PHOTO

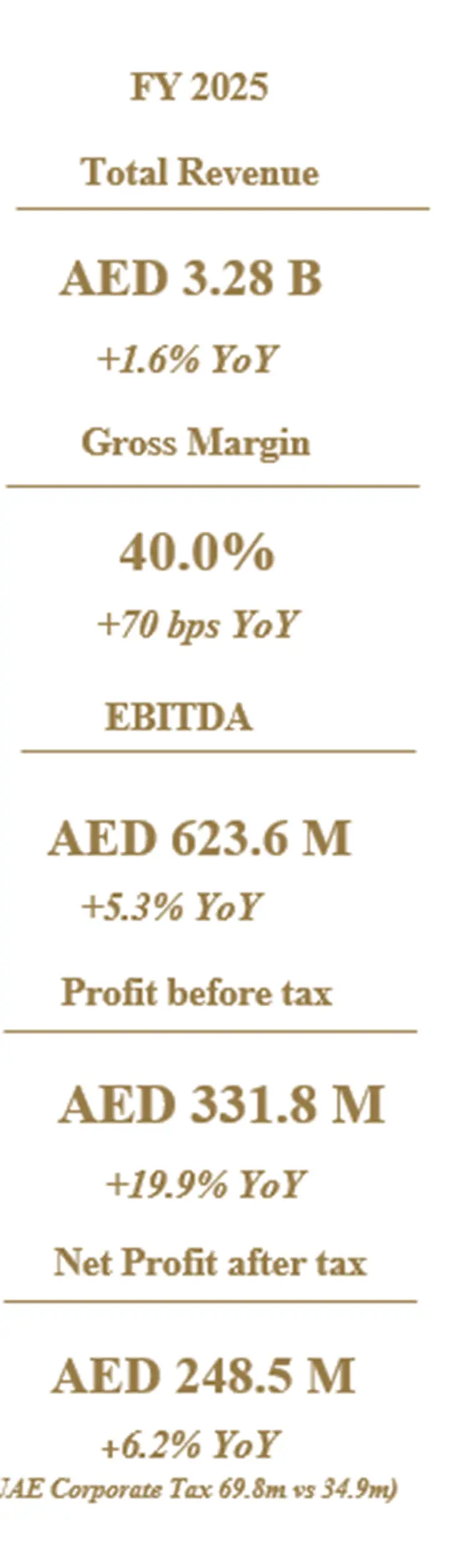

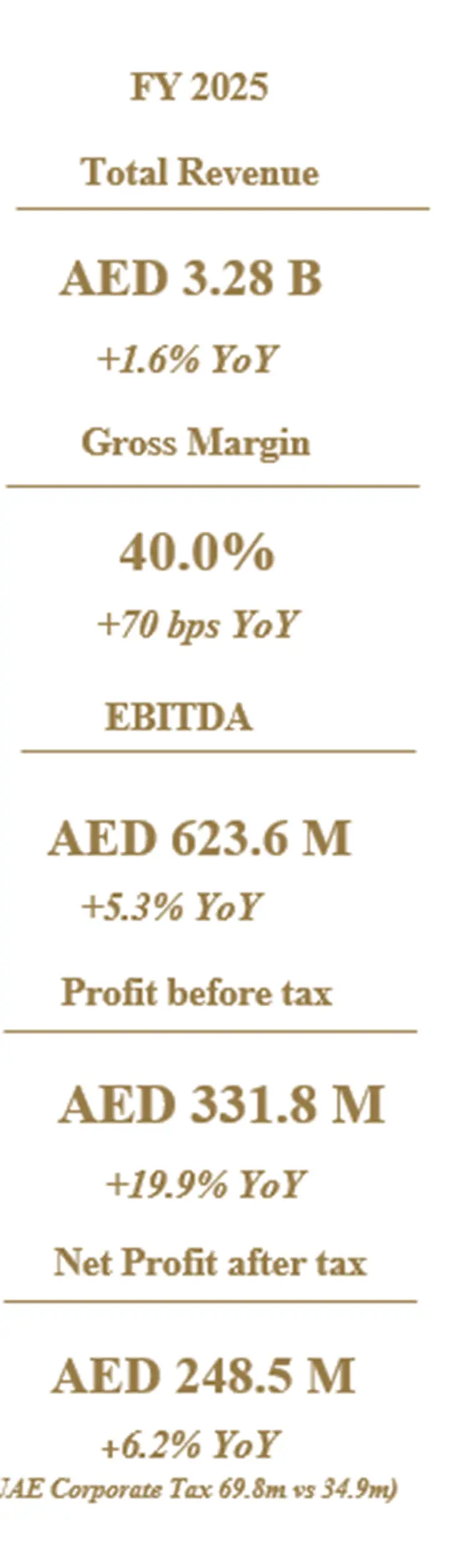

- Gross profit margin: Continued improvement by 190bps YoY to 39.1% in Q4 2025, while in FY 2025 improved by 70bps YoY to 40.0%.

- Profit Before Tax: Increased by 14.5% YoY to AED 94.0 million in Q4 2025, compared to AED 82.1 million in Q4 2024. FY 2025 Profit before tax increased by 19.9% YoY to AED 331.8 million.

- EBITDA performance: EBITDA increased by 1.0% YoY in Q4 2025 to AED 159.6 million, while in FY 2025 EBITDA increased 5.3% YoY to AED 623.6 million.

- Financial health: Net debt position stood at AED 1.49 billion in Q4 2025, increased by 7.1% compared to Q4 2024. The net debt to EBITDA ratio also increased from 2.35x in Q4 2024 to 2.40x in Q4 2025.

- Dividend: The Board of Directors proposed a cash dividend distribution of 10 fils per share (AED 99.4 million) for H2 2025

Ras Al Khaimah, United Arab Emirates: RAK Ceramics PJSC (Ticker: RAKCEC: Abu Dhabi), one of the world’s leading lifestyle ceramics brands, reported resilient financial results for the fourth quarter and the year ending 31st December 2025.

Financial Highlights (Q4 and FY25)

RAK Ceramics delivered robust gross margins and healthy bottom-line growth in Q4 & FY 2025, despite ongoing market headwinds in certain geographies. Strong activity in the UAE real estate and construction sectors remained a key driver of top-line growth, supported by an increased contribution from higher-margin project business and premium product segments.

In Q4 2025, total revenue stood at AED 856.4 million, down 1.7% YoY. In FY 2025, total revenue rose 1.6% YoY to AED 3.28 billion.

In Q4 2025, Gross profit margin improved to 39.1% compared to 37.2% in the same quarter last year. Gross profit margin improved to 40.0% in FY 2025 compared to 39.3% in FY 2024.

In Q4 2025, profit before tax jumped 14.5% YoY to AED 94.0 million. In FY 2025, profit before tax jumped 19.9% YoY to AED 331.8 million.

In Q4 2025, net profit after tax rose 2.5% higher YoY to AED 65.8 million. In FY 2025, net profit after tax jumped by 6.2% to AED 248.5 million from AED 234.1 million in the year-before period.

EBITDA rose 1.0% to AED 159.6 million in Q4 2025 from AED 158.1 million in the year before period. EBITDA rose by 5.3% to AED 623.6 million in FY 2025, from AED 592.2 million in the year-before period.

EBITDA margins rose 0.5% to 18.6% in Q4 2025 from 18.1% in the same quarter last year. In FY 2025, EBITDA margins rose 0.7% YoY to 19.0%.

Net debt position stood at AED 1.49 billion, up 7.1% YoY, due to higher capex spending mainly for upgradation of plants in the UAE. The net debt to EBITDA ratio also increased from 2.35x in Q4 2024 to 2.40x in Q4 2025.

*UAE Corporate tax impact is AED 22.8m vs 7.9m in Q4 2025 vs LY and in FY it is AED 69.8m vs 34.9m in last year

Segment performance highlights

- Tiles segment: FY 2025 delivered growth in tiles division in both volume and value, led by the UAE, the Middle East, Europe (Germany), and Bangladesh. Revenue from tiles division rose 1.9% to AED 1.89 billion in FY 2025 compared to AED 1.86 billion in FY 2024.

- Sanitaryware segment: Revenue was flat at AED 466.4 million in FY 2025 supported by sales in the UAE, Saudi Arabia and the Middle East.

- Faucets segment: Revenue grew by 4.6% YoY to AED 465.2 million in FY 2025 driven by improved performance in Saudi Arabia, Europe, Asia and Africa. We remain committed to improving Kludi’s operational performance and are progressing with our cost-optimisation strategy, including relocating key EU production facilities to the UAE.

- Tableware segment: Delivered resilient performance, with revenue marginally lower by 1.4% YoY at AED 364.1 million in FY 2025. We are focusing on higher-margin channels such as airlines and premium hospitality projects. In October 2025, RAK Porcelain Group announced a strategic acquisition of Bankook Design Chambre S.L., the owner of the Cookplay brand, expanding its premium tableware portfolio and strengthening its presence in the European market.

Tiles & Sanitaryware market highlights

- The UAE market continued to outperform, driven by the tiles and sanitaryware segment, coupled with the strength in the real estate sector. Revenue in the UAE market jumped 13.4% in FY 2025 to AED 955.8 million. A greater share of project-based business has contributed positively to both revenue and margin, with growing demand for large-format porcelain tiles.

- In Saudi Arabia, revenue declined by 17.7% in FY 2025 to AED 232.1 million as performance remained under pressure due to intense competition and an oversupply of tiles from local producers. We are well positioned to meet market demand as the Saudi Arabia market is experiencing a decisive shift from Ceramic tiles to Porcelain tiles. Also, we are making steady progress on the Greenfield Tiles Project in Yanbu - expected completion by Q1 2027, to support long-term capacity and cost competitiveness.

- In Europe, revenue declined by 5.2% to AED 323.3 million in FY 2025, as demand stayed subdued amid macroeconomic headwinds across the retail and project sectors and intensified competition from regional players. Italy was further impacted by the withdrawal of renovation incentives; mitigation and turnaround initiatives have been initiated across Europe operations.

- In India, revenue declined by 9.2% to AED 331.1 million in FY 2025, as the market experienced a cyclical slowdown during the year marked by limited domestic growth across the industry. We are strengthening our retail presence, including revamping of retail stores & own showrooms and expanding our dealer network.

- In Bangladesh, revenue increased by 5.0% to AED 220.5 million, as the market showed signs of recovery. We have initiated actions to regain market share through new product launches, competitive pricing, and stronger distribution channels. The formation of a new government following the national elections is expected to revive stalled public-sector projects, supporting revenue growth in FY 2026.

- In Middle East, revenue in FY 2025 rose 6.1% YoY to AED 128.3 million, driven by favorable market conditions.

Commenting on the performance, Abdallah Massaad, Group Chief Executive Officer of RAK Ceramics, said:

“We are encouraged by the progress achieved during the year, particularly in margin expansion, manufacturing efficiencies, and the strength of our UAE operations. While near-term challenges persist in certain markets, we are actively executing targeted turnaround and growth initiatives across our portfolio.

With a strong foundation, a clear strategic roadmap, and ongoing investments in capacity, innovation, and sustainability, we are well-positioned to deliver profitable growth and further strengthen our global footprint in the years ahead.”

Strategic Highlights

Upgradation Projects

- We are developing state-of-the-art slab production facilities in the UAE, with one facility having commenced commercial production in July 2025 and another under development, expected to begin commercial production by end of February 2026.

- We are upgrading the UAE sanitaryware facility by adopting energy-efficient technologies, expanding the product portfolio, and implementing initiatives to reduce carbon emissions in line with our sustainability objectives.

Design Excellence Spotlight

- In November 2025, RAK Ceramics kicked off a vibrant Dubai Design Week at the RAK Ceramics Design Hub in Dubai Design District, hosting Workshops that brought design enthusiasts together to explore patterns, textures, and creativity.

- In November 2025, RAK Ceramics participated in Saudi Build 2025 in Riyadh, highlighting its latest tiles, Sanitaryware and Faucets collections for the Saudi market.

- In December 2025, KLUDI concluded its participation at Big 5 Global 2025, in Dubai, UAE, engaging with industry professionals, clients, and partners while presenting its latest innovations and design-driven bathroom solutions.

Awards & Recognition

- In November 2025 in Dubai, KLUDI received the Design Middle East Award 2025 for Design Excellence in Bathroom Fittings, celebrating its commitment to innovation, precision engineering, and timeless design.

- In November 2025, RAK Ceramics was recognised at the MENA Green Building Awards 2025, for Sustainable Building Product of the Year - Indoor Air Quality for its porcelain and ceramic tiles, highlighting the brand’s commitment to healthier indoor environments and sustainable building solutions.

About RAK Ceramics

RAK Ceramics is one of the largest ceramics’ brands in the world. Specialising in ceramic and gres porcelain wall and floor tiles, tableware, sanitaryware and faucets, the Company has the capacity to produce 118 million square meters of tiles, 5.7 million pieces of sanitaryware, 36 million pieces of porcelain tableware and 2.6 million pieces of faucets per year at its 23 state-of-the-art plants across the United Arab Emirates, India, Bangladesh and Europe.

Founded in 1989 and headquartered in the United Arab Emirates, RAK Ceramics serves clients in more than 150 countries through its network of operational hubs in Europe, Middle East and North Africa, Asia, North and South America and Australia.

RAK Ceramics is a publicly listed company on the Abu Dhabi Securities Exchange in the United Arab Emirates and as a group has an annual turnover of approximately USD $1 billion.

Learn more about RAK Ceramics : https://www.rakceramics.com

Contact Us

If you have any questions or require further information, please do not hesitate to contact our investor relations department.

Investor Relations: RAK Ceramics PJSC

Sarang Dublish

E. ir@rakceramics.com | corporate.rakceramics.com

For media enquiries, please contact:

Kaizzen Communications Consultants LLC (Financial communications advisor)

Shweta Soni

Suhas Pandit

E. rakceramics@kaizzencomm.com