Saudi Arabia seems keen on defending its market share against growing output from rival producers

China's factory activity shrank the most in two years, and the Chinese economic growth rate reached its lowest since the second quarter of 2009

Jeddah, Saudi Arabia - 6 September 2015: Alkhabeer Capital, a leading asset management and investment firm based in Saudi Arabia, and authorized by the Capital Market Authority (license number 07074-37), announced the release its analysis of the oil market. The analysis addresses the future outlook of oil in light of economic and geopolitical events. Oil prices are expected to remain subdued this year and for the most of next year, as the global supply glut is likely to persist, while demand is anticipated to increase only at a modest rate. The analysis also addresses supply and demand expectations and the negative and positive effects of oil on the region, with surging output from key OPEC members and prospects of fresh supply from Iran will further pressurize oil. Besides, technological innovations have led shale production to remain remarkably resilient.

Analysis of the Oil Market

The analysis showed that subdued growth in China, one of the largest oil consuming nations, will likely lead to lower demand. Moreover, most of the additional recent demand was led by strategic stockpiling, which might start abating by next year. The current record high levels of oil inventories across the OECD countries might delay the timing of any upward movement in oil price. Although major oil companies have scaled back their expansion plans, we do not expect an immediate impact as most investment projects have a lead time of a few years. Meanwhile, Increase in usage of fuel efficient technologies and a stronger US Dollar would add to the woes. Moreover, An unexpected escalation of geopolitical conflicts in the Middle East and elsewhere could reverse the course of oil prices.

"Bear Market for Oil is Expected to Last Well into 2016"

The analysis showed that oil prices are currently hovering close to their 6-1/2-year lows, a drop of nearly 60% from the highs seen last year. Major oil exporting countries, especially the larger OPEC members have embarked on price cuts since the last quarter of 2014 in a bid to defend their market share and to force higher cost production facilities to shut down. Efforts by the cartel to flood the oil market with excess supply and drive out oil producers with higher operating costs, particularly those in the US, have proven largely ineffective till date. With the US topping the list of producers last year and large producers in the GCC refusing to agree with other OPEC members for lowering oil production, the outlook for oil prices appears muted. Major oil companies have also forecasted a 'prolonged' period of low oil prices and scaled back their capital expenditure plans. With global supply showing no signs of abating and oil demand expected to grow at a modest pace, we expect oil prices to remain subdued in 2015 and for the most of 2016.

"Persistent Surplus in Global Oil Likely to Continue In 2016"

Growth in oil supply has been the predominant factor that has contributed to the slump in oil markets since June last year. World oil supply continues to outstrip demand, with EIA figures showing that the supply-demand imbalance reached about 2.6 million barrels per day (mbpd) in the second quarter of the year, compared to 0.8 mbpd in the same period last year.

"OPEC refuses to slash production with Saudi and Iraq increasing production near record levels "

Ever since the slide in crude oil prices began, it was widely expected that the OPEC would slash its oil output in a bid to increase prices. But the cartel, which produces about 40% of the world's crude oil, refrained calls by some members to lower output at its meeting last year and has increased production by more than 1.7 mbpd since November 2014.

"Prospect of fresh supply from Iran looms large"

Iran, which reached a historic nuclear deal with major world powers last month, has indicated that it is ready to boost oil production by 500,000 bpd within a week of sanctions against the nation being lifted. Moreover there are speculations suggesting that Iran already has around 30 to 40 million barrels of oil in tankers anchored in the Persian Gulf which could came to the market as soon as the lifting of sanctions comes into effect. Increased oil supply from Iran is likely to keep global oil supply at elevated levels and impact oil markets in the near future. However, many experts opine that it would be at least six months or probably more than a year before Iran is able to impact supply effectively.

"US Shale output has been resilient to lower oil prices and drop in oil rigs"

The sharp increase in shale oil production has resulted in a major shift in global oil market dynamics. The US has been increasing oil output at a robust pace and was the world's biggest oil producer in 2014. Many experts earlier believed that the oil crash witnessed last year would substantially affect the US oil industry, but shale production has remained remarkably resilient.

Though the viability of shale firms has depleted amid low oil prices, it appears that shale oil would continue to have a profound influence on the global oil market in the foreseeable future. According to the IEA's recent report on the world oil market, total US oil supply is likely to keep growing through 2016, but at a much slower pace than in 2014. The EIA has also stated that US crude oil production is expected to grow 8.6% to 9.47 mbpd in 2015, the highest in 45 years.

"Global Oil Demand is Expected to Remain Subdued"

The IEA's most recent forecast shows that global oil demand growth is anticipated to rise beyond 95 mbpd by the end of 2016. However, the agency expects world oil demand growth to decline to 1.2 mbpd in 2016, from approximately 1.4 mbpd this year.

"Forecasts for global economic growth have reduced"

Recently, the IMF lowered its projections on the world's GDP growth for 2015. Other than that, central banks of the US and China, two of the largest oil consumers in the world, downgraded their 2015 GDP growth forecasts, raising additional concerns about the extent of improvement in oil demand. Recent data also showed that the Chinese economy expanded 7% YoY during the second quarter of 2015, its lowest growth rate since the second quarter of 2009. The IEA expects China's oil demand to grow merely by 3% in 2015 and 2016, if the nation's economic growth remains between 6%-7%. Additionally, another survey showed that the country's factory activity shrank the most in two years in July. Furthermore, China's Association of Automobile Manufacturers has forecasted annual sales of both passenger and commercial cars to increase by only 3% this year, down from an earlier estimate of 7% in January and a 9.9% growth in 2014.

"Demand from strategic stockpiling could ease next year"

Taking advantage of low oil prices, many countries have stepped up their strategic petroleum oil reserves. According to EIA, OECD commercial oil inventories hit a record high level of 2,876 million barrels in May, roughly 300 million barrels more than a year ago. US crude inventories touched 464 million barrels in mid-July, about 100 million barrels above the five-year seasonal average.

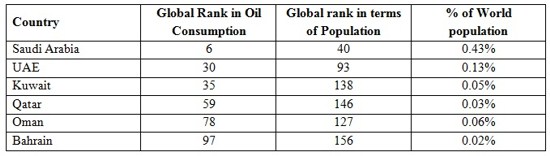

"Middle Eastern demand anticipated to ease as GCC countries contemplate removal of subsidies"

On the regional front, the UAE recently announced the removal of fuel subsidies to boost the government's fiscal health. This move has increased petroleum prices which might bite consumers' real income, thereby forcing them to reduce their fuel spending. According to a survey by BP Statistics, the Middle East consumed about 13.7% of the global oil usage in 2014. The usage when compared in terms of population appears very high as GCC countries roughly account for only 0.7% of the global population. If this step by the UAE government proves a success, other GCC nations might follow suit and adopt similar measures, thereby having a wider negative impact on regional oil demand.

Source: Alkhabeer Capital

"Increase in fuel efficient technologies"

A survey by the Energy Information Administration shows that the stock of conventional fuel utilizing cars has been decreasing since the past few years and the decline is anticipated to continue over the next decade. Moreover, with the stock of cars using alternative fuels anticipated to rise going forward, market experts believe that this could worsen the omnipresent oil supply glut.

"Stronger US Dollar will add to the woes"

Amid expectations that the US Fed might raise interest rates later this year, the US Dollar has significantly rallied against its major counterparts. As we move ahead, any improvement in the US economy's health is likely to further boost the US Dollar. Commodities which are inversely correlated to the US Dollar will be pressurized by a stronger dollar. However, on the other hand weaker home currencies can benefit oil exporting countries such as Russia.

"Geopolitical Risks Can Reverse the Course of Oil Prices"

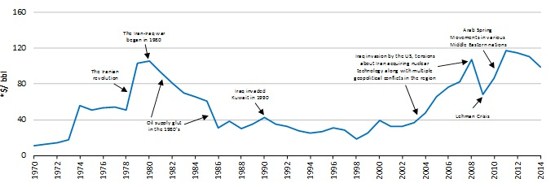

With the OPEC maintaining its policy of not altering oil production, disputes have started to emerge among member countries with Algeria, Angola, Venezuela and Libya urging other producers to roll back production. Amid strong prospects of Tehran inking a nuclear deal with its western peers by the end of this year, possibilities have strengthened that Iran might increase its oil output and urge the OPEC to re-establish its quota system, thereby increasing its confrontational issues with Saudi Arabia and fuelling regional instability. The chart below depicts that oil prices have been impacted substantially by geopolitical events in the past.

Significant Geopolitical Events Impacting Oil Prices

Source: Alkhabeer Capital

The resurgence of geopolitical tensions and the violence in Syria and Iraq poses a serious threat to the region's stability. The increasing influence of ISIS and the disruption of oilfields and ports in strategic areas presents a serious challenge to oil production in the region. Going forward, if conflicts escalate and result in damage to oil infrastructure, oil prices could rebound.

Summing Up

As indicated in our earlier oil update "Oil Market Dynamics", we continue to maintain a cautious outlook on oil prices. Crude prices are not expected to witness any significant rise in the near term, especially amid little possibility of any major oil producing country cutting down output. Saudi Arabia, the swing producer, has shown little inclination to roll back its oil output as demanded by some of the OPEC members. Besides, Russia, the major non-OPEC producer, clearly has no intention of curbing its crude output significantly, while prospects of more oil supply from Iran loom large. This indicates that a further downside in oil prices cannot be ruled out. Benchmark oil futures for delivery in December 2016 are significantly below their January levels, indicating that the outlook for oil prices is not very optimistic.

On the demand side, other than a stronger US Dollar weighing on the purchasing power of oil importing economies, lower expectations of global economic growth have also raised worries among oil exporters. Fuel demand in the Middle Eastern region might also show some signs of easing, if the UAE's recent move to abolish energy subsidies is adopted by the remaining GCC nations. Furthermore, market experts fear that oil inventories across the OECD countries have reached a record high level, which might delay the timing of any upward movement in oil prices. However, if geopolitical tensions in the Middle East escalate, oil prices could surprise on the upside.

-Ends-

About Alkhabeer Capital

Alkhabeer Capital is a leading asset management & investment firm providing world-class investment products and services, that endeavors to help institutions, family groups and qualified investors access to and/or allocate capital in ways that deliver real and enduring economic value.

It is licensed by Saudi Arabia's Capital Market Authority (CMA) license # 07074-37. The asset management area provides investment opportunities through a large and growing portfolio of public and private funds in the areas of real estate, private equity, capital markets and venture capital, while the investment banking area offers specialized Sharia compliant capital raising and M&A advisory services to businesses, private investors and families.

Alkhabeer Capital also provides advisory services on structuring Waqf entities and Waqf wealth management through its "Waqf" Program which targets educational institutes, charitable foundations, family groups, high net worth individuals and other philanthropists who wish to establish Waqf entities.

Alkhabeer Capital has offices in Jeddah and Riyadh.

For more details on Alkhabeer Capital, please visit www.alkhabeer.com

Alkhabeer Capital on Social Media:

https://twitter.com/AlkhabeerCap

https://www.facebook.com/AlkhabeerCap

Contacts

Abdulrahman Omar Baroom

Vice President, Corporate Communications

Alkhabeer Capital

Tel: +966 12 612 9344

a.baroom@alkhabeer.com

Press Release 2015