RIYADH – ADES Holding Company (“ADES” or the “Company”) and together with its subsidiaries (the “Group”), a leading oil and gas drilling and production services provider in the Middle East and North Africa region (the “MENA” region), today announces its intention to proceed with an initial public offering (“IPO” or the “Offering”) and the listing of its shares (“Shares”) on the Saudi Exchange’s Main Market.

On 21 June 2023, the Capital Market Authority (“CMA”) approved the Company’s application for registering its share capital and Offering 338,718,754 ordinary shares of the Company’s total capital by way of sale of 101,615,626 existing shares (the “Sale Shares”) by ADES Investments Holding Ltd., the Public Investment Fund (“PIF”) and Zamil Group Investment Ltd. (in proportion to their existing shareholding), together referred to as (the “Selling Shareholders”), and the issuance of 237,103,128 new shares (the “New Shares”) (referred to with the Sale Shares as (the “Offer Shares” and each as an “Offer Share”) for public offering through a capital increase. The Sale Shares represent 9% and the New Shares represent 21% of the Company’s issued share capital upon completion of the Offering, totalling 30% of the issued share capital (after issuance of the New Shares and the Company’s capital increase).

The Company will also issue 33,871,875 new shares to be allocated to the employees of the Company and its Subsidiaries, which shall be maintained as treasury shares until they are transferred to the employees in accordance with the provisions of the long-term incentive scheme.

The Offering proceeds after deducting IPO-related expenses will be distributed to the Selling Shareholders pro rata based on their shareholding in the Sale Shares, with the remaining proceeds used to reduce part of the Group’s outstanding debt and finance the Group’s strategy to achieve its growth objectives.

The final pricing of the Offer Shares will be announced on Monday 13/03/1445H Corresponding to 18 September 2023G.

Offering overview

The IPO of ADES comprises an offer of 338,718,754 ordinary shares, representing 30% of the Company’s issued share capital (after the increase) through the sale of a mix of existing shares and newly issued shares.

The Offer Shares will be listed and traded on the Saudi Exchange’s Main Market following the completion of the IPO and listing formalities with the CMA and the Saudi Exchange.

The Offer Shares will be offered for subscription to individual investors (“Individual Subscribers”) and institutional investors (“Participating Parties”), including Participating Parties outside the United States in “offshore transactions” in accordance with Regulation S under the US Securities Act of 1933, as amended (the “Securities Act”).

A maximum of 338,718,754 shares, representing 100% of total Offer Shares, to be initially allocated to Participating Parties

The financial advisors (as defined below) may, in coordination with the Company, reduce the number of shares allocated to Participating Parties to 304,846,879 shares, representing 90% of total Offer Shares, to accommodate for Individual Subscriber demand.

A maximum of 33,871,875 ordinary shares, representing 10% of the total Offer Shares, will be allocated to Individual Subscribers. Individual Subscribers must, at the time of subscription, have an active stock portfolio at a Capital Market Institution associated with the Receiving Agent being subscribed through, otherwise subscriptions will be rendered void and the amounts paid will be refunded.

The final Offering price will be determined at the end of the book-building process.

Company overview

The Group is a leading oil and gas drilling services provider in the MENA region, focusing on creating value for its clients by providing competitive service rates through leveraging its low-cost business model.

The Group’s evolving portfolio of services primarily includes onshore and offshore contract drilling and workover services, which include maintenance, repair, and enhancement of oil healthy production.

The Group has global-scale operations across seven countries: the Kingdom of Saudi Arabia, Kuwait, Qatar, Egypt, Algeria, Tunisia, and India. Operations in India will start in 2023G on the back of already awarded contracts.

The Group is one of the largest offshore jackup drilling rig operators globally (by number of jackup rigs) .

The Group has established an exemplary track record of expansion in recent years. It has a proven ability to take advantage of market cycles to expand its fleet and acquire fit for purpose assets at attractive valuation and deploy them under existing contracts.

The Group also benefits from leveraging a lean and low-cost operating model, relying on a skilled local workforce, local suppliers and in-house maintenance team, which results in industry-low overheads and unlocks cost efficiencies.

The Group recently effected its planned strategic relocation of headquarters to the Kingdom of Saudi Arabia where its main client (Saudi Aramco) and the majority of the Group’s operations, shareholders, and banks are located.

The Group has strong and diversified customer relationships with both national oil companies (“NOCs”) and international oil companies (“IOCs”) throughout the MENA region.

The Group’s key clients are Saudi Aramco in the Kingdom of Saudi Arabia, Kuwait Oil Company in Kuwait and North Oil Company in Qatar, which in aggregate represent more than 95% of the Group’s total backlog as of 31 December 2022G and 82% of revenue from contracts with customers for the year ended 2022G.

Other clients include other NOCs and their joint ventures with IOCs, such as Total Energies in Qatar, Oil and Natural Gas Corporation in India, the Gulf of Suez Petroleum Company (“GUPCO”) and the General Petroleum Company (“GPC”) in Egypt and ENAFOR in Algeria.

A total workforce of 5,275 employees as of 31 December 2022G supports the Group’s operations.

ADES in numbers

An aggregate fleet of 85 rigs in seven countries (including three rigs that will be operating in India), including a total of 36 onshore drilling rigs, 46 jackup offshore drilling rigs (of which four are leased), two jackup barges, and one mobile offshore production unit (“MOPU”)

SAR 27.6 billion (USD 7.4 billion ) total backlog as of 30 June 2023G

98% effective utilisation rate for the year ended 31 December 2022G and over 90% for the last five years

SAR 1.98 billion (USD 528 million) total revenue from contracts with customers in H1 2023G

EBITDA margin of 47.0% in H1 2023G

Zero employee fatalities and a total recordable injury rate of 0.10 per 200,000 working hours as of 31 December 2022G, reflecting the Group’s longstanding commitment to HSE and strong safety track record

Company strategic direction

Continue to build on the Company’s track record of delivering growth organically through continued participation in tenders and through selective, value-accretive M&A with a focus on assets with strong returns on investment potential. The Group makes acquisitions using either a “buy to contract” method, in which it secures a contract before finalising the acquisition, or a “contract acquisition” method, in which it acquires an asset with an ongoing contract that can be novated to the Group.

Maintaining cost control through continued commitment to a lean cost structure, low operating expenses, operating cost-saving measures and a reliance on local talent to maintain excellent quality service to continue offering client best-in-class services at reasonable prices.

Maintaining an efficient approach to capital structure, while paying sustainable dividends and allowing room for growth.

Ayman Abbas, Chairman of ADES, commented: “Since inception, ADES has grown from a local driller operating predominantly in North Africa to one of the largest drilling operators in the MENA region with a fleet of 85 rigs and operations spanning seven countries, including India where three rigs will be operating in 2023. We are now present in the most attractive drilling markets globally and partner of choice for the largest and most reliable energy suppliers around the world. Our IPO will support us in continuing to deliver growth and cement our position as the leader in the jackup drilling market in Saudi Arabia and globally.”

Mohamed Farouk, CEO of ADES, commented: “ADES’ IPO on the Saudi Exchange marks an important milestone for the Company and is a key step in realising our ambitious growth strategy. Our extensive track record of operational excellence and successful growth, underpinned by our high-quality client relationships, resilient business model and solid backlog, means we are well positioned to deliver strong returns to shareholders. Our IPO offers international and retail investors a highly compelling opportunity to invest in a leading global drilling operator with a growing international footprint.”

About ADES

ADES Holding Company, headquartered in Al Khobar in the Kingdom of Saudi Arabia, is a leading oil and gas drilling and production services provider in the MENA region. The Company has over 7,500 employees and a fleet of 85 rigs across seven countries in the MENA region and India, including 36 onshore drilling rigs, 46 jackup offshore drilling rigs, two jackup barges, and one mobile offshore production unit (“MOPU”).

For more information, visit: www.adesgroup.com

KEY INVESTMENT HIGHLIGHTS: DRILLING FOR VALUE

1. Leading global drilling operator focused on the most attractive and resilient drilling markets with a growing global footprint:

ADES has built an extensive track record of operational excellence, formed longstanding relationships with well-regarded clients and developed a deep understanding of market dynamics.

The Group grew from a local driller operating predominantly in North Africa to one of the largest drilling operators in the MENA region with a fleet of 85 rigs and operations spanning seven countries (including three rigs that will be operating in India).

Over the past decade, the Group expanded its footprint across key geographies, leveraging its ability to identify underserved, niche profitable markets and acquiring value-accretive, distressed assets and companies.

In line with its targeted expansion preliminary in the GCC countries, the Group’s backlog increased from SAR 3.5 billion (USD 0.9 billion in 2020G to SAR 27.4 billion (USD 7.3 billion) in 2022G with 97% coming from the GCC.

The Group is the largest shallow water driller in the market in which it operates and has become the partner of choice for key energy suppliers in its markets.

The Group is present in the most attractive drilling markets globally. The Middle East is characterised by low extraction costs, non-harsh environments, and a predominance of drilling intensive legacy fields, making the region less affected by short-term oil price volatility.

The Group is the national leader in offshore drilling in the Kingdom of Saudi Arabia and is the largest jackup rig operator for Saudi Aramco. It has 33 jackup rigs contracted in the Kingdom of Saudi Arabia, all of which have been added since 2016G, translating to an approximately 36% market share as at 31 December 2022G.

2. Operating in markets with high barriers to entry:

The Group benefits from high barriers to entry in markets in which it operates, such as significant capital requirements to acquire new assets, a stringent pre-qualification process, local content requirements, rig supply chain constraints, long lead time to build new rigs, and stringent technical specifications for rigs.

With its existing large fleet of 46 jackup rigs, the Group is the largest offshore jackup rig operator in its markets and is well-positioned to benefit from the increased demand for and scarcity of jackup rigs in the future.

The Group is one of the leading drillers in terms of local content due to its ability to provide a substantial portion of services utilizing local workforce in each individual market.

3. Business model resilient by design and well-equipped to withstand market cycles and deliver sustainable performance:

The Group’s business model is primarily focused on resilient sub-segments of the drilling industry and is founded on a lean cost structure, which has allowed it to achieve a track record of profitable growth throughout cyclical market conditions in the oil and gas industry.

The Group operates primarily in regions with low costs of production that are dominated by NOCs and is focused on the largest and most resilient drilling markets across the MENA region, namely the Kingdom of Saudi Arabia, Kuwait and Qatar, which are key for the global security of energy supply.

The Group’s lean cost structure is characterised by a high-skill, low-cost, local workforce, an in-house maintenance and technical team, and lean organisational structure, enabling the Group to save on operating costs by maximising the utilisation and efficiencies of acquired rigs.

Supported by a solid backlog, the Group has a proven ability to perform through cycles and maintained actual utilisation rates of 89%, 94% and 98% in 2020G, 2021G and 2022G, respectively.

The Group’s revenue from contracts with customers has increased from SAR 1.695 billion (USD 452 million) in 2020G and SAR 1.5 billion (USD 404 million) in 2021G to SAR 2.467 billion (USD 658 million) in 2022G.

The Group maintained a steady EBITDA margin since 2014G, despite significant volatility in the price of oil and gas, with an average of 42.3% between 2020G and 2022G.

4. High quality client relationships and the partner of choice for the largest and most reliable energy suppliers globally:

The Group put in place a project management framework structured around four key pillars, program management, shipyards, staffing, and procurement and logistics, to ensure seamless and efficient delivery of future deployments of rigs to its clients.

The Group has cultivated a client base dominated by the largest global NOCs, who are focused on delivering on long-term strategies and are less susceptible to short-term energy price cycles.

In line with its targeted expansion in the GCC countries, the proportion of the Group’s backlog from GCC-based customers is 97%, amounting to SAR 27.4 billion (USD 7.3 billion) in 2022G.

The Group is well-positioned to benefit from Saudi Aramco’s growth plans because it has aligned its capabilities and asset base to Saudi Aramco’s needs and requirements.

The Group is currently delivering one of the largest rig deployment programs ever awarded to a driller by Saudi Aramco after winning two large tenders in 2022G consisting of a total of 16 rigs, in addition to three contracted rigs that were transferred to the Group after it acquired Seadrill rigs, which make a total of 19 rigs to be delivered to Saudi Aramco. As at May 2023G, seven drilling rigs have been deployed into operation and 12 drilling rigs are still under preparation and are scheduled for delivery by the end of the fourth quarter of 2023G.

5. Robust contracts and predictable cash flows underpinned by solid backlog:

The Group’s operational excellence and strong health and safety records underpin its strong client relationships and long-standing contracts, enabling it to generate predictable cash flows and a substantial backlog.

The proportion of the Group’s backlog from GCC-based customers increased from 92%, amounting to SAR 3.2 billion (USD 0.9 billion), in 2020G, to 97%, amounting to SAR 27.4 billion (USD 7.3 billion), in 2022G.

The Group’s client contracts have a weighted average remaining contract term of 5.8 years as at 31 December 2022G.

6. Track record of disciplined value-enhancing acquisitions focused on delivering value-accretive growth:

The Group takes a disciplined and non-speculative approach to acquiring assets and makes acquisitions primarily using:

a “buy to contract” method, in which it secures a contract before finalising the acquisition, or;

a “contract acquisition” method, in which it acquires an asset with an ongoing contract that can be novated to the Group.

The Group has a strong track record of procuring, upgrading, commissioning and successfully integrating the rigs it acquires in a short period.

The Group has proven to be extremely nimble in capturing market opportunities and pivoted quickly from acquiring legacy assets to acquiring premium assets since 2021G, when the prices of premium assets dropped and returns on these investments met the Group’s relevant investment thresholds.

In 2022G, the Group completed the acquisition of 24 rigs and entered into a final agreement to acquire a further two rigs.

The Group targets payback of up to five to seven years, depending on the asset, contract framework and country of investment.

In addition to the acquisitive growth, the Group has also grown organically due to its lean cost structure and strong client relationships.

7. Robust Health, Safety, and Environment (HSE) policies and our, with exemplary safety track record, are our license to operate:

The Group, through its subsidiaries, is an active member of industry organisations such as International Marine Contractors Association (“IMCA”) and the International Association of Drilling Contractors (“IADC”), and all the operational offshore rigs in its fleet are either IACS-certified or pending recertification.

The Group has consistently maintained a strong position within Saudi Aramco’s Rigs Efficiency Index (“REI”), a key performance indicator considered by Saudi Aramco when awarding long-term contracts, with an average REI score of 90 for the three years ended 31 March 2023, as well as a “high performance” or above rating for 20 out of a total of 25 rigs contracted and operational with Saudi Aramco.

The Group’s longstanding commitment to HSE has enabled it to maintain a strong safety track record, with zero employee fatalities and a total recordable injury rate of 0.10 per 200,000 working hours, which is lower than the IADC worldwide standard rate of 0.67 as of 31 December 2022G.

The Group is developing new tools to improve safety records, such as the “Rig Eye”, an on-site camera-based artificial intelligence system to increase operational efficiency and prevent rig accidents.

ADES is considered to be among the first drillers to launch a project with the aim to reduce emissions from engines by 6% by 2030G and is currently testing new ways to reduce emissions to meet clients’ targets.

8. Highly capable management team supported by strategic shareholders:

The management team comprises diverse, high-calibre professionals with a deep understanding of the industry’s dynamics and inefficiencies and significant industry experience gained from global and local corporations.

The management’s diverse professional backgrounds are a key strength as they facilitate the Group’s ability to transfer best practices from different industries and introduce innovative solutions to address complex client needs.

The Group also has backing from long-term shareholders who provide unique market access and strategic know-how. ADES Investments Holding Ltd owns the majority stake of 54.5% in the Company and the PIF and Zamil Investment Limited own 35.5% and 10.0% stakes, respectively, thereby being key strategic supporters of the Group’s growth.

BACKGROUND TO THE OFFERING

The Offering will be restricted to the following groups of subscribers:

Tranche (A): Participating Parties: this tranche comprises the parties entitled to participate in the book-building process as specified in the Instructions for Book Building Process and Allocation Method in Initial Public Offerings issued by the board of the CMA, which includes investment funds, companies, Qualified Foreign Investors, GCC corporate investors and certain other foreign investors pursuant to swap arrangements (collectively the “Participating Parties” and each a ”Participating Party”). The number of the Offer Shares provisionally allocated to the Participating Parties is 338,718,754 Offer Shares, representing 100% of the total Offer Shares. Final allocation shall be after the end of the individual subscription period, and if there is sufficient demand from the Individual Subscribers (as defined below), the Joint Financial Advisors, in consultation with the Company, will have the right to reduce the number of Offer Shares allocated to Participating Parties to 304,846,879 Shares, representing 90% of the total Offer Shares.

Tranche (B): Individual Subscribers: this tranche comprises Saudi Arabian natural persons, including any Saudi female divorcee or widow with minor children from a marriage to a non-Saudi individual who can subscribe for her own benefit or on behalf of her minor children on the condition that she proves that she is a divorcee or widow and the mother of her minor children, in addition to any non-Saudi natural person who is a resident in the Kingdom, or GCC nationals, who have a bank account and are entitled to open an investment account with one of the Receiving Agents and an active stock portfolio with one of the Capital Market Institution affiliated with the Receiving Agent through which the subscription is being made (collectively, the “Individual Subscribers” and each a “Individual Subscriber”). A subscription for shares made by a person in the name of his divorcee will be deemed invalid and the law will be enforced against such an applicant if a transaction of this nature is proved to have occurred. If a duplicate subscription is made, the second subscription will be considered void and only the first subscription will be considered. A maximum of 33,871,875 Shares, representing 10% of the total Offer Shares, will be allocated to Individual Subscribers. If Individual Subscribers do not subscribe for all the shares allocated to them, the Joint Financial Advisors may reduce the number of shares allotted to them in proportion to the number of shares for which they subscribed.

The Offer Shares will be offered to certain Qualified Foreign Investors (“QFIs”) or to foreign investors located outside the United States through swap agreements (“SWAP”). This class will subscribe outside the United States in “offshore transactions” in accordance with Regulation S under the US Securities Act. The Offer Shares have not and will not be registered under the US Securities Act or the securities laws of any state of the United States of America or under any other law or regulation outside the Kingdom. This Offering may not be considered as an offer to sell or an invitation to purchase securities in any jurisdiction where this Offering is unlawful or is not permitted.

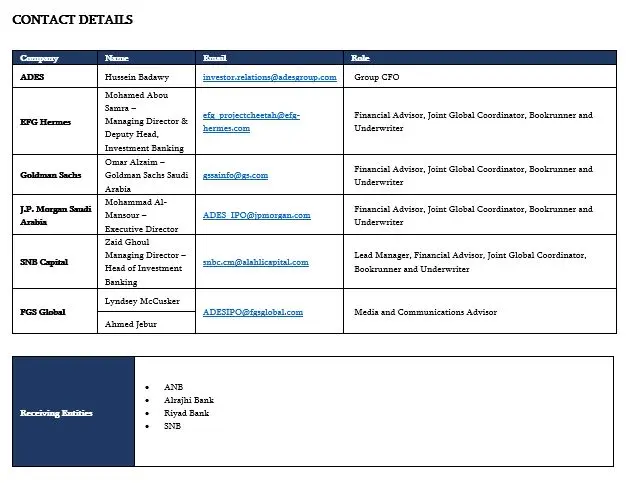

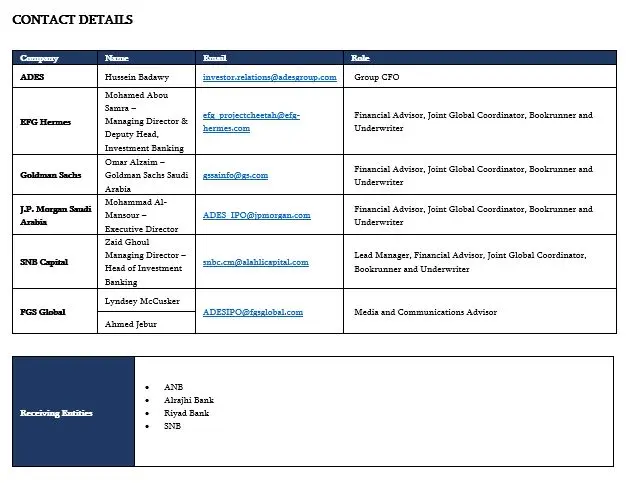

With respect to the Offering, the Company appointed EFG Hermes Saudi Arabia (“Hermes”), Goldman Sachs Saudi Arabia (“Goldman Sachs”), J.P. Morgan Saudi Arabia (“J.P. Morgan”) and SNB Capital Company (“SNB Capital”) as its financial advisors (collectively referred to as the “Financial Advisors”) and global coordinators. In addition, the Company has appointed SNB Capital Company as Lead Manager (the “Lead Manager”) in relation to the Offering. The Company has also appointed Hermes, Goldman Sachs, J.P. Morgan, SNB Capital, GIB Capital, HSBC Saudi Arabia, Al Rajhi Capital and Saudi Fransi Capital as bookrunners and underwriters (the “Underwriters”) in relation to the Offering.

Arab National Bank (“ANB”), Alrajhi Bank (“Alrajhi”), Riyad Bank and The Saudi National Bank (“SNB”) have been appointed as receiving entities (collectively, the “Receiving Entities”) for the Individual Subscribers’ tranche.

Lazard Financial Advisory (“Lazard”) has been appointed as Independent Financial Advisor to the Company.

The CMA and Saudi Exchange approvals have been obtained for the Offering and listing as outlined below:

The IPO of ADES comprises an offer of 338,718,754 ordinary shares, representing 30% of the Company’s issued share capital through the sale of a mix of existing shares and newly issued shares.

The Offer Shares will be listed and traded on the Saudi Exchange’s Main Market following the completion of the IPO and listing formalities with the CMA and the Saudi Exchange.

The Offer Shares will be offered for subscription to Individual Subscribers and Participating Parties, including Participating Parties outside the United States in “offshore transactions” in accordance with Regulation S under the Securities Act.

A maximum of 338,718,754 shares, representing 100% of total Offer Shares, will be allocated to Participating Parties.

The Financial Advisors may, in coordination with the Company, reduce the number of shares allocated to Participating Parties to 304,846,879 shares, representing 90% of total Offer Shares, to accommodate for Individual Subscriber demand.

A maximum of 33,871,875 ordinary shares, representing 10% of the total Offer Shares, will be allocated to Individual Subscribers.

Note: The above timetable and dates therein are indicative. Actual dates will be communicated through announcements appearing on the websites of the Saudi Exchange (www.saudiexchange.sa) and the websites of the Joint Financial Advisors.