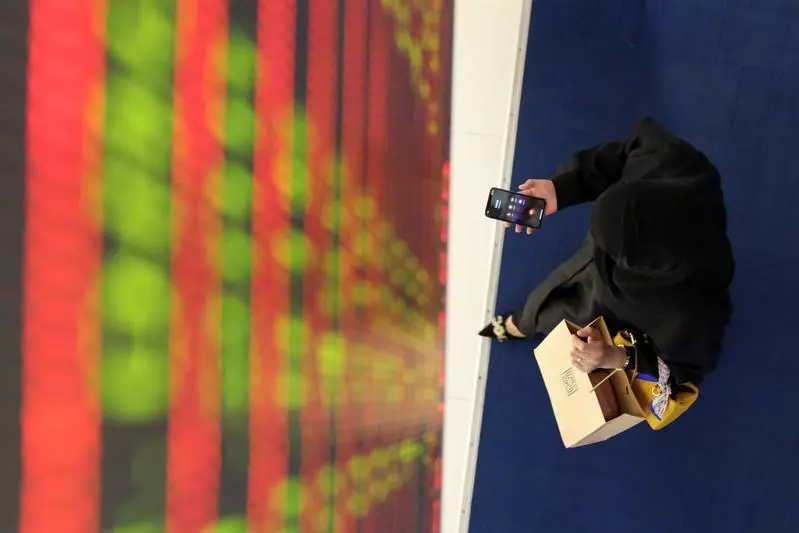

PHOTO

The initial public offerings (IPO) activity in the Middle East and North Africa retained strong momentum during the first quarter with the region witnessing 10 IPOs for the three-month period raising a total of $1.2 billion, according to leading professional services network EY.

Globally, Q1 2024 witnessed a total of 287 IPOs, raising $23.7 billion - a 7% increase in value year on year (YoY) - as market participants navigated uncertainties stemming from recent economic fluctuations and a global election year.

In the Mena region, Saudi Arabia dominated the listing activity with nine IPOs followed by UAE, which had the IPO of Parkin Company PJSC, that raised the highest proceeds in the region for the quarter at $0.4billion, stated EY in its Mena IPO Eye Q1 2024 report.

An additional 25 private companies and 10 funds across various sectors intend to list on Mena exchanges in 2024. KSA leads with 21 announced IPOs, followed by the UAE with one.

Outside of the GCC, Raya Information Technology in Egypt and Crédit Populaire d'Algérie in Algeria have announced their planned IPOs, it added.

In terms of Mena stock exchange performance, the Egyptian Exchange emerged at the top with an 8% gain during Q1 2024, followed by Boursa Kuwait Premier Market with 7.5% and Dubai Financial Market with 4.6%.

At the end of the quarter, eight out of the 10 Mena IPOs had a positive return compared to their IPO price, with MBC Group achieving the highest gain of 128%, it added.

Brad Watson, EY Mena Strategy and Transactions Leader, said: "The first quarter 2024 started off on a positive note with 10 IPOs concentrated in the GCC region, raising a total of $1.2 billion. Saudi Arabia continued to dominate listing activity with nine IPOs across diverse sectors, while DFM welcomed its first listing in 2024. The region has retained a robust pipeline, with several companies in the GCC and North Africa having announced their intentions to list."

KSA was again the frontrunner in listing activity in Q1 2024. The country’s largest – and the region’s second-largest – IPO was raised by Modern Mills Company at $724 million, accounting for 27.3% of the overall proceeds.

This was followed by MBC Group with $222 million and Middle East Pharmaceutical Industries Company with $131 million.

According EY, all three IPOs were listed on the Tadawul Main Market. The remaining six listings took place on the Nomu – Parallel Market with total proceeds of $57m. The funds have been sourced from a variety of sectors, such as healthcare, F&B, and media and entertainment.

The kingdom also continued to lead the pipeline activity for the Mena region with several companies, such as Saudi Manpower Solutions Company (SMASCO), Miahona, and Panda Retail Company, announcing their plans to list.

In the UAE, Parkin Company raised the highest proceeds in the region in Q1 2024 with $0.4b on DFM, contributing 37.2% of the total IPO value. The IPO was oversubscribed 165 times, with the highest first-day gain among the quarter’s listings at 35%.

This is the third Roads and Transport Authority (RTA) asset to have listed after Salik and the Dubai Taxi Company (DTC).

The country also announced significant upcoming listings, including Spinneys, LuLu Group and Etihad Airways, it stated.

According to EY, the UAE has issued mandatory environmental, social and governance (ESG) reporting guidelines for listed companies on Abu Dhabi Securities Exchange (ADX). The move marks a significant step toward enhancing transparency and promoting sustainable practices in the region's financial markets.

In addition, Muscat Stock Exchange (MSX) introduced voluntary ESG disclosure guidelines in 2023, with mandatory sustainability reporting expected to be implemented by 2025.

Meanwhile, Saudi Green Initiative, which aims to plant 10 billion trees by 2030, among other goals, demonstrates a commitment to environmental protection and a shift towards renewable energy sources. By embracing ESG reporting, GCC can unlock sustainable growth, attract responsible investments and contribute to a greener global economy.

Gregory Hughes, EY Mena IPO Leader, pointed out that the start of the year had been strong with no sign of a slowdown in IPO activity.

"The successful listing of Parkin Company on the DFM demonstrated a continued commitment toward the Dubai government’s privatization program that involves listing state-owned companies as part of the nation’s economic diversification drive," he added.

Copyright 2024 Al Hilal Publishing and Marketing Group Provided by SyndiGate Media Inc. (Syndigate.info).