TECOM Group (the “Company”), a member of the Dubai Holding group and owner, manager and operator of 10 strategic, sector-focused business districts across Dubai and a major contributor to the rapid growth of Dubai’s knowledge and innovation-based economy, today announces its intention to proceed with an initial public offering (the “IPO” or the “Global Offering”) and to list its ordinary shares for trading on the DFM.

SUMMARY OF THE GLOBAL SHARE OFFERING

- Six hundred and twenty five million (625,000,000) ordinary shares (the “Shares”) will be made available in the Global Offering, representing 12.5% of TECOM Group’s issued share capital. The Global Offering comprises the Qualified Institutional Offering, the Exempt Offer, and the UAE Retail Offer

- The Qualified Institutional Offering and the Exempt Offer subscription period is expected to run from 16 June 2022 to 24 June 2022

- The UAE Retail Offer subscription period is expected to run from 16 June 2022 to 23 June 2022

- Admission of shares to trading on the DFM is anticipated on 5 July 2022

- DHAM LLC (“DHAM” or “Dubai Holding Asset Management” or “Selling Shareholder”), reserves the right to amend the size of the Global Offering at any time prior to the end of the subscription period, subject to the approval of the SCA. DHAM is TECOM Group’s majority shareholder and Dubai Holding is its ultimate holding company

- The Internal Sharia Supervision Committees of Emirates NBD Bank PJSC and First Abu Dhabi Bank PJSC have issued pronouncements confirming that, in their view, the Global Offering is compliant with Shariah principles

SUMMARY OF DIVIDEND POLICY

- TECOM Group intends to adopt a semi-annual dividend distribution policy to pay dividends in cash after the Global Offering in October and April of each year, subject to the Board of Directors and General Assembly’s approval

- The Company expects to pay a dividend amount of AED 800 million per annum over the next three years (through to October 2025)

- The Company’s ability to pay dividends is dependent on a number of factors, among others, the availability of distributable reserves, the Company’s capital expenditure plans, and market conditions

SUMMARY OF TECOM GROUP INVESTMENT PROPOSITION

- Central player in Dubai’s business hub proposition strongly positioned to benefit from Dubai’s broader commercial real estate market recovery and macroeconomic tailwinds

- Owner and operator of an iconic, high-quality, and resilient real estate portfolio strategically located across Dubai that offers a business-friendly regulatory regime, supported by value-added services

- Long-term and diversified international and regional marquee customer base

- Attractive financial profile and balance sheet underpinned by robust income-generating portfolio that has delivered consistent high-quality revenue and cash flow

- Robust governance frameworks and sustainability to be further embedded in the core of the operating model

- Dynamic management team with a proven track record and supportive shareholder

- Clear roadmap for achieving growth objectives and continuing to deliver strong performance over the medium term

- TECOM Group benefits from the support of Dubai Holding as a committed ultimate holding company. Dubai Holding has a reputation for excellence in Dubai as a key driver of economic diversification and enabler of the Dubai government’s vision

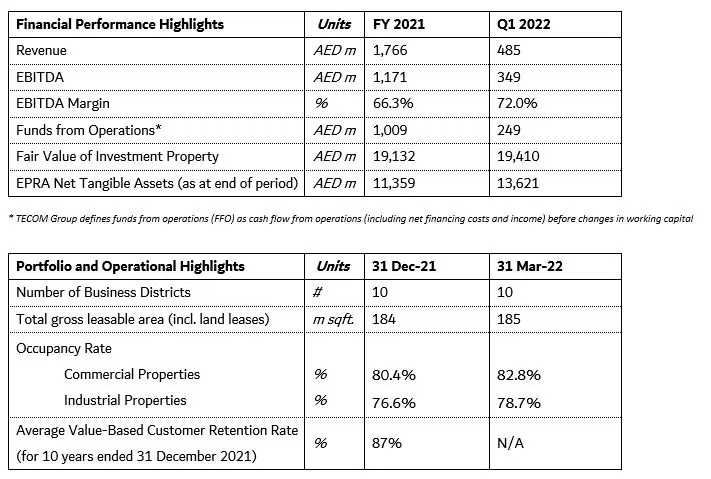

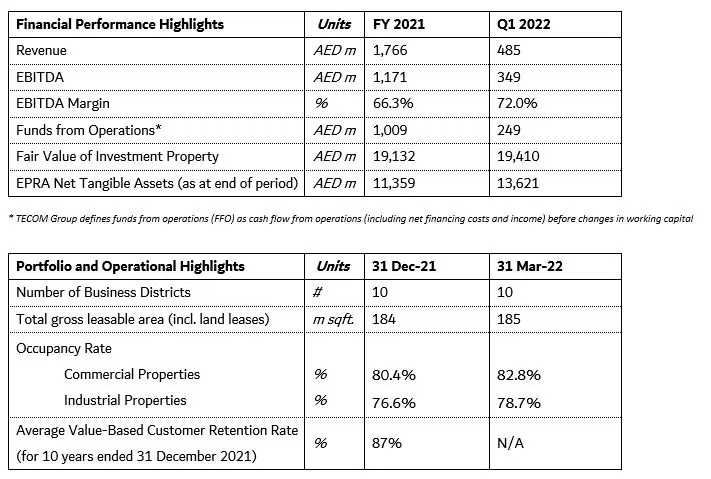

SUMMARY OF TECOM GROUP’S FINANCIAL AND OPERATING PERFORMANCE HIGHLIGHTS:

Commenting on the launch of the TECOM Group IPO process, Amit Kaushal, Dubai Holding Group Chief Executive Officer, said:

“As Dubai Holding’s primary commercial development and leasing business, TECOM Group has helped execute our key role in diversifying Dubai’s economy and driving innovation and business growth and development. We have supported its growth into a successful creator of innovative business ecosystems and a partner of choice for multinational businesses as well as entrepreneurs in the region.

“We believe TECOM Group is ready to embark on a new chapter as a publicly listed company. By remaining the ultimate holding company of the Company, we will remain fully committed to working alongside TECOM Group’s new shareholders to support its growth ambitions and further bolster its role as a key enabler of Dubai and the region’s knowledge-based economy.”

Malek Al Malek[1], Chairman of TECOM Group (from Listing), said:

“Our visionary leadership has consistently set new objectives in business excellence and competitiveness consolidating Dubai’s global position as a leading business and talent hub. For more than two decades, TECOM Group has been the cornerstone of these ambitions, contributing to the nation’s knowledge economy by attracting global companies and skilled talent across six key sectors as well as boosting the ease of doing business. Our Company has succeeded in establishing a vibrant environment that enables existing and prospective customers to amplify their growth ambitions while evolving at pace with global industries and the future of the workplace.

“With our intention to list on DFM we are expanding our contribution to Dubai’s financial market and bolstering our vision to further unlock the Emirate’s economic and business growth potential. The IPO offers investors a unique opportunity to be part owners of a company that is benefiting from Dubai’s attractive underlying macroeconomic, industry, and business dynamics.”

Abdulla Belhoul, TECOM Group Chief Executive Officer, said:

“At TECOM Group, we have continuously delivered on our role as a strategic business enabler of Dubai by bringing to life 10 world-class, vibrant, specialised business districts. Our commitment to digital transformation and ensuring a seamless customer journey sets us apart, providing advanced solutions to over 7,800 customers and more than 100,000 professionals.

By being at the forefront of innovation and identifying high-growth industries and working models of the future, we have continuously grown our asset base and established strong customer loyalty. From 2021 up until the first quarter of 2022, TECOM Group achieved major milestones including the inauguration of regional headquarters, state-of-the-art higher education campuses, and research and development centres. Our track record demonstrates confidence in the Company and reaffirms Dubai’s leading role as the go-to destination for businesses looking to tap into new opportunities.

As TECOM Group embarks on its next chapter of growth through the IPO, we intend to continue to support the development of business ecosystems and strategic sectors in Dubai, while maximising synergies across these ecosystems and driving new opportunities in the high-growth industry segments Dubai has to offer.”

DETAILS OF THE GLOBAL SHARE OFFERING

Six hundred and twenty five million (625,000,000) shares are being made available in the Global Offering, representing 12.5% of TECOM Group’s issued share capital. All the Shares are existing shares being sold by the Selling Shareholder, and the Company will not receive any proceeds from the Global Offering. The Selling Shareholder reserves the right to amend the size of the Global Offering at any time prior to the end of the subscription period at its sole discretion, subject to the applicable laws of the UAE and the approval of the SCA.

The Global Offering shall be made available to the following subscribers:

- to individual and other investors and to Dubai Holding Group Eligible Employees (as defined in the prospectus relating to the UAE Retail Offer (the “UAE Prospectus”) as part of the UAE Retail Offer; and

- to professional investors and other investors in a number of countries outside the United States of America, including in the UAE, as part of the Qualified Institutional Offering and the Exempt Offer.

The Emirates Investment Authority (the “EIA”) shall be entitled to subscribe for up to 5% of the Global Offering, and the percentage of Shares which the EIA will purchase shall be allocated in full before the commencement of allocation to any other Subscribers to the Global Offering.

The UAE Retail Offer subscription period is expected to run from 16 June 2022 to 23 June 2022, with the Qualified Institutional Offering subscription period expected to run from 16 June 2022 to 24 June 2022.

The completion of the Global Offering and admission of the Shares to listing and trading on the DFM (“Admission”) is currently expected to take place in July 2022, subject to market conditions and obtaining relevant regulatory approvals in the UAE, including approval of Admission.

The Shares held by the Selling Shareholder following completion of the Global Offering shall be subject to a lock-up which starts on the date of Admission and ends 180 days thereafter, subject to certain terms and conditions.

Details of the Global Offering will be included in the UAE Prospectus and public subscription announcement (the “Public Announcement”) with respect to the UAE Retail Offer and the English language International Offering Memorandum with respect to the Qualified Institutional Offering and the Exempt Offer. The UAE Prospectus and the Public Announcement will be published today and the International Offering Memorandum is expected to be published in due course. The UAE Prospectus and the International Offering Memorandum will be available at www.ipo.tecomgroup.ae.

Emirates NBD Capital PSC, First Abu Dhabi Bank PJSC, Goldman Sachs International, Morgan Stanley & Co. International plc and UBS AG, London Branch have been appointed as Joint Global Coordinators and Joint Bookrunners.

Emirates NBD Bank PJSC has been appointed as the Lead Receiving Bank. Abu Dhabi Islamic Bank PJSC, Ajman Bank PJSC, Commercial Bank of Dubai PSC, Dubai Islamic Bank PJSC, Emirates Islamic Bank PJSC, First Abu Dhabi Bank PJSC, Mashreq Bank PSC, Sharjah Islamic Bank PJSC, and have also been appointed as Receiving Banks.

The Internal Sharia Supervision Committees of Emirates NBD Bank PJSC and First Abu Dhabi Bank PJSC have issued pronouncements confirming that, in their view, the Global Offering is compliant with Shariah principles. Investors may not rely on these pronouncements and should undertake their own due diligence to ensure that the Global Offering is Shariah-compliant for their own purposes.

OVERVIEW OF TECOM GROUP

For more than two decades, TECOM Group has been at the forefront of Dubai’s economic growth and diversification by building and growing 10 world class, sector-focused business districts strategically located across the Emirate. The Company has played an instrumental role in delivering Dubai’s economic vision and developing its business ecosystem, providing dynamic environments for global corporations, regional entrepreneurs and freelancers to set-up, scale and access the MENA region’s diverse markets. TECOM Group provides high-quality real estate products and value-added services, contributing to the growth and development of six vital non-oil sectors, including technology, media, science, education, design, and manufacturing.

COMPETITIVE STRENGTHS

TECOM Group has a unique business model and a strong track record. Its competitive strengths can be summarised as follows:

- Central player in Dubai’s business hub proposition strongly positioned to benefit from Dubai’s broader commercial real estate market recovery and macroeconomic tailwinds

TECOM Group’s strategically located and differentiated portfolio, supported by long term strategic tenants, has been an integral part of Dubai’s economic diversification and global competitiveness. Operating in Dubai, one of the most diversified and dynamic economies within the GCC region, will help enable TECOM Group to further capitalise on the Emirate’s unique positioning, favourable macroeconomic tailwinds and supportive real estate fundamentals.

- Iconic, high-quality and resilient asset portfolio strategically located across Dubai that offers a business-friendly regulatory regime

TECOM Group offers a complementary portfolio of 10 business districts diversified across asset classes, sectors, and communities strategically located across Dubai. These assets offer relevant connectivity, regulatory, and business enablement benefits across a large customer and tenant base. The Company’s specialised community offering spans a range of price points for both CBD[2] and non-CBD properties and offers attractive commercial office spaces, land leases, warehouses, worker accommodation facilities, and associated retail which fulfil the infrastructure needs of six essential sectors (technology, media, education, science, design, and manufacturing). Nine of TECOM Group’s 10 business districts are located in free zones, which allow for 100% foreign ownership. Furthermore, TECOM Group’s business districts allow for complete repatriation of profits and a range of industry-specific services.

- Long-term and diversified international and regional marquee customer base

TECOM Group’s full-service offering has proved a top choice for global and regional blue-chip companies, including major industry leaders, and strategic business partners, such as Meta (formerly known as Facebook), Google, Visa, BBC, CNN, Unilever, and Dior, among others. In addition to a high-quality community and strong customer base, its customers have demonstrated high levels of loyalty and retention over the years.

- Attractive financial profile and balance sheet underpinned by robust income-generating portfolio that has delivered consistent high-quality revenue and cash flow

The Company operates a stable yielding real estate portfolio in Dubai largely owing to its:

-

- Long-term and diversified customer base;

- High-quality portfolio and service offering; and

- Diversified asset mix and industry exposure, significantly reducing concentration risk.

As such, the Company has delivered robust financial performance and operational resilience through the cycle amid global and regional economic downturns, geopolitical instability, and, most recently, the COVID-19 pandemic.

-

- TECOM Group’s revenue for the year ended 31 December 2021 was AED 1.77 billion, and EBITDA for the same period was AED 1.17 billion with a healthy EBITDA margin of approximately 66.3%.

- EBITDA margins have held steady of at least 66% in each of the years ended 31 December 2019, 2020, and 2021.

- TECOM Group generated AED 1.0 billion of funds from operations (FFO)[3] in FY 2021 supported by stable cash flow generation from investment properties.

- Stable and resilient cash flow generation over the last 3 years; FY 2021 recurring free cash flow (FCF)[4] was AED 798 million.

- The Company’s cash conversion increased in 2021, indicating efficient working capital management and stringent cost discipline.

- Robust governance frameworks and sustainability to be further embedded in the core of the operating model

TECOM Group places sustainability and environmental, social and governance (“ESG”) issues at the core of its operating model and has begun implementing Group-wide ESG initiatives in line with the United Nation’s Sustainable Development Goals and 2030 Agenda for Sustainable Development, as well as Dubai’s Clean Energy Strategy and Dubai Net Zero Emissions Strategy 2050 to produce 100% of Dubai’s energy requirements from clean sources by 2050. TECOM Group has also completed a number of solar energy projects across several business districts, such as Dubai Outsource City, Dubai International Academic City, and Design District, all of which have contributed to reducing traditional energy consumption and its carbon footprint.

- Dynamic management team with proven track record and supportive shareholder

TECOM Group’s senior management team of seasoned executives have extensive operating experience in the real estate industry, with six out of the seven members of its senior management team having over 10 years of experience in the industry and four of the seven members having over 10 years of experience within the Company. A significant proportion of its senior management team has long-tenured board membership experience and experience working for publicly listed companies. Additionally, with DHAM as its majority shareholder - and Dubai Holding as its majority ultimate holding company shareholder – TECOM Group benefits from the support of a committed major shareholder with a reputation for excellence in Dubai as a key driver of economic diversification and enabler of the Dubai government’s vision.

- Clear roadmap for achieving growth objectives and continuing to deliver strong performance over the medium term.

TECOM Group has a clearly defined growth strategy anchored upon four core pillars with the objective of driving net asset value growth and maximising shareholder returns.

- Capitalise on favourable real estate sector dynamics: According to JLL, the commercial real estate environment in Dubai is currently exhibiting signs of plateauing office supply, with rents bottoming out and rental growth returning following the COVID-19 pandemic. TECOM Group benefits from well-structured and flexible lease agreements that allow it to re-align rental rates in line with growing market rates.

- Occupancy ramp-up: The Company’s current portfolio of built to lease developments (excluding land leases) had an occupancy rate of around 78% as of 31 December 2021, demonstrating ample headroom for further growth. Illustratively, an occupancy growth of 5% to 10% would translate to approximately 1.5 to 2.1 million square feet of incremental leased area.

- Attractive built to suit (BTS) projects, infrastructure development and acquisitions: Throughout its more than 20-year history, TECOM Group has developed distinctive know-how in developing exclusive built to suit projects for strategic tenants according to their specifications. Since 2016, the Company has delivered built to suit projects for SAP, Samsung, Huawei, MasterCard, the University of Wollongong, the University of Birmingham, Firmenich and Himalaya, which remain long-term customers within their communities to this day. These developments are already fully contracted, provide highly visible income streams and reinforce TECOM Group’s robust financial profile.

- Embedded growth potential: TECOM Group has embedded growth potential from its current available land bank of 40.4 million square feet and access to additional land through an exclusive right of first offer with DHAM. The land bank provides headroom for expanding the occupancy of TECOM Group’s land lease segment, as well as selected built to suit or built to lease expansion for its commercial or industrial leasing segments.

BUSINESS MODEL

TECOM Group offers a range of properties and services to its customers. The Company divides its operations into four financial segments: (i) commercial leasing, (ii) industrial leasing, (iii) land leasing and (iv) services and others.

- Commercial leasing: consists of built to lease and built to suit properties. Built to lease properties are TECOM Group’s commercial properties which are typically developed for multiple tenants and are leased out to customers, and include office, retail space and business centres. Built to suit properties typically represent the Company’s commercial properties where it was able to identify customers in advance of developing the property to build a single-tenant customised property that meet a tenant’s specifications, which are then leased out to them upon completion.

- Industrial leasing: consists of warehouses, showrooms and worker accommodation (housing used by corporate tenants to accommodate their workers).

- Land leasing: consists of land leases and land available within TECOM Group’s business districts that already has or is expected to develop the necessary infrastructure (such as connecting roads, water, electricity, and sewage) that allows the Company to lease the land. TECOM Group’s strategy is to retain such land in order to be able to lease it to customers to suit their specific needs, such as manufacturing, offices, retail, worker accommodation or academic purposes.

- Services and others: consists of government and business services primarily to tenants and their employees. TECOM Group’s added-value services include:

- Advertising assets. TECOM Group has installed, and have advertising assets and provisions for, advertising such as unipoles, mini-unipoles, and digital screens in its business districts, which are leased to advertising firms and generate revenue.

- Event Venue Management. TECOM Group manages and leases indoor and outdoor venues for events, concerts and corporate training across its business districts.

- Property Management & Leasing Agreement. TECOM Group signs property management and leasing agreements with investors to manage their leasing operations of premises for a fee. TECOM Group will enter into contracts in its own name and collect full rent on the owner’s behalf.

- D/Quarters. Launched in early 2022, D/Quarters is a future-focused co-working space for freelancers, entrepreneurs, SMEs and global corporations with flexible, scalable workspace solutions.

- GoFreelance. Launched in 2018, TECOM Group’s “GoFreelance” service supports freelance talent that provides them with opportunities to obtain new jobs and grow their network. TECOM Group has approximately 2,400 freelancers participating in this service.

- axs. Launched in 2014, this business and government digitally enabled services platform aims to facilitate access to multiple services under one umbrella to tenants, customers, companies, employees and other individuals within TECOM Group’s business districts. Services provided through axs include more than 200 corporate services and are currently being provided to more than 120,000 professionals, entrepreneurs, students and dependents.

- in5. Launched in 2013, this enabling platform for start-ups and entrepreneurs offers key benefits, which include a robust business set-up framework, training and mentorship, networking, investment opportunities, and prototyping labs, studios and creative workspaces.

CLUSTERS AND BUSINESS DISTRICTS

TECOM Group’s commercial properties, industrial properties, land leases and services are marketed to customers and managed by the Company in clusters and business districts. The Company currently operates ten business districts that host customers from six specific industries. TECOM Group refers to each industry it serves as a "cluster", which consists of one or more business districts operating in the same industry. TECOM Group currently operates the following six clusters:

- Tech Cluster: Consists of Dubai Internet City and Dubai Outsource City.

- Media Cluster: Consists of Dubai Media City, Dubai Studio City and Dubai Production City.

- Education Cluster: Consists of Dubai International Academic City and the Dubai Knowledge Park.

- Science Cluster: Consists of Dubai Science Park.

- Design Cluster: Consists of Dubai Design District.

- Manufacturing Cluster: Consists of Dubai Industrial City.

DIVIDEND POLICY

TECOM Group intends to maintain a dividend policy designed to reflect the Company’s expectation of strong cash flow and expected long-term earnings potential while allowing the Company to retain sufficient capital to fund ongoing operating requirements and continued investment for long-term growth. Always subject to Board of Directors and general assembly approval, TECOM Group:

- Intends to adopt a semi-annual dividend distribution policy to pay dividends in cash after the Global Offering in October and April of each year.

- Expects to pay a dividend amount of AED 800 million per annum over the next three years (through to October 2025).

- Expects to pay the first interim dividend of AED 200 million in October 2022 and expects to pay the second interim dividend of AED 200 million in April 2023, totalling AED 400 million, which payments collectively pertain to the performance of TECOM Group in the second half of 2022.

- Thereafter, interim dividends are expected to be paid in April and October of each year for the remaining dividend distribution policy period of AED 400 million for each interim period.

The expected dividend distribution policy payment schedule is set out below:

- October 2022: AED 200 million

- April 2023: AED 200 million

- October 2023: AED 400 million

- April 2024: AED 400 million

- October 2024: AED 400 million

- April 2025: AED 400 million

- October 2025: AED 400 million

The Company’s ability to pay dividends is dependent on a number of factors, including the availability of distributable reserves, the Company’s capital expenditure plans, and other cash requirements in future periods, and there is no assurance that the Company will pay dividends or, if a dividend is paid, what the amount of such dividend will be.

-Ends-

MEDIA ENQUIRIES

TECOM Group

media@tecomgroup.ae

Brunswick Group

Celine Aswad

tecomgroup@brunswickgroup.com

INVESTOR RELATIONS ENQUIRIES

ir@tecomgroup.ae

JOINT GLOBAL COORDINATORS AND JOINT BOOKRUNNERS

Emirates NBD Capital PSC

First Abu Dhabi Bank PJSC

Goldman Sachs International

Morgan Stanley & Co. International plc

UBS AG, London Branch

LEAD RECEIVING BANK

Emirates NBD Bank PJSC

Dedicated IPO call centre number: 800-TECOM-IPO open from 09 June 2022

DISCLAIMER

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may or should be placed by any person for any purposes whatsoever on the information contained in this announcement or on its completeness, accuracy or fairness. The information in this announcement is subject to change. No obligation is undertaken to update this announcement or to correct any inaccuracies, and the distribution of this announcement shall not be deemed to be any form of commitment on the part of TECOM Group to proceed with the IPO or any transaction or arrangement referred to herein. This announcement has not been approved by any competent regulatory authority. None of the Joint Global Coordinators and/or any of their respective subsidiary undertakings, affiliates or any of their respective directors, officers, employees, advisers and/or agents are responsible for the contents of this announcement.

This announcement does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for any shares or any other securities nor shall it (or any part of it) or the fact of its distribution, form the basis of, or be relied on in connection with or act as an inducement to enter into, any contract or commitment whatsoever. Investors should not purchase any shares referred to in this announcement except on the basis of information in the International Offering Memorandum to be published by TECOM Group in due course in connection with the proposed admission of its ordinary shares to trading on the Dubai Financial Market. The IPO and the distribution of this announcement and other information in connection with the IPO in certain jurisdictions may be restricted by law and persons into whose possession this announcement, any document or other information referred to herein comes should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction.

In particular, this announcement does not contain or constitute an offer of, or the solicitation of an offer to buy or subscribe for, securities to any person in the United States, Australia, Canada, the United Arab Emirates or Japan, or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The securities referred to herein have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in compliance with applicable state law. The offer and sale of the securities referred to herein has not been and will not be registered under the Securities Act or under the applicable securities laws of the United States, Australia, Canada or Japan. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada or Japan. Any securities sold in the United States will be sold only to qualified institutional buyers (as defined in Rule 144A under the Securities Act) in reliance on Rule 144A (“QIBs”). There will be no public offer of the securities in the United States or any jurisdiction other than the UAE. Copies of this announcement are not being, and should not be, distributed in or sent into the United States, Australia, Canada, the United Arab Emirates or Japan.

In the European Economic Area (the “EEA”), this announcement and this Offering are only addressed to and directed at persons in member states of the EEA who are “qualified investors” within the meaning of Article 2(e) of Regulation (EU) 2017/1129 (as amended) (“EU Qualified Investors”). In the United Kingdom, this announcement and this Offering are only addressed to and directed at persons who are “qualified investors” within the meaning of Article 2(e) of Regulation (EU) 2017/1129 (as amended), as it forms part of UK law by virtue of the European Union (Withdrawal) Act 2018 who (i) have professional experience in matters relating to investments falling within Article 19(5) of The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”); (ii) are high net worth entities falling within Article 49(2)(a) to (d) of the Order; and/or (iii) other persons to whom it may lawfully be communicated (all such persons being referred to in (i), (ii), and (iii) are defined as “UK Qualified Investors”).

In the Abu Dhabi Global Market (the “ADGM”), this announcement is directed only at persons who are “Authorised Persons” or “Recognised Bodies” (as such terms are defined in the Financial Services Regulatory Authority’s (the “FSRA”) Financial Services and Markets Regulations (the “FSMR”)) or persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 18 of the FSMR) in connection with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated (together, “ADGM Qualified Investors”).

In the Dubai International Financial Centre (the “DIFC”), this announcement is directed only at persons who meet the “Deemed Professional Client” criteria set out in Rule 2.3.4 of the Dubai Financial Services Authority’s (the “DFSA”) Conduct of Business Module of the DFSA Rulebook and who are not natural persons (together, “DIFC Qualified Investors”).

This announcement must not be acted or relied on (i) in the United States, by persons other than QIBs; (ii) in any member state of the EEA, by persons who are not EU Qualified Investors; (iii) in the United Kingdom, by persons who are not UK Qualified Investors; (iv) in the ADGM, by persons who are not ADGM Qualified Investors; and (v) in the DIFC, by persons who are not DIFC Qualified Investors. Any securities, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities, and any investment activity, to which this announcement relates (i) in any member state of the EEA is available only to, and may be engaged in only with, EU Qualified Investors; and (ii) in the United Kingdom is available only to, and may be engaged only with, UK Qualified Investors.

This announcement has not been reviewed, verified, approved and/or licensed by the Central Bank of the UAE, the Securities and Commodities Authority of the UAE and/or any other relevant licensing authority in the UAE including any licensing authority incorporated under the laws and regulations of any of the free zones established and operating in the territory of the UAE, including the FSRA and the DFSA or any other authority in any other jurisdiction.

Exempt offer statement (DIFC): This announcement relates to a potential Exempt Offer which may be made in the DIFC in accordance with the Dubai Financial Services Authority’s (“DFSA”) Rulebook. It is intended for distribution only to persons of a type specified in those rules. It must not be delivered to, or relied on by, any other person. The DFSA has no responsibility for reviewing or verifying any documents in connection with Exempt Offers. The DFSA has not approved this announcement nor taken steps to verify the information set out in it and has no responsibility for it. The securities to which this announcement relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers and subscribers of the securities referred to herein should conduct their own due diligence on the securities. If you do not understand the contents of this announcement, you should consult an authorised financial adviser.

Exempt Offer Statement (ADGM): This announcement relates to a potential Exempt Offer which may be made in accordance with the Market Rules of the ADGM Financial Services Regulatory Authority. This announcement is intended for distribution only to persons of a type specified in the Market Rules. It must not be delivered to, or relied on by, any other person. The ADGM Financial Services Regulatory Authority has no responsibility for reviewing or verifying any documents in connection with Exempt Offers. The ADGM Financial Services Regulatory Authority has not approved this announcement nor taken steps to verify the information set out in it, and has no responsibility for it. The securities to which this announcement relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers of the securities referred to herein should conduct their own due diligence on the securities. If you do not understand the contents of this announcement you should consult an authorised financial advisor.

Notice to Prospective Investors in the Kingdom of Saudi Arabia: This document may not be distributed in the Kingdom of Saudi Arabia except to such persons as are permitted under the Rules on the Offer of Securities and Continuing Obligations issued by the Board of the Capital Market Authority (the “Capital Market Authority”) pursuant to resolution number 3-123-2017, dated 27 December 2017, based on the Capital Market Law issued by Royal Decree No. M/30 dated 2/6/1424H, as amended by Resolution of the Board of the Capital Market Authority number 5-5-2022 dated 5 January 2022.

Solely for the purposes of the product governance requirements of Chapter 3 of the FCA Handbook Product Intervention and Product Governance Sourcebook (the “UK Product Governance Requirements”), and/or any equivalent requirements elsewhere to the extent determined to be applicable, and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any “manufacturer” (for the purposes of the UK Product Governance Requirements and/or any equivalent requirements elsewhere to the extent determined to be applicable) may otherwise have with respect thereto, the securities to which this announcement relates have been subject to a product approval process, which has determined that such securities are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in Chapter 3 of the FCA Handbook Conduct of Business Sourcebook; and (ii) eligible for distribution through all permitted distribution channels (the “Target Market Assessment”). Notwithstanding the Target Market Assessment, “distributors” should note that: the price of the securities may decline and investors could lose all or part of their investment; the securities offer no guaranteed income and no capital protection; and an investment in the securities to be issued in the Global Offering is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to any contractual, legal or regulatory selling restrictions in relation to the Global Offering. Furthermore, it is noted that, notwithstanding the Target Market Assessment, the underwriters will only procure investors who meet the criteria of professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of Chapters 9A or 10A respectively of the FCA Handbook Conduct of Business Sourcebook; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the securities.

Each distributor is responsible for undertaking its own target market assessment in respect of the securities and determining appropriate distribution channels.

In connection with the withdrawal of the United Kingdom from the European Union, the Joint Global Coordinators may, at their discretion, undertake their obligations in connection with the potential Offering by any of their affiliates based in the EEA.

If you do not understand the contents of this announcement you should consult an authorised financial adviser.

None of the Selling Shareholder, TECOM Group, the Joint Global Coordinators and/or any of their respective subsidiary undertakings, affiliates or any of their respective directors, officers, employees, advisers, agents or any other person(s) accepts any responsibility or liability whatsoever for, or makes any representation or warranty, express or implied, as to the truth, accuracy, completeness or fairness of the information or opinions in this announcement (or whether any information has been omitted from this announcement) or any other information relating to TECOM Group or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith.

This announcement does not constitute a recommendation concerning the IPO. The price and value of securities and any income from them can go down as well as up and, in the worst case, you could lose your entire investment. Past performance is not a guide to future performance. Information in this announcement cannot be relied upon as a guide to future performance. Before purchasing any securities in TECOM Group, persons viewing this announcement should ensure that they fully understand and accept the risks which will be set out in the Prospectus and the International Offering Memorandum prepared for the IPO, when published. There is no guarantee that the IPO will take place and potential investors should not base their financial or investment decisions on the intentions of TECOM Group or any other person in relation to the IPO at this stage. Potential investors should consult a professional adviser as to the suitability of the IPO for the person(s) concerned.

This announcement contains “forward looking” statements, beliefs or opinions, including statements with respect to the business, financial condition, results of operations, liquidity, prospects, growth, strategy and plans of TECOM Group, and the industry in which TECOM Group operates. These forward looking statements involve known and unknown risks and uncertainties, many of which are beyond TECOM Group’s control and all of which are based on the Company’s current beliefs and expectations about future events. Forward looking statements are sometimes identified by the use of forward looking terminology such as “believes”, “expects”, “may”, “will”, “could”, “should”, “shall”, “risk”, “intends”, “estimates”, “aims”, “plans”, “predicts”, “continues”, “assumes”, “positioned” or “anticipates” or the negative thereof, other variations thereon or comparable terminology or by discussions of strategy, plans, objectives, goals, future events or intentions. These forward-looking statements include all matters that are not historical facts and involve predictions. Forward looking statements may and often do differ materially from actual results. They appear in a number of places throughout this announcement and include statements regarding the intentions, beliefs or current expectations of the directors or TECOM Group with respect to future events and are subject to risks relating to future events and other risks, uncertainties and assumptions relating to TECOM Group’s business, concerning, amongst other things, the results of operations, financial condition, prospects, growth and strategies of TECOM Group and the industry in which it operates.

No assurance can be given that such future results will be achieved; actual events or results may differ materially as a result of risks and uncertainties facing TECOM Group. Such risks and uncertainties could cause actual results to vary materially from the future results indicated, expressed or implied in such forward-looking statements. The forward-looking statements contained in this announcement speak only as of the date of this announcement. The Selling Shareholder, TECOM Group, the Joint Global Coordinators and/or their respective affiliates, expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained in this announcement to reflect any change in its expectations or any change in events, conditions or circumstances on which such statements are based unless required to do so by applicable law.

Goldman Sachs International, Morgan Stanley & Co. International plc and UBS AG, London Branch are each authorised by the Prudential Regulation Authority (the “PRA”) and regulated by the Financial Conduct Authority (the “FCA”) and the PRA in the United Kingdom. Emirates NBD Capital PSC and First Abu Dhabi Bank PJSC are each authorised and regulated in the United Arab Emirates by the Central Bank of the UAE.

The Joint Global Coordinators are acting exclusively for the Company and no-one else in connection with the Global Offering. They will not regard any other person as their respective clients in relation to the Global Offering and will not be responsible to anyone other than the Company for providing the protections afforded to their respective clients, nor for providing advice in relation to the Global Offering, the contents of this announcement or any transaction, arrangement or other matter referred to herein.

In connection with the Global Offering, each of the Joint Global Coordinators and any of their affiliates, may take up a portion of the Shares in the Global Offering as a principal position and in that capacity may retain, purchase, sell, or offer to sell for their own accounts such Shares and other securities of the Company or related investments in connection with the Global Offering or otherwise. Accordingly, references in the International Offering Memorandum, once published, to the Shares being issued, offered, subscribed, acquired, placed or otherwise dealt in should be read as including any issue or offer to, or subscription, acquisition, placing or dealing by, each of the Joint Global Coordinators and any of their affiliates acting in such capacity. In addition, certain of the Joint Global Coordinators or their affiliates may enter into financing arrangements with investors in connection with which they or their affiliates may from time to time acquire, hold or dispose of Shares. None of the Joint Global Coordinators or any of their respective affiliates intends to disclose the extent of any such investment or transactions otherwise than in accordance with any legal or regulatory obligations to do so.

[1] Current Group CEO of DHAM

[2] TECOM Group classifies its assets between central business districts (CBD) and non-central business districts (non-CBD). CBD districts includes Dubai Internet City, Dubai Media City, Dubai Knowledge Park and Dubai Design District. The remainder of TECOM Group’s business districts are classified as non-CBD.

[3] Funds from operations = Cash generated from operations before change of working capital net finance costs

[4] Recurring free cash flow = Funds from operations maintenance & enhancement capex