PHOTO

As Egypt seems poised to attract fresh investments in government treasuries following the recent steep devaluation of the local currency, fears are reignited that the cash-strapped country might resort once again to inflows of hot money and shelve urgent economic reforms.

“Given that we believe that most of the Egyptian pound’s weakening is behind us, we should see foreign demand for Egyptian pound-denominated assets increase,” said Callee Davis, an analyst with London-based Oxford Economics.

“That said, some foreign investors may prefer to wait for more clarity on the trajectory of the Egyptian pound before flocking back. But this approach is also not ideal, as it drags out Egypt’s heavy reliance on debt.”

On January 11, the Central Bank of Egypt had announced another round of depreciation of the Egyptian pound, which went down within a few hours from 27.6 to nearly 32/$ before settling at 29.6 on the same day. A few days later, the CBE issued EGP-denominated T-bonds of 3 billion with high yields, which were oversubscribed by 102%. In contrast, a CBE auction to sell T-bonds worth EGP 7.5 billion in December was undersubscribed by 22%.

Since the devaluation, the government has also issued a large number of 91-day T-bills, which were largely oversubscribed too, Davis added.

“Unfortunately, it does put the Egyptians at risk of further hot money outflows within the context of another external shock,” said Davis. “However, the immediate external financing situation is so dire that I think the government would be happy to attract these types of funds in the short term to cover its financing gap.”

Egyptian foreign reserves have been dealt several blows in recent years due to sudden capital outflows. In June, Egypt’s finance Minister said that nearly $15 billion left the country during the 2018 emerging market crisis and close to $20 billion left following the outbreak of the global pandemic in 2020. Outflows of nearly $20 billion also followed the Russian invasion of Ukraine.

Last year, Maait said that the government had “learned the lesson” and vowed not to depend any longer on foreign purchases of treasuries to finance its budget. Since then, the government has been stressing the need to focus on FDIs.

Since March, the Egyptian pound has lost nearly 50 percent of its value. The CBE move towards “a more flexible” exchange rate was to meet one of the key conditions set by the International Monetary Fund before approving a $3 billion support package for Egypt in December. The IMF loan deal requires other major economic reforms including further fiscal consolidation, containing gross financing needs and reducing the role of the government in the economy.

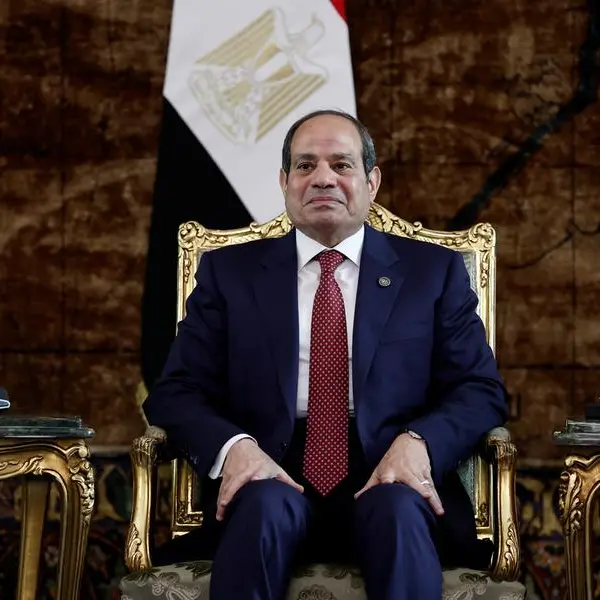

Last month, Egypt’s President Abdel Fattah el-Sissi approved a sweeping privatisation program that lists dozens of economic sectors from the which the state is expected to withdraw allowing private investors to take over. To attract foreign investments, the government had also unveiled a plan to sell major shares of state-owned enterprises in the stock exchange market.

“The risk, though, is that a sudden influx of hot money diminishes the urgency of reducing the state's footprint in the economy,” Davis warned.

Amr Elalfy, Head of Research at Prime Securities, downplayed fears that the government might be necessarily repeating the same mistake of previous years insisting that the foreign-held T-bills constitute only 5% of the total outstanding treasury bills.

“What would really attract hot money is high yields combined with the potential of the Egyptian pound to appreciate,” said Elalfy. “Only then can investors benefit from high returns and the forex. It is too early to say this will necessarily happen. We have to wait at least until the exchange rate to stabilise.”

Elalfy expects the Egyptian pound to rise back to 27 against the greenback by the end of the year given the capital inflows expected from the IMF loan, FDIs and increased exports.

However, Davis is not as optimistic. She believes the Egyptian pound still faces the risk of further depreciation, reaching 32/$, before the end of 2023.

“There are still an estimated $5 billion in goods waiting in ports while overseas cash withdrawals are still subject to limits, so some forex hurdles remain,” she said. “If the government's plans to attract the necessary forex, which include ramping up FDI and portfolio inflows, fall short, this will create room for further currency weakness.”

(Reporting by Noha El Hennawy; editing by Seban Scaria)