PHOTO

An economic recovery in Saudi Arabia is expected to be gradual with an elevated level of uncertainty and it may take until the second half of 2022 for all the lost private-sector output in 2020 to be recouped, National Bank of Kuwait (NBK) said in a report.

Like many other countries worldwide, GCC states too were hit hard due to shocks stemming from the impact of the coronavirus pandemic as well as its impact on the demand of oil.

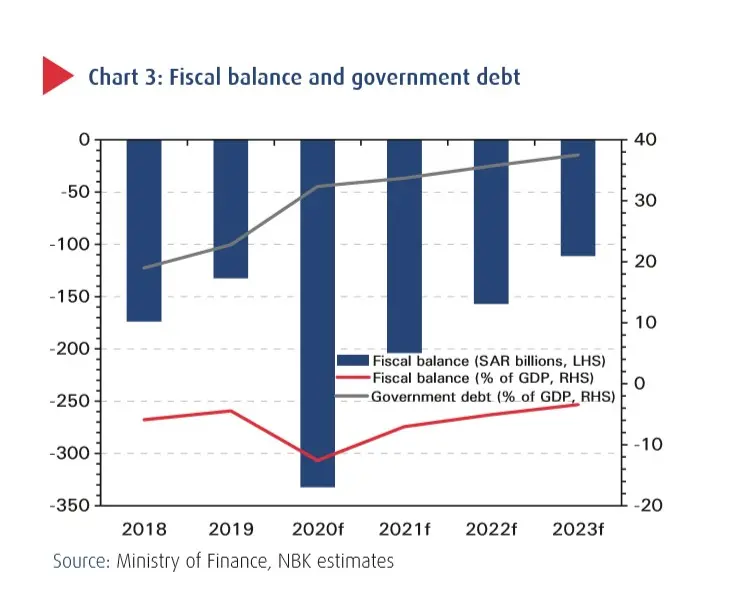

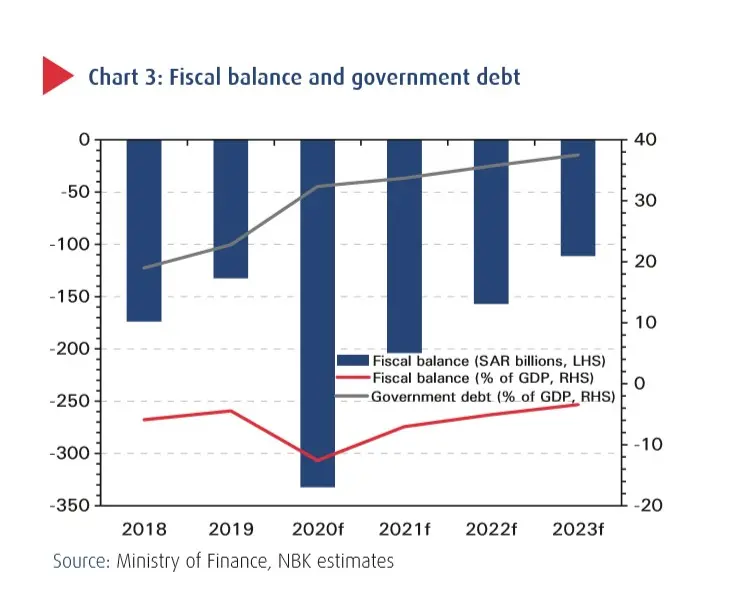

Saudi Arabia's fiscal position came under pressure in H1 2020 as revenues dropped by 36 percent and spending decreased 8 percent resulting in a deficit of SAR 143 billion. The government dealt with its finances by tripling the VAT, increased customs, and discontinued the cost of living allowances.

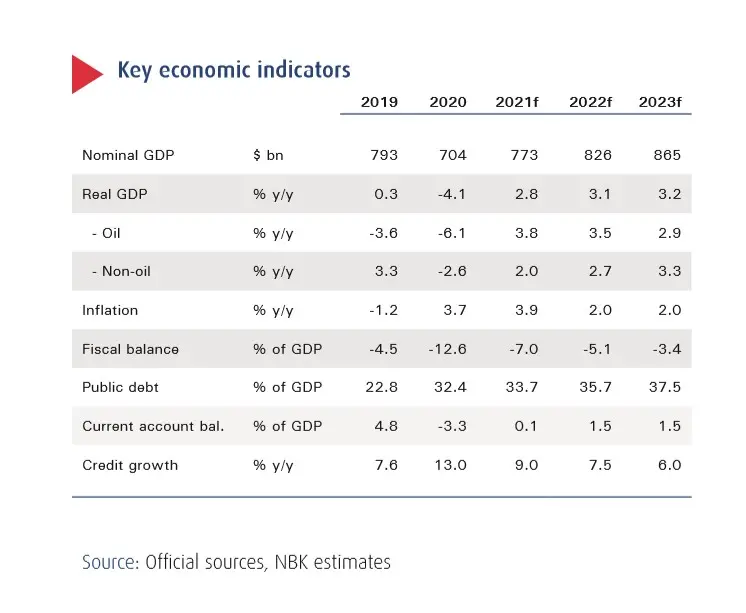

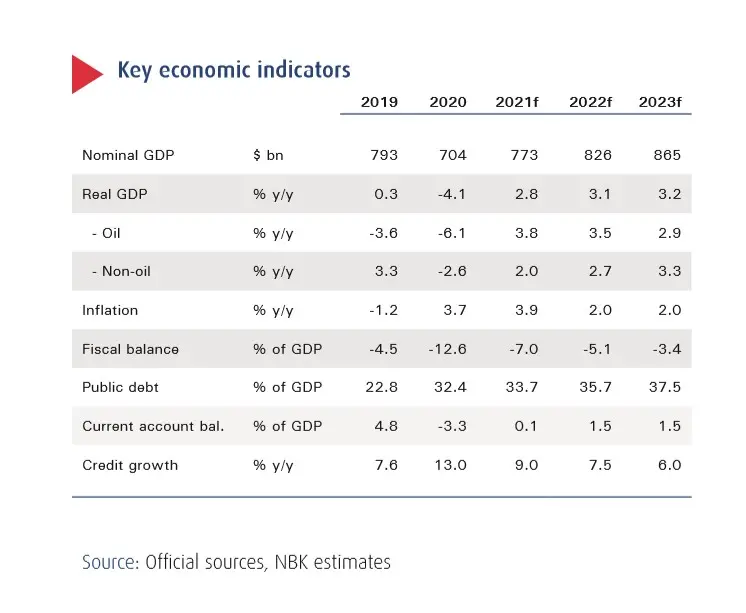

“We forecast non-oil growth to drop by 2.6 percent in 2020 before rebounding to 2 percent in 2021 with GDP growth at -4.1 percent this year and +2.8 percent next year given that the oil sector should start supporting growth in 2021,” the report said.

According to NBK, Saudi Arabia's fiscal deficit is expected to drop to 7 percent of GDP in 2021, significantly better than the 12.6 percent projected this year as revenues increase while spending is reduced.

In 2022-23, broadly flat spending coupled with higher revenues is expected to result in a deficit of 3.4 percent in 2023. Accordingly, the debt/GDP ratio will likely reach around 37 percent in 2023, still way below the 50 percent cap.

The main downside risk is related to COVID-19, especially if the containment of the virus and/or deployment of a vaccine in the region is considerably delayed. Oil prices are also a downside risk if the demand remains depressed and supply is not contained by OPEC+, the report said.

Following the tripling of VAT, inflation jumped to 5.7 percent in September, and average inflation is projected to remain elevated at 3.7 percent this year and 3.9 percent in 2021, before normalizing at 2 percent thereafter.

As for credit, growth has been powering ahead to reach 10 percent year-to-date in August supported by mortgages.

Corporate credit growth picked up to around 7 percent YTD, but with more than 75 percent of that increase occurring in Q1, before the lockdowns and other pandemic-related restrictions were imposed.

"We expect credit growth of 13 percent in 2020, softening to a still-strong 9 percent in 2021. Recently, the government scrapped the 15 percent VAT on real estate transactions, replacing it with a 5 percent sales tax, in an effort to continue supporting the sector," NBK said in its report.

Both oil and non-oil sectors are expected to support the recovery in 2021.

In a quarter that is expected to be the worst in 2020 given the lockdown, the non-oil sector contracted by 8.2 percent y/y in Q2, resulting in a 3.2 percent fall in H1 2020. Unsurprisingly, the private sector was impacted (-10 percent y/y in Q2) much more than the government sector (-3.5 percent).

The retail and hospitality sector were the hardest hit as it contracted by 18.3 percent in Q2, while the finance sector was the most resilient, inching down only 0.3 percent.

More than 64,000 private-sector jobs were lost during Q2 and the unemployment rate among Saudis jumped from 11.8 percent in Q1 to 15.4 percent.

Data indicates a sequential improvement in output starting in Q3, but possibly still contracting annually, resulting in a 2.6 percent decrease in nonoil GDP in 2020, the report said, adding, this is limited projected contraction is mainly due to a resilient government sector while the private sector is forecast to shrink by 3.9 percent.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020