PHOTO

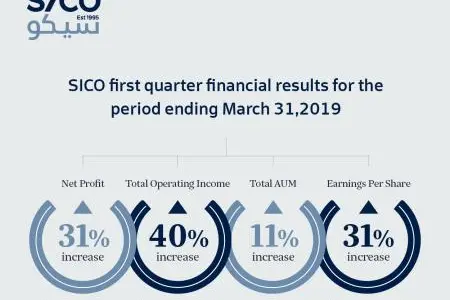

Manama, Kingdom of Bahrain:SICO BSC (c), licensed as a conventional wholesale bank by the Central Bank of Bahrain “CBB”, announced today its consolidated results for the first quarter ended 31 March 2019. SICO’s consolidated net profit for the first quarter increased 31% to BD 1.9 million compared with BD 1.4 million for the corresponding period in 2018. Net operating income grew 40% to BD 4.5 million from BD 3.2 million achieved in the same quarter of 2018 reflecting strong growth in the top line performance. Total operating expenses, including staff overheads, general administration and other expenses, increased 14% to BD 1.9 million from BD 1.6 million for the same period last year. First quarter 2019 earnings per share (EPS) were 5.03 Bahraini fils compared to 3.85 Bahraini fils in the same period last year. Total comprehensive income grew 26% to BD 1.9 million from BD 1.5 million in the first quarter of 2018.

Commenting on SICO’s performance for the quarter, Chairman of the Board Shaikh Abdulla bin Khalifa Al Khalifa said: “SICO delivered an encouraging financial performance for the first quarter of the year with our various business line delivering growth and contributing positively to our bottom-line. SICO continues to demonstrate its ability to seize market opportunities and inspire investor confidence, starting 2019 on a strong path to build on our track record of success and value creation.”

Growth during the quarter was primarily driven by higher investment income, which increased 76% to BD 2.5 million in the first quarter of 2019 from BD 1.4 million in the same period last year. SICO’s performance was further supported by strong results from its assets management division, with total assets under management (AUMs) growing 11% to BD 775.2 million (US$ 2.1 billion) from BD 699.1 million (US$ 1.9 billion) at year-end 2018. Fee based income increased 15% to BD 954 thousand in the first quarter of 2019 versus BD 828 thousand in the same period last year.

Assets under custody with the Bank’s wholly-owned subsidiary, SICO Funds Services Company (SFS) grew by 6% from BD 2.3 billion (US$ 6.2 billion) at the end of 2018 to BD 2.5 billion (US$ 6.5 billion) at 31 March 2019.

SICO’s total balance sheet footings stood at BD 138.8 million as at 31 March 2019, increasing by 3% from the BD 135.3 million at the end of 2018. Meanwhile, SICO’s total shareholders’ equity amounted to BD 54.5 million, net of BD 3.1 million cash dividends for FY 2018 distributed during the first quarter of 2019, versus BD 55.7 million at year-end 2018. SICO’s consolidated capital adequacy ratio stood at a healthy 54.92% as at 31 March 2019.

Chief Executive Officer Ms. Najla Al Shirawi reported: “The early months of 2019 saw us continue to operate against a backdrop of global uncertainty and rich valuations across major markets. Nevertheless, confidence in SICO’s insights and investment approach remained resolute, exemplified by our growing AUM base and higher returns from proprietary portfolios. We were particularly successful in capturing the growing appetite for regional debt products, which in-turn helped offset slower equity markets activity and pullback on sell-side businesses. Meanwhile, we continued to leverage our success as market maker on the Bahrain Bourse and liquidity providers on the DFM and ADX, with the division’s income delivering a strong performance and a growing share of our total operating income.”

-Ends-

About SICO

SICO is a leading regional asset manager, broker, and investment bank, with USD 2.1 bn in assets under management (AUM). Today SICO operates under a wholesale banking licence from the Central Bank of Bahrain and also oversees two wholly owned subsidiaries: an Abu Dhabi-based brokerage firm, SICO Financial Brokerage and a specialised regional custody house, SICO Fund Services Company (SFS). Headquartered in the Kingdom of Bahrain with a growing regional and international presence, SICO has a well-established track record as a trusted regional bank offering a comprehensive suite of financial solutions, including asset management, brokerage, investment banking, and market making, backed by a robust and experienced research team that provides regional insight and analysis of more than 90 percent of the region’s major equities. Since inception in 1995, SICO has consistently outperformed the market and developed a solid base of institutional clients. Going forward, the bank’s continued growth will be guided by its commitments to strong corporate governance and developing trusting relationships with its clients. The bank will also continue to invest in its information technology capabilities and the human capital of its 100 exceptional employees.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.