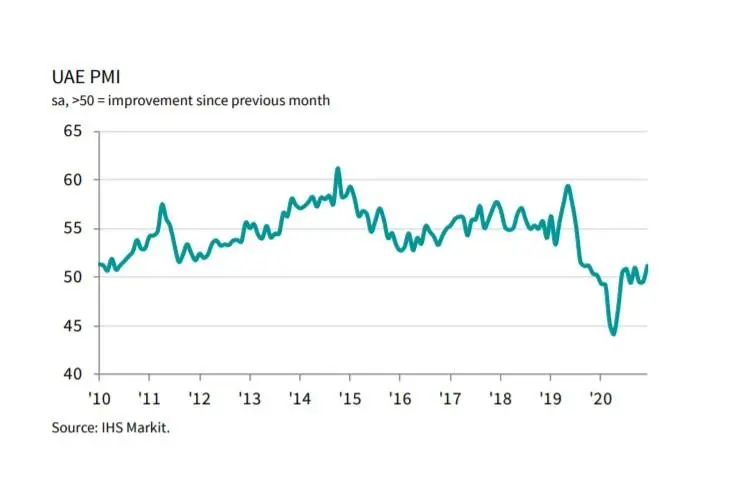

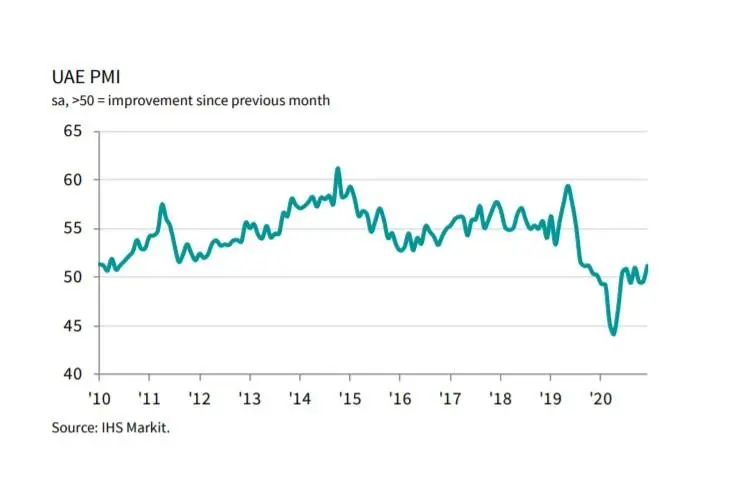

Its Purchasing Managers’ Index – a composite indicator designed to give an overview of operating conditions in the non-oil private sector economy rose from 49.5 in November to 51.2 in December, indicating an improvement in the sector's performance.

Price pressures remained weak in December, while the outlook for future activity improved only slightly from November's record low, according to the PMI survey conducted by IHS Markit.

Despite rising to its highest level for 16 months, however, the rate of growth signalled by the index was only mild, it said.

Output levels returned to growth territory at the end of the year. The latest data signalled a solid increase in non-oil activity that was the second-fastest since September 2019 (behind July's recent high). Firms related the surge in output to an improvement in market conditions and a sustained rise in client demand.

New business also rose in December, mostly due to an upturn to a solid rise in demand from abroad, particularly from Gulf countries, and the continued offering of price discounts.

"Rising output and new orders, particularly from abroad, were key drivers of the renewed improvement in non-oil business conditions in December," David Owen, Economist at IHS Markit, said.

Notably, new export orders grew at the strongest rate in 15 months.

At the same time, employment numbers continued to fall in December, with the rate of job shedding quickening from November. Firms reduced their workforces in each month throughout 2020. The latest fall came amid a drop in backlogs of work, the fourth in consecutive months, although the pace of depletion slowed again from October's recent record, IHS Markit said.

"However, the jobs market continued to act as a drag on the sector, as employment fell again at the end of the year. Moreover, the rate of job shedding quickened, as cash flow shortages meant some firms were unable to pay for new staff," Owen said.

According to the survey, the outlook for the next 12 months of activity picked up only slightly from November's record low. Most companies expect business activity to remain flat over 2021, despite hopes of a broad recovery in global economic conditions. Only 2 percent of respondents gave an optimistic outlook for the sector, IHS Markit said.

(Writing by Seban Scaria, editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021