PHOTO

- Americana Restaurants achieved 14.4% year-on-year revenue growth driven by strong brand performance and portfolio expansion.

- The Company maintained robust free-cash-flow generation and a debt-free balance sheet.

- Overall performance driven by positive momentum in Like for like sales, strategic expansion, product innovation, and continued cost discipline supported robust results across key markets.

Abu Dhabi and Riyadh: Americana Restaurants International PLC (“Americana Restaurants” or the “Company”) (ADX symbol: AMR/ ISIN: AEE01135A222) (Saudi Stock Exchange symbol: 6015), the largest out-of-home dining and quick service restaurant operator in the Middle East & North Africa (“MENA”) and Kazakhstan, today announced its financial results for the nine-month period ended 30 September 2025.

Solid Performance across Key Markets

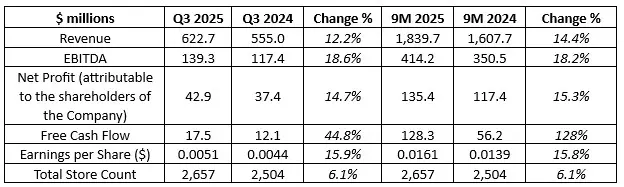

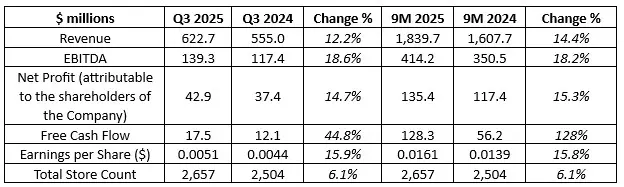

Americana Restaurants continues to deliver strong results, reporting an increase of 10.4% in

like-for-like sales for the first nine months, supported by ongoing operational initiatives, menu innovation, and digital engagement. The Company reported a total revenue of $1,839.7 million for the first nine months of 2025, representing a 14.4% increase year-on-year.

EBITDA and net profit for the nine months also improved compared to the same period last year with EBITDA reaching $414.2 million, up 18.2% compared to the same period of 2024. This increase reflects the resilient business model, disciplined cost management, and enhanced operational efficiency.

Net profit attributable to shareholders of the Company for the nine-month period stood at

$135.4 million, marking 15.3% increase year-on-year and maintaining a 7.4% margin showing a marginal improvement from last year despite the impact of tax regulations this year amounting to $11.3 million in key markets in 2025. Net profit of last year also included positive one-off items totalling to $7.2 million primarily related to marketing reliefs received in Q1 2024 and normalized thereafter.

Free cash flow for the nine-month period reached $128.3 million, demonstrating 128% growth with 53% conversion rate, driven by solid operational performance and strong working-capital management. The Company continues to maintain a robust, debt-free balance sheet with healthy cash reserves.

In Q3 2025, Americana Restaurants continued its solid trajectory, reporting revenues of $ 622.7 million, representing a 12.2% increase compared to Q3 2024. EBITDA and net profit also grew by 18.6% and 14.7%, reaching $ 139.3 million and $ 42.9 million, respectively. This performance reflects the Company’s resilient operations, disciplined cost management, and continued efficiency across key markets.

Footprint Growth and Portfolio Expansion

During the first nine months of 2025, the Company opened 68 new stores and integrated 46 additional restaurants from Pizza Hut Oman, bringing the total store count to 2,657 across 12 countries. The Company adopted a selective approach to store expansion to ensure judicious capital deployment.

9M 2025 Financial Overview

Championing Inclusion and Social Responsibility

Americana Restaurants continued to strengthen its inclusion and social responsibility initiatives in the United Arab Emirates during the third quarter of the year. In partnership with the Sharjah City for Humanitarian Services, the company opened four new inclusive Pizza Hut stores across four emirates, operated by People of Determination with hearing and speech impairments. This milestone reinforces Americana Restaurants’ commitment to creating an inclusive work environment that ensures equal opportunities for all.

To further promote accessibility and awareness, Americana Restaurants launched the “Sign & Smile” card, an interactive guide that helps customers learn basic sign-language phrases to place orders and communicate with employees. The card acts as a bridge for meaningful interaction, reflecting the company’s vision of building a more inclusive and connected community.

Earnings Conference Call

A conference call to present earnings, followed by a Q&A session, has been scheduled for Monday, 03 November, 2025 at 17:00 (GST) / 14:00 (BST) / 9:00 (EDT). The call will be hosted by Amarpal Sandhu (CEO), Harsh Bansal (CFO & CGO) and Pujeet Parekh (Head Investor Relations). Interested parties are invited to join the call by clicking here.

About Americana Restaurants

Americana Restaurants is the largest out-of-home dining and quick service restaurant (QSR) operator in its 12 countries of operation across the Middle East, North Africa and Kazakhstan.

The Company’s portfolio includes a range of iconic global brands, including KFC, Pizza Hut, Hardee’s, Krispy Kreme, Peet’s Coffee, Wimpy, TGI Friday’s, Costa Coffee Baskin Robbins and carpo. Americana Restaurants’ customer-centric restaurant platform, which includes 19 proprietary SuperApps, allows customers to experience their favourite global restaurant brands and meals when they want, where they want and how they want.

The Company’s historic IPO on the Abu Dhabi Securities Exchange (ADX) and the Saudi Exchange in 2022 marked the region’s first-ever concurrent dual-listing. Today, Americana Restaurants is a leading master franchisee and a food and beverage pioneer with decades-long heritage, an extensive geographic footprint, long-standing franchisor relationships and a diverse restaurant portfolio that spans the full out-of-home dining spectrum from QSR to fast casual, coffee and indulgence.

For more information, please visit: www.americanarestaurants.com

Contact

Investor Relations

Pujeet Parekh

Head of Investor Relations and Business Development

Investor.Relations@americanarestaurants.com

Media

Imane Elsayed

Communications Manager

ielsayed@americana-food.com