PHOTO

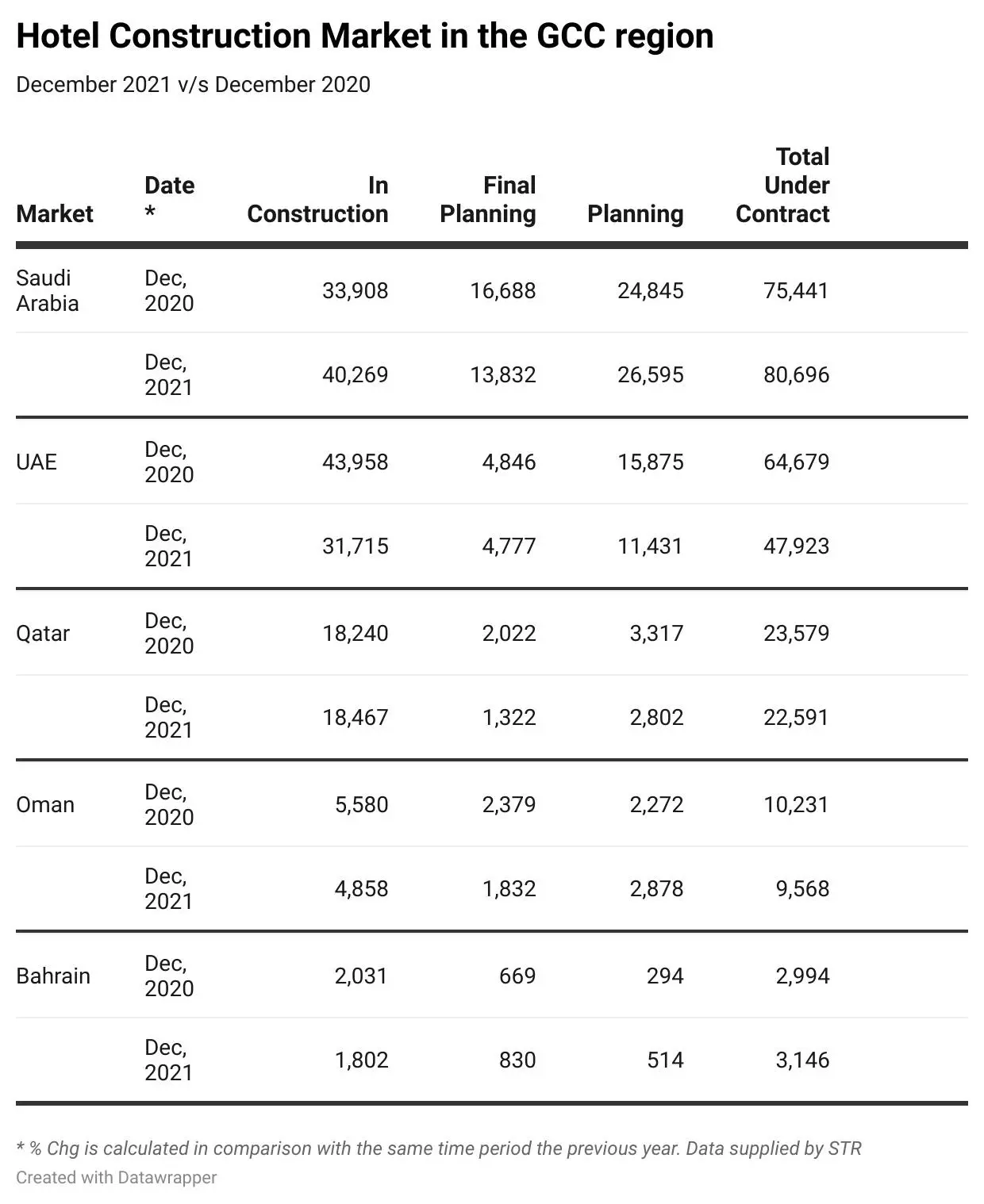

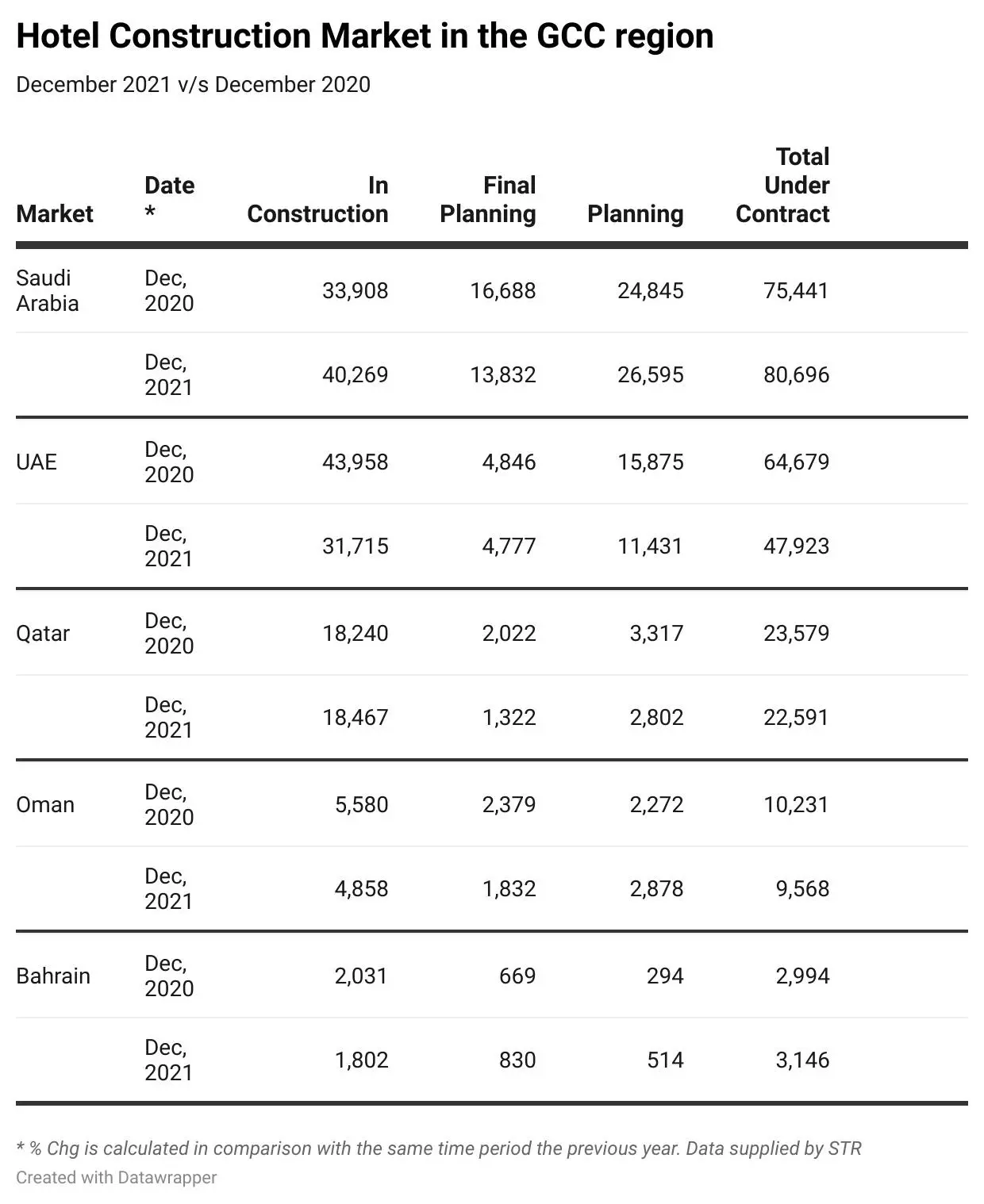

Saudi Arabia and the United Arab Emirates continue to lead the hospitality market in the Middle East and Africa region, with 40,269 and 31,715 rooms under construction, respectively, as of December 2021.

This, however, comes at a time when the region witnessed a fall of 5.5 percent in hotel construction activity in the fourth quarter compared to the same period in the previous year, according to hospitality industry data provider STR.

“The global supply chain shortage has been well documented, and the construction industry is no exception. However, this is one of many factors influencing this reduction in current development,” said Christopher Robson, Senior Manager – Hotels & Tourism at CBRE (Dubai).

With hotels, one of the most impacted asset classes during the pandemic, STR’s Area Director Middle East & Africa Philip Wooller pointed out that construction delays and project deferrals didn’t come as a surprise.

“The Middle East, however, has proven exceptionally resilient throughout the pandemic mainly driven by its strong leisure and staycation markets such as Dubai, Ajman, and Ras Al Khaimah,” he said.

While the pandemic has impacted hospitality development directly, with supply chain, labour, and cash flow issues, Robson said this has a short-term impact on the sector.

“Over the long term, it is positive to see planning developments on the increase in the Middle East region buoyed by international events and the positive increase in tourism numbers since the reopening of travel corridors,” he said.

STR’s Wooller pointed out that country visions, such as the much-touted Saudi Vision 2030, continue to prioritize and incentivise tourism as a key pillar of future economic growth. “Coupled with the significant hotel performance recovery during 2021 across the majority of regional markets, the region continues to prove fertile ground for future hotel development,” he said.

Dubai leads the market

According to year-end 2021 data released by STR, the Middle East hotel industry reported revenue per available room (RevPAR) was 85.6 percent of the pre-pandemic comparable, the highest among the global regions.

Robin Rossmann, Managing Director at STR, had said in a press release that the Middle East was the leader in opening to international arrivals and hosting large events, such as Expo 2020, which has driven hotel performance in Dubai.

STR data showed Dubai hotel rates reached a six-year high in December 2021, recording 956-UAE dirham average daily rate (ADR) and 747-dirham RevPAR, as hotels operated at 78 percent capacity.

The medium to long-term outlook for hotel occupancy in the UAE and Saudi Arabia is good, according to Juwai IQI’s Co-Founder and CEO Kashif Ansari.

“Saudi Arabia is making a concerted push to increase its role as a regional centre that attracts more business and tourism visitors. In the UAE, an increase in tourism from nearby countries, including Turkey, Israel, and Iran, is expected to boost the travel sector this year and next.”

He expects 2022 and 2023 to be record-breaking years for hotel openings in many markets.

“The industry will digest a large number of delayed projects and bring them online. The delay between beginning to plan for hotel and completing construction can be years, so the trends we are seeing now reflect decisions made as far back as 2018.”

While the hotel construction sector is currently feeling the impact of the pandemic, CBRE’s Robson said they are witnessing an improvement in the use of sustainable materials, efficiencies in planning and construction processes, and renewable energy technologies coming into the sector.

“In the medium to long term, this will improve operational efficiencies, reinforcing the region as a tourist destination and improving foreign investment opportunities,” he concluded.

(Reporting by SA Kader; Editing by Anoop Menon)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2022