PHOTO

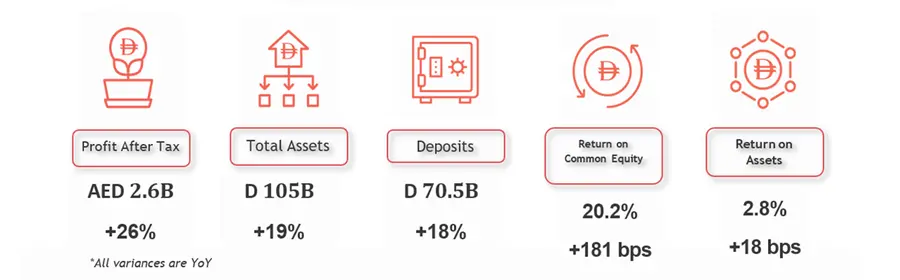

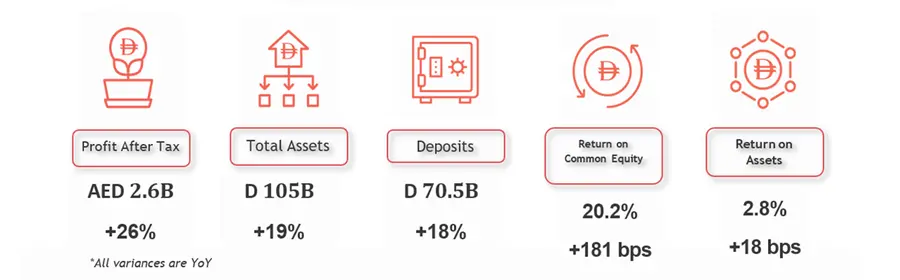

Ras Al Khaimah, United Arab Emirates - The National Bank of Ras Al Khaimah (RAKBANK) today reported its financial results for the full year and the fourth quarter of 2025.

50 years of sustainable growth – all-time high profitability...

FY’25 performance supported by net interest margin of 4.3%, an industry leading CASA ratio of 65%, and a 29% YoY growth in non-interest income driven by wealth management, FX and investment income

...driven by product innovation & balance sheet growth

The Bank’s balance sheet grew by D 16.7B YoY with Gross Loans & Advances growing by 11.7% YoY to D 56B, deposits growing by 18% and launch of new products like new wealth products, SME payment capabilities, crypto brokerage and corporate escrow services

...with robust credit quality and capital adequacy

Impaired loans ratio has improved to 1.9% from 2.2% for same period last year and CAR ratio remained stable at 18.1%,well above regulatory requirements

…alongside our highest ever investments

In technology, people, infrastructure, and premises increased by 20% YoY

…and outstanding shareholder returns

In FY’25 shareholder returns improved further with return on common equity at 20.2%, up from 18.4% in PY and return on assets at 2.8%, up from 2.6% in PY

*Profit after tax

About RAKBANK

We’re RAKBANK.

Banking should feel simple. Human. Helpful. So that’s the kind we build.

Since 1976, we’ve been helping people and businesses across the UAE grow with confidence, giving them the tools, the support, and the trust to make things happen. We started as a community bank and grew into one of the country’s most dynamic financial institutions. What’s never changed is our belief that banking should work for people, not the other way around.

Today, we’re leading a new chapter, one that combines smart digital innovation with genuine human connection. We call it digital with a human touch.

We serve customers across every segment through our Personal Banking Group (PBG), Business Banking Group (BBG), and Wholesale Banking Group (WBG). As the UAE’s go-to SME bank, we’re helping thousands of businesses grow and thrive with seamless, digital-first banking.

Our group also includes Skiply, the region’s leading school payments app; Protego, our next-generation insurance aggregator; and RAK Insurance, one of the UAE’s most trusted insurers, together creating an ecosystem that makes life simpler and safer for our customers.

From empowering entrepreneurs and SMEs to launching the UAE’s first crypto brokerage for retail customers and our own AI-powered digital assistant, we’re shaping the future of banking while keeping the heart of it the same: people.

RAKBANK — Digital with a human touch.

For more information, please visit www.rakbank.ae.

Alternatively, you can connect with us on our social media platforms:

- X.com/rakbanklive

- Instagram.com/rakbank

- tiktok.com/@rakbank

- https://www.linkedin.com/company/rakbank

For enquiries, please contact:

Svyatoslav Shlyakhtin

ir@rakbank.ae

Michelle Saddi

michelle.saddi@rakbank.ae

PR & Media Contact:

Suzana Saoud

Associate Account Director

Gambit Communications

Suzana@gambit.ae