PHOTO

- More than half of KSA consumers say they would purchase a product that has innovated to make it as affordable as possible (59%)

- Healthy living is the #1 top life priority: a third of KSA consumers want to build, maintain or improve their health and wellness (33%)

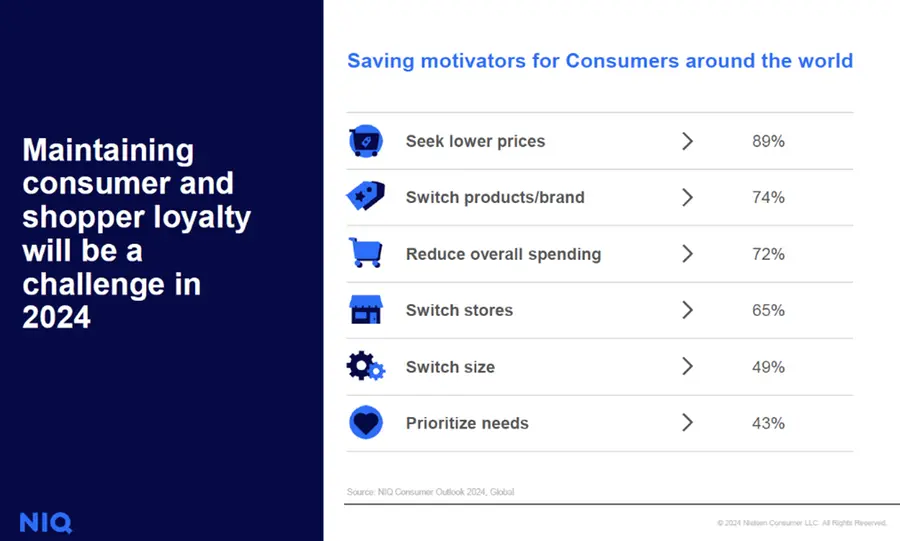

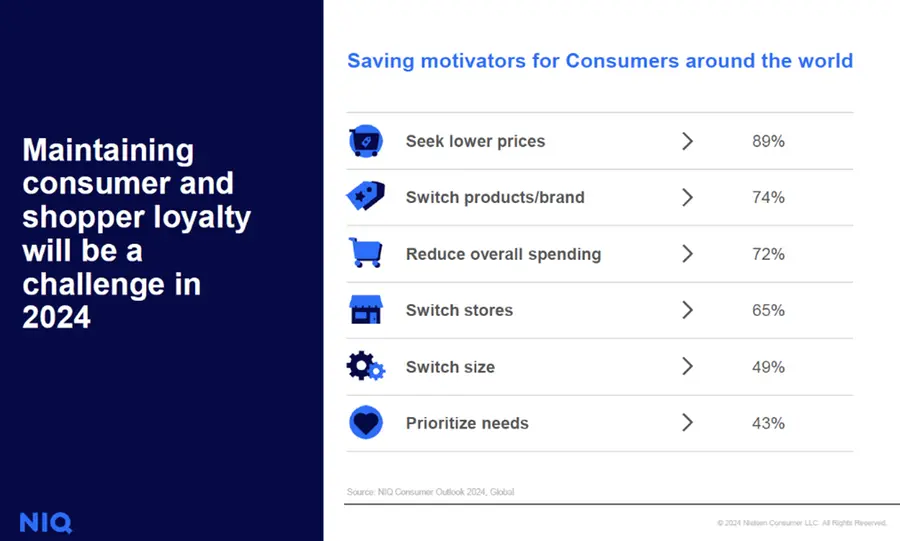

Riyadh— According to NielsenIQ, there has been a notable shift in consumer behavior, as preferences have increasingly leaned away from premium market offerings towards more economically priced options within the mainstream or budget-friendly tiers. This evolution in consumer preferences reflects a growing emphasis on financial prudence and the desire for products that meet essential needs without exceeding budgetary constraints.

In Saudi Arabia (KSA), 98% of KSA consumers have changed how they shop for FMCG – with preferred saving strategies being: shopping online (33%) to get better deals and shopping where loyalty schemes are in effect (27%). Interestingly, 23% use digital technology to find the best deals on their preferred brands, but only 17% opt for private-label products. This trend signifies a broader change in purchasing habits, where the allure of premium products has been outweighed by the appeal of affordability and the practical benefits of cost-effective alternatives.

These findings appeared in “Consumer Outlook 2024", the latest NielsenIQ Thought Leadership report capturing the mindset and sentiment of consumers around the world.

“Over the last 2 years or more, global consumers have indicated they will seek ways to reduce expenses and prioritize affordability. These intentions are driving real impact; the whole structure of global pricing has experienced a small shift in favor of lower price tiers. Saudi Arabian consumers are progressively leaning into selections that prioritize cost-efficiency, reflecting a broader move towards purchasing practices focused on value. This development highlights a rising focus on affordability in product offerings, pricing models, and buying patterns. Even amidst this trend towards cost sensitivity, there's a persistent demand for high-quality, premium items, especially those offering significant health and wellness benefits”, explains Pavlos Pavlou, NielsenIQ Managing Director in the Kingdom of Saudi Arabia.

Other key findings from the report for Saudi Arabian consumers:

- Although cost of living remains top of mind, 71% are optimistic their financial situation will be better by the end of 2024. Concurrently, job security sentiment has also improved by 4 percentage points compared to the previous quarters.

- Healthy living is the top life priority influencing consumers: about a third of consumers want to build, maintain or improve their health and wellness, while 63% would try a new product because it is better for their health.

- More than half of KSA consumers (56%) would choose a product or service because it has sustainable credentials, while about the same would purchase a product that has innovated to make it as affordable as possible (59%).

- More than a third of consumers prefer shopping often and at discount/value stores (37%), while 24% of consumers prefer to buy whatever brand is on promotion.

-Ends-

About NielsenIQ

NielsenIQ is the world’s leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. In 2023, NielsenIQ combined with GfK, bringing together the two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NielsenIQ delivers the Full ViewTM.

NielsenIQ is an Advent International portfolio company with operations in 100+ markets, covering more than 90% of the world’s population. For more information, visit NIQ.com.

About the report

NielsenIQ´s Consumer Outlook report explores critical trends and insights that shape the consumer landscape, delivering invaluable data and analysis for businesses and stakeholders worldwide.

Navigating the intricate global economic terrain, the report delves into the repercussions of significant economic events and trends, shedding light on their impact on consumer confidence and spending behavior. Moving beyond a broad overview, the analysis explores regional variances, providing in-depth insights into the unique dynamics of Asia Pacific, Europe, North America, Africa, the Middle East, and Latin America. This bi-annual thought leadership study uncovers nuances in consumer preferences and changes in consumer attitudes and purchasing patterns, empowering retailers and manufacturers with a strategic understanding of their target markets to facilitate the formulation of tailored strategies for sustainable growth.

NielsenIQ´s Global Consumer 2024 survey was conducted between December 2023 and January 2024, polling nearly 16,000 online consumers in 23 countries throughout Asia-Pacific, Europe, Latin America, the Middle East/Africa, and North America.