PHOTO

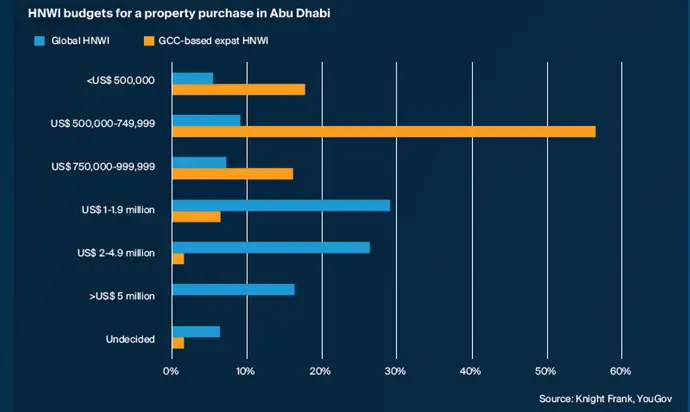

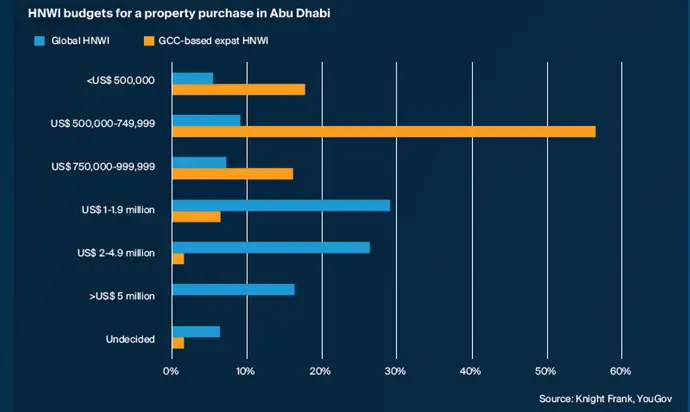

- Global HNWI have an average budget of US$ 3.4 million for a home in the UAE capital

- Global HNWI plan to spend an average of US$ 2.9 million on a home in Ras Al Khaimah

Dubai: High-net-worth-individuals (HNWI) around the world are prepared to spend US$ 408.3 million on residential real estate in Abu Dhabi and a further US$ 388.5 million in Ras Al Khaimah, according to global property consultancy, Knight Frank’s second annual 2024 Destination Dubai report.

Knight Frank has surveyed 317 HNWI – 217 around the world and 100 GCC-based HNWI expats – to gain an understanding of their attitudes, appetite and aspirations when it comes to investing in real estate in Dubai, Abu Dhabi and Ras Al Khaimah. Collectively, the HNWI respondents have a net worth of US$ 5.4 billion and own 1,149 homes around the world between them.

ABU DHABI

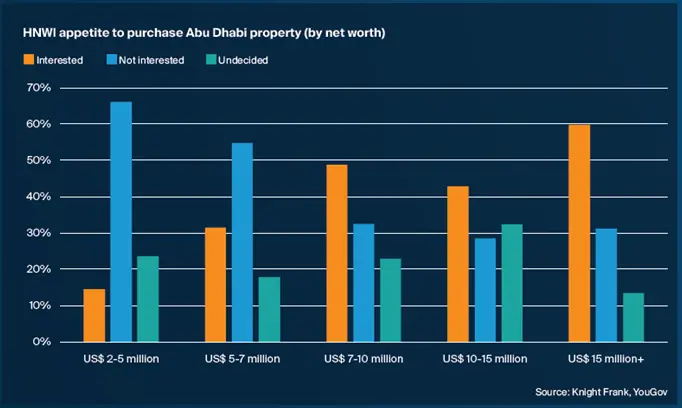

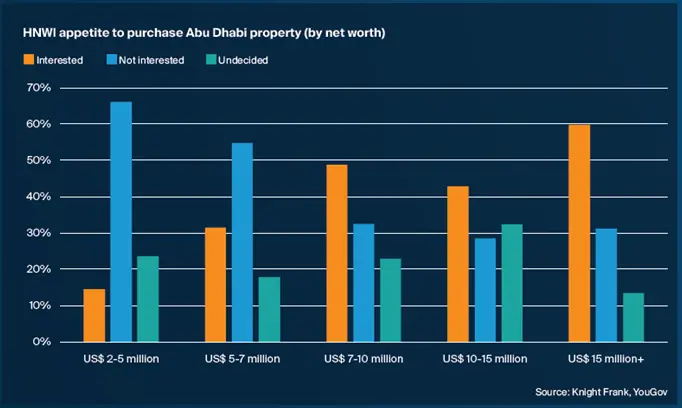

Knight Frank says HNWI demonstrate a modest appetite to purchase real estate in the UAE capital, with 23% indicating a desire to do so. This pattern quickly reverses as personal net worth rises. Indeed, while just 14% for those with a net worth of US$ 2-5 million are keen to purchase property in Abu Dhabi, 57% for those with personal wealth in excess of US$ 15 million would like to buy residential property in the UAE capital.

Furthermore, Knight Frank highlights the success of the ‘Visit Abu Dhabi’ campaign, with 50% of GCC-based expat HNWI and 67% of global HNWI with a net worth of over US$ 20 million indicating they have been positively influenced in the direction of visiting the city directly as a result of the global advertising efforts of the Department of Culture & Tourism, Abu Dhabi.

Shehzad Jamal, Partner – Strategy & Consultancy, MEA, explained: “Residential values in Abu Dhabi have remained relatively stable for the last four years, which has played a significant role in encouraging domestic buyers to transition from renting to owning. And with homes in Abu Dhabi trading for around AED 1,000 per square foot, they remain about one-third cheaper than Dubai, which is further adding to the appeal of home ownership in the city amongst domestic buyers. International buyers too have become increasingly active, contributing to the rising deal volumes now being recorded in the emirate.”

During 2023, Abu Dhabi registered a record 15,653 property deals (up 73.7% on 2022) totalling AED 87.1bn in property deals, across all sectors, up on the AED 61bn figure reached in 2022. Notably, the capital welcomed 1,098 non-resident investors in 2023, which represents a 175% increase on 2022.

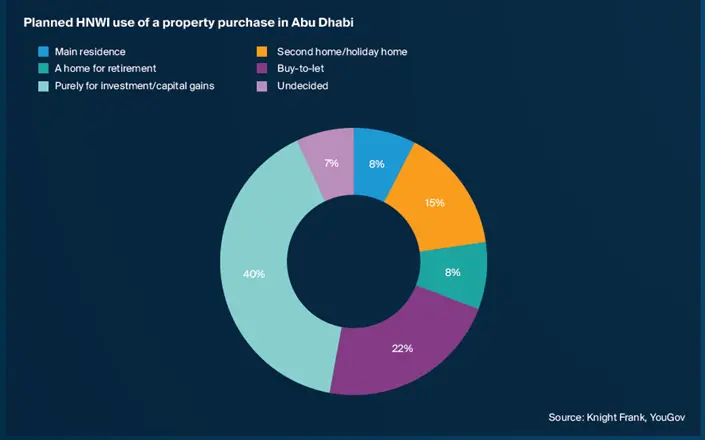

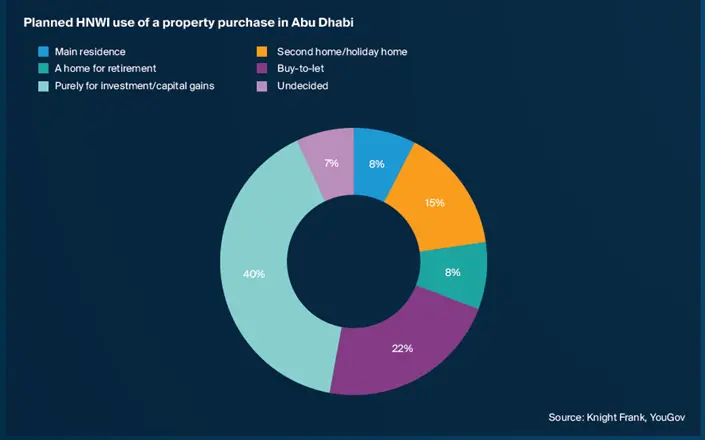

Faisal Durrani, Partner – Head of Research, MENA, said: “While 40% of HNWI plan to purchase in Abu Dhabi purely for investment reasons, 8% are keen on a primary residence in the city, while a further 15% would consider buying a second home in the UAE capital. This is watershed moment for the city, which has often trailed Dubai in this area.

“Furthermore, the sale of a Nobu-branded 3-bedroom penthouse in March represented a significant milestone for Abu Dhabi’s residential market. This is not only because it is the most expensive property ever sold in the capital – both in terms of absolute price and price per square metre – but also because it signals Abu Dhabi’s emergence as a magnet for global capital. Indeed, this is reflected in the fact that the total value of sales to international buyers not residing in the UAE has jumped from just 3% of all of Aldar’s home sales in 2021 to 28% last year”.

FAVOURITE HOT SPOTS IN THE CAPITAL

Abu Dhabi island (21%) commands the most interest in terms of locations for a property acquisition amongst HNWI despite not being designated as an investment zone for international buyers, says Knight Frank. Saadiyat Island, (16%) which is home to the F1 Grand Prix race each November, as well the Louvre and Guggenheim museums is named as the second most likely target neighbourhood for a real estate purchase.

Jamal added: “Villas on Saadiyat Island have performed well over the last 12 months, with prices rising by 10% over the last 12 months. However, prices have been hovering at a glass ceiling of around AED 1,500 psf for over three years, which may indeed be why buyers are so keen on this location. By contrast, villa prices on the Palm Jumeirah in Dubai currently stand at around the AED 7,000 psf mark”.

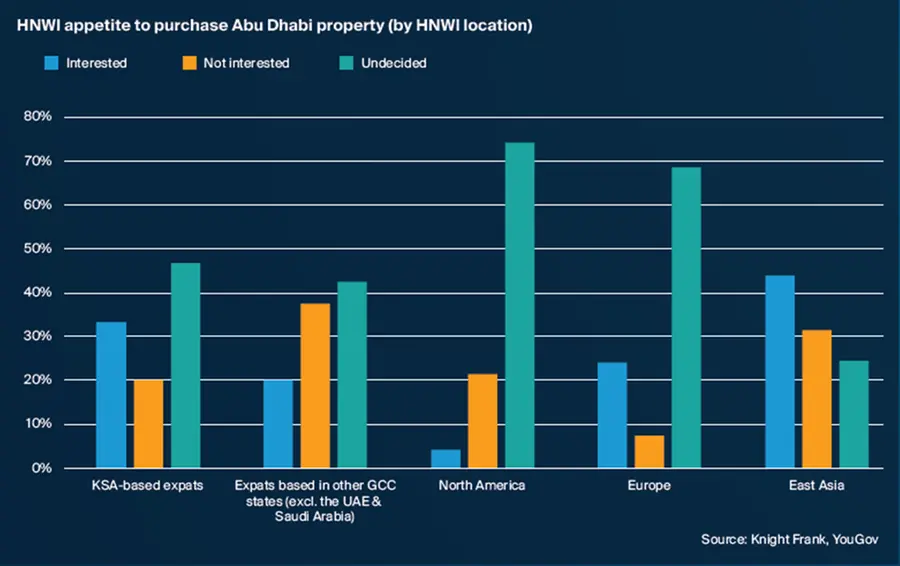

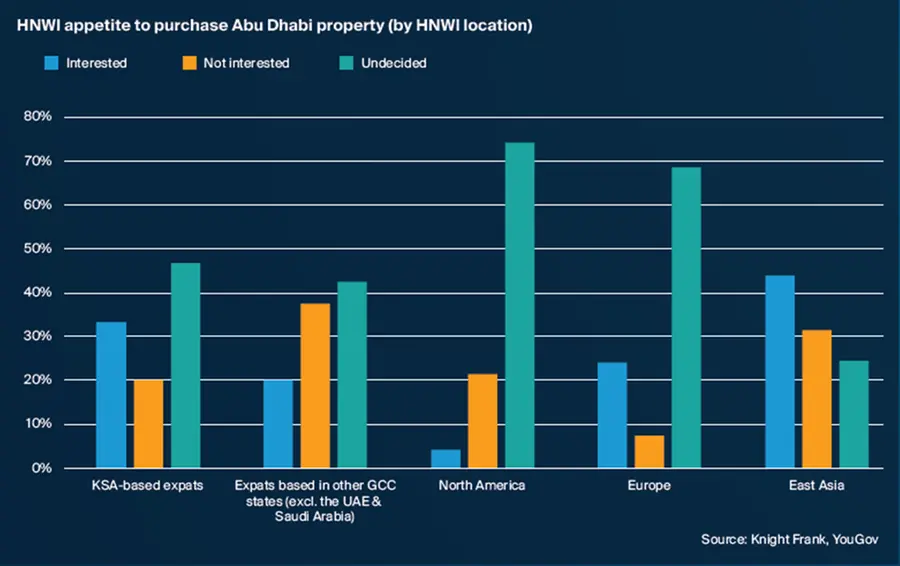

GCC-based expat HNWI top location choices in Abu Dhabi include Saadiyat Island (32%) and Maryah Island (24%), while for global HNWI, Saadiyat Island (33%) emerged as the top pick.

RAS AL KHAIMAH

Away from the UAE capital, Knight Frank has found that the UAE’s northern most emirate, Ras Al Khaimah (RAK) (2%) has been named as the fourth most likely property investment destination in the country for global HNWI, behind Dubai (67%), Abu Dhabi (23%), Sharjah (5%).

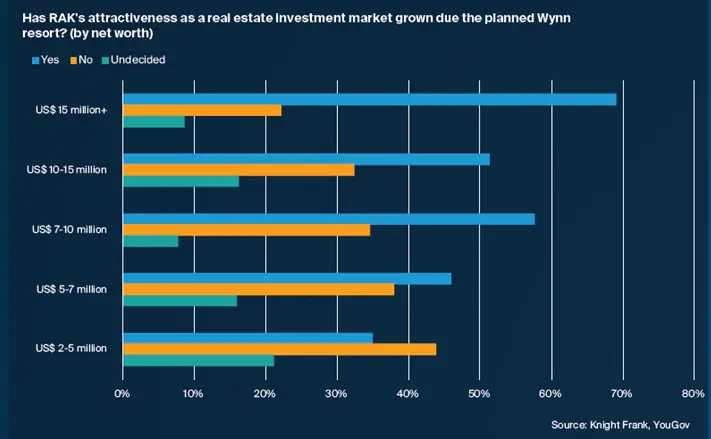

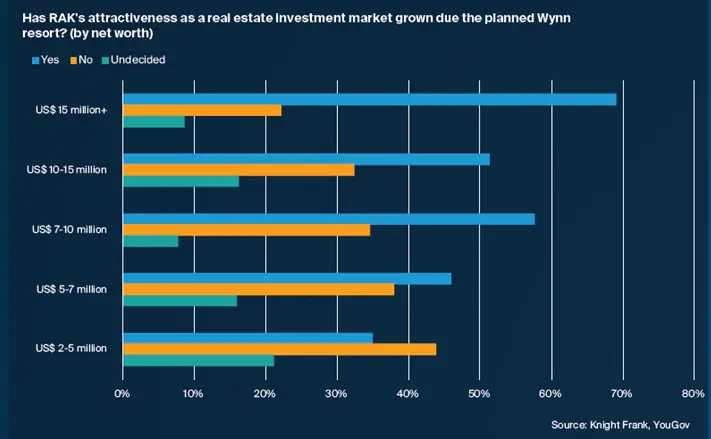

According to Knight Frank, the planned arrival of the Wynn Resort, including its responsible gaming venue, is playing a significant role in transforming the fortunes of RAK.

Jamal continued: “Ras Al Khaimah’s rugged natural landscape and adrenaline fuelled attractions stand in stark contrast to Dubai’s hyper-urban, skyscraper studded skyline. RAK has quietly carved out a niche for itself over the last 10-years, emerging as an alternative tourist magnet to Dubai. And the Wynn Resort is adding to the long list of growing attractions.”

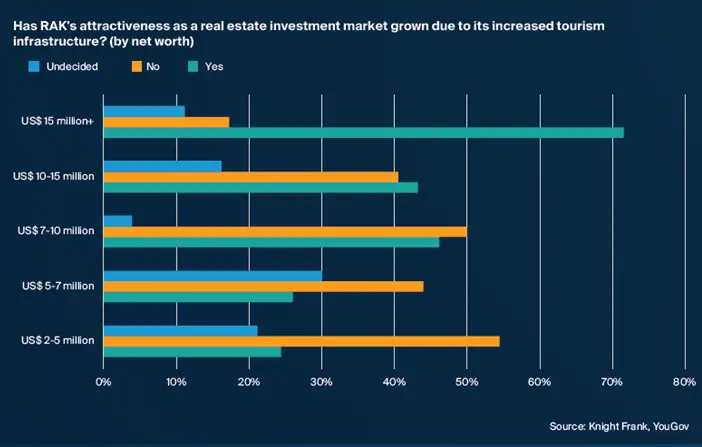

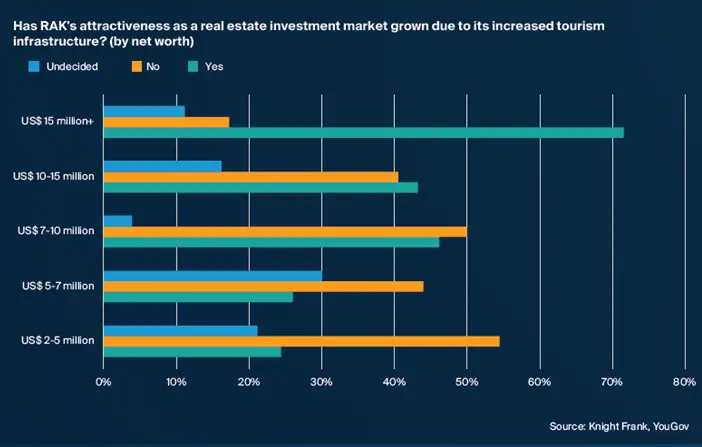

Knight Frank has found that 46% of global HNWI view RAK more favourably as a result of its economic transformation and increasing level of tourism infrastructure. This figure climbs to 75% of those with a net worth of over US$ 20 million.

UAE-based HNWI expats (80%) Saudi-based HNWI expats (60%) consider the arrival of the Wynn Resort most favourably in the context of viewing RAK as a real estate investment destination, says Knight Frank.

RAK AIMING FOR THE BIG LEAGUES

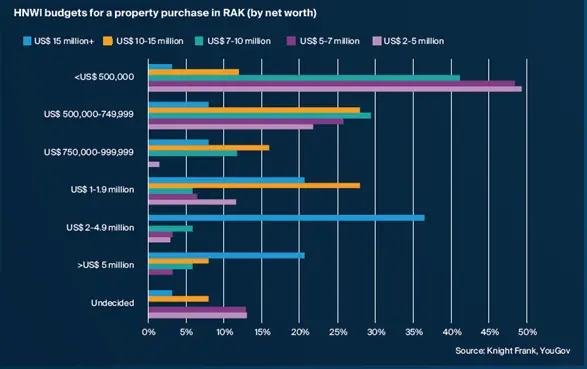

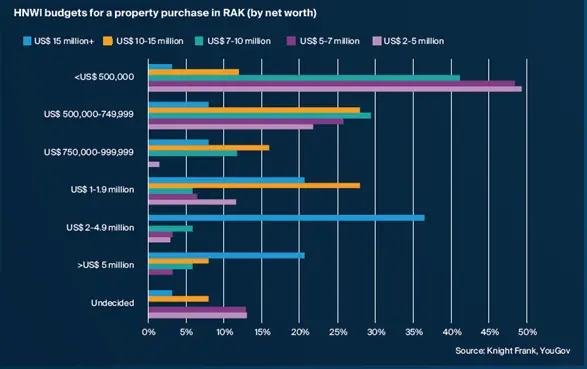

30% of global HNWI say they are prepared to spend US$ 500,000 on property in RAK, lower than Abu Dhabi’s US$ 3.4 million. Budgets however rise rapidly with levels of personal net worth. 37% of those with a net worth of more than US$ 15 million, for instance would be willing to allocate US$ 2-4.9 million towards real estate in RAK and a further 21% would be prepared to spend more than US$ 5 million.

East Asian HNWI appear to be most convinced by RAK’s tourism and hospitality offering, with 28% willing to commit to spending US$ 2-4.9 million for property in RAK – the highest across all our HNWI regions, according to Knight Frank’s report.

On an individual level, GCC-based expats have the lowest budgets (US$ 700,000), while global HNWI budgets range from US$ 1.2 million for those with a net worth of less than US$ 5 million and climbs to US$ 3.9 million amongst the UHNWI (net worth > US$ 20 million).

Durrani concluded, “What’s fascinating is that not only have we managed to unearth US$ 388.5 million in private capital that is poised to move into the RAK property market, but that this figure is just 4.8% lower than we’ve uncovered for Abu Dhabi, highlighting how quickly RAK’s appeal has grown globally both as a tourist destination and a property investment location”.

-Ends-

About Knight Frank:

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, the Knight Frank network has 487 offices across 53 territories and more than 20,000 people The Group advises clients ranging from individual owners and buyers to major developers, investors, and corporate tenants. For further information about the Firm, please visit www.knightfrank.com.

In the MENA region, we have strategically positioned offices in key countries such as the United Arab Emirates, Saudi Arabia, Bahrain, Qatar, and Egypt. For the past 13 years, we have been offering integrated residential and commercial real estate services, including transactional support, consultancy, and management.

Understanding the unique intricacies of local markets is at the core of what we do, we blend this understanding with our global resources to provide you with tailored solutions that meet your specific needs. At Knight Frank, excellence, innovation, and a genuine focus on our clients drive everything we do. We are not just consultants; we are trusted partners in property ready to support you on your real estate journey, no matter the scale of your endeavour.

For all Media and PR inquiries, please contact:

Roksar Kamal, PR Manager

Roksar.kamal@me.knightfrank.com

Let's connect socially - find us on LinkedIn, Instagram, and Twitter. For more information and to explore how we can be your partners in property, please visit our website at https://www.knightfrank.ae.