PHOTO

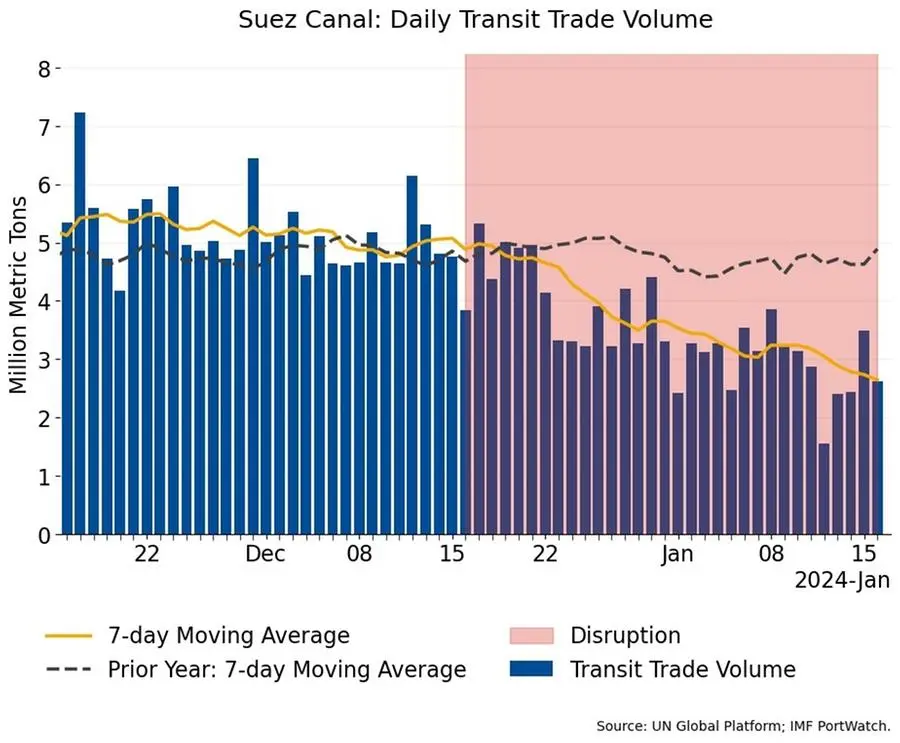

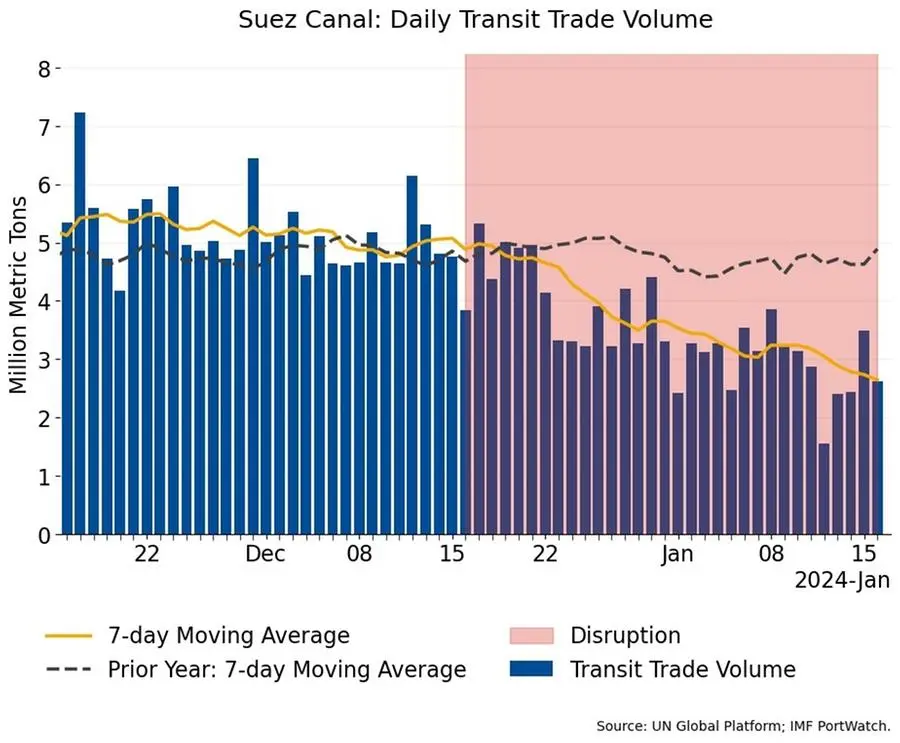

The ongoing Red Sea crisis continues to have an increased impact on international trade flows, with the latest data from the PortWatch platform by the International Monetary Fund (IMF) revealing that transit volumes across the Suez Canal are down an estimated 37% year-on-year in the first two weeks of January.

Attacks on commercial ships prompted shipping companies to re-route traffic away from the Red Sea, a systemically important shipping lane that facilitates about 11% of global maritime trade volume and over 19,000 transit calls annually, PortWatch data reveals, accounting for $1 trillion annually.

According to PortWatch data, the top three industries traded through this sea corridor include petroleum, chemical and non-metallic mineral products, mining and quarrying, and agriculture.

Chart courtesy: IMF PortWatch

Earlier this week, Suez Canal Authority’s (SCA) Chairman Osama Rabie was quoted by Asharq Business as saying that revenues had declined by around 40% in the first 11 days of 2024.

Since November, Houthi rebels have stepped up attacks on commercial shipping vessels travelling through the Red Sea in response to Israel’s war with Gaza, prompting many shipping groups to cease operations in the area or reroute traffic around Africa’s Cape of Good Hope, resulting in significant delays and spiralling costs.

In response to the attacks, a US-led coalition has retaliated by targeted attacks on the Iran-backed Houthi militia in Yemen in recent days.

A new Moody’s Investors Service report this week stated the most recent escalation could raise threat levels for US military assets in the GCC, while adding that a direct military conflict that involves Iran could pose significant risks to all Middle East sovereigns.

(Reporting by Bindu Rai, editing by Seban Scaria)