Kuwait: Kuwait Financial Centre “Markaz” recently released its Monthly Markets Review report. Markaz report stated that Kuwait finally broke out of its three-month losing streak and became the best performing market in the GCC region for the month of November. The Kuwait All Share Index gained 1.3% for the month with the YTD returns moving up to 8.4% as investors welcomed the initiatives by Central Bank of Kuwait (CBK) to revive the credit growth and boost consumer spending by increasing the personal loan limit from KD15,000 to KD 25,000. Zain Telecommunications, which registered the biggest loss in the month of October, emerged to be the best performing blue chip Company from Kuwait, gaining 4% during the month. Boubyan Bank continues to be one of the best performing blue chip stocks, with a monthly gain of 3.4% and an YTD return of 30.5%. Recently, Boursa Kuwait introduced an electronic platform that shall enable the existing Over-The-Counter (OTC) market move to a platform for conducting transactions, which shall benefit investors in trading unlisted securities. . Interestingly, liquidity in Boursa Kuwait increased during the month, with average daily value traded increasing by nearly 7% compared to October.

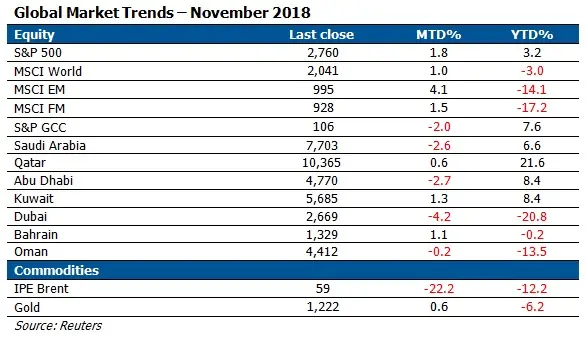

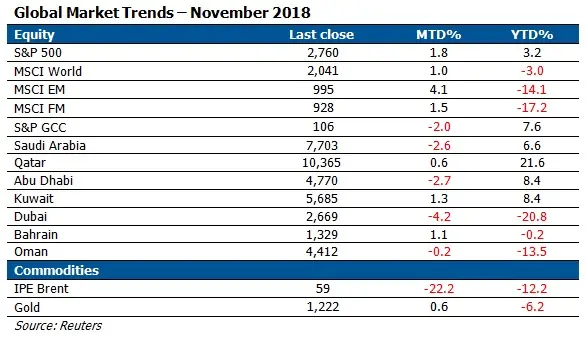

The S&P GCC index took a downturn in the month of November. The index fell 2% for the month, drawing down on the overall gains for the year, which now stand at 7.6%. This was mainly due to the sharp fall in oil prices, the continued trade war uncertainties and geo political concerns. Saudi Arabia, Abu Dhabi and Dubai saw large pullbacks with the Saudi Tadawul index, Abu Dhabi index and the DFM General Index falling 2.6%, 2.7% and 4.2% for the month of November, respectively. Overall, Qatar and Bahrain indices gained 0.6%, and 1.1% respectively, whereas, the Oman and Abu Dhabi index lost 0.2% and 2.7% during the month. Ezdan holdings and Masraf Al Raya were the top two performers among GCC blue chip companies, rising by 16.4% and 5.5% during the month respectively.

The oil market was under intense selling pressure we saw an acceleration in price fall. Record high oil production from the United States and a slowing global demand for the commodity could be cited as reasons for the negative performance. OPEC is preparing to rein its output on expectations that the oil market will be oversupplied next year. Brent crude continued to fall adding to its momentum from last month, with a MTD performance of -22.2%.

Market trends

Saudi Market continued to be in focus during November as geo-political turbulence and a continued drop in oil prices maintained a grip on the market prices. The proportion of shares held by foreign investors on the Saudi Stock Exchange (Tadawul) has been steadily falling in recent weeks. International shareholders controlled 5.07% of all listed shares on 27 September, but the figure had fallen to 4.71% by early November (Forbes). While, the yield on the KSA USD 5 billion bonds due 2028 climbed to a record 4.6 percent.

Talks of a retreating trade war has brought back some confidence to the Chinese markets, however, the prolonged uncertainty has already generated significant pressure over the Chinese economy. Steel, Real estate, e-commerce and electronics sectors suffered weaker demand during the month of November. Consumer confidence dropped and the Shanghai all share index lost 0.57% for the month of November. However, the overall emerging markets saw a positive month with global investors increasing their exposure towards the emerging markets. Talks of a slower pace of U.S Fed rate hikes and improving fundamentals helped bring back the positive momentum to the emerging markets and the MSCI EM Index gained 4.06% for the month of November.

The U.S. markets have been volatile this month as energy companies were battered due to a free fall in oil prices and a slump in tech stocks, the FAANG (Facebook, Amazon, Apple, Netflix and Google) stocks fell by over 20% from their 52-week highs, brought the S&P 500 Index down to its lowest levels in five months. The S&P 500 registered a MTD performance of -1.86%. The Federal Reserve is still expected to raise interest rates next month and three times next year, but US Fed Vice Chairman Richard Clarida said that there is some evidence the world economy is cooling down and that they would be more cautious moving forward on their pace of increasing interest rates. MSCI World Index gained just 0.96% in November.

-Ends-

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the Region with total assets under management of over KD 1.02 billion as of 30 June 2018 (USD 3.37 billion). Markaz was listed on the Boursa Kuwait in 1997.

For further information, please contact:

Alrazi Y. Al-Budaiwi

Media & Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Tel: +965 2224 8000

Fax: +965 2246 7264

Email: abudaiwi@markaz.com

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.