Abu Dhabi, UAE – Bayut, the UAE's leading property portal, has rolled out its Abu Dhabi real estate market reports for H1 2023. According to the data observed on Bayut, the sales prices of apartments and villas in the affordable category have become increasingly competitive, while prices for luxury properties have witnessed a decline. Conversely, the rental prices for budget apartments and villas have seen an upward trend alongside the prices for luxury properties.

- According to Bayut's real estate market report for H1 2023, sales prices for affordable apartments have generally decreased by up to 5%, whereas villas have become more expensive by up to 3.42%. Prices in the luxury segment have decreased by under 1% for villas and increased by up to 4.4% for apartments.

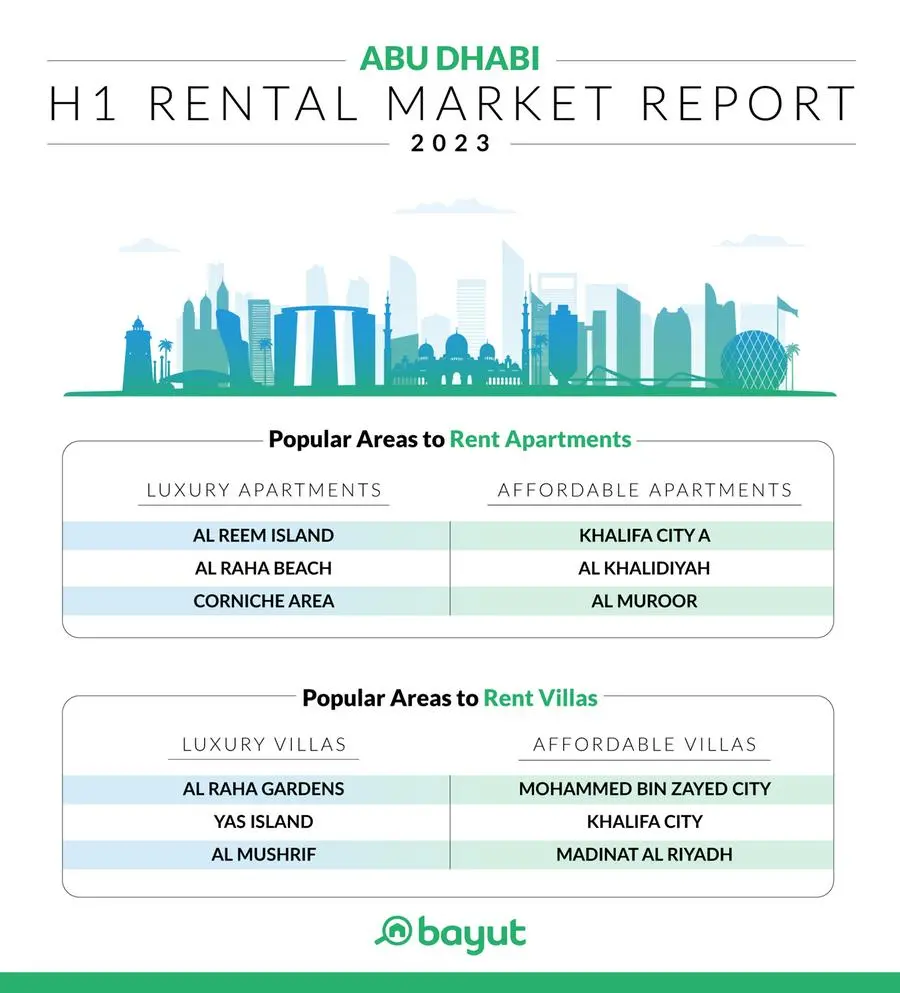

- In terms of rental prices, there has been a moderate increase of up to 8% for budget apartments and villas. Luxury properties have witnessed higher rental appreciation, with upticks of up to 11% in H1 2023.

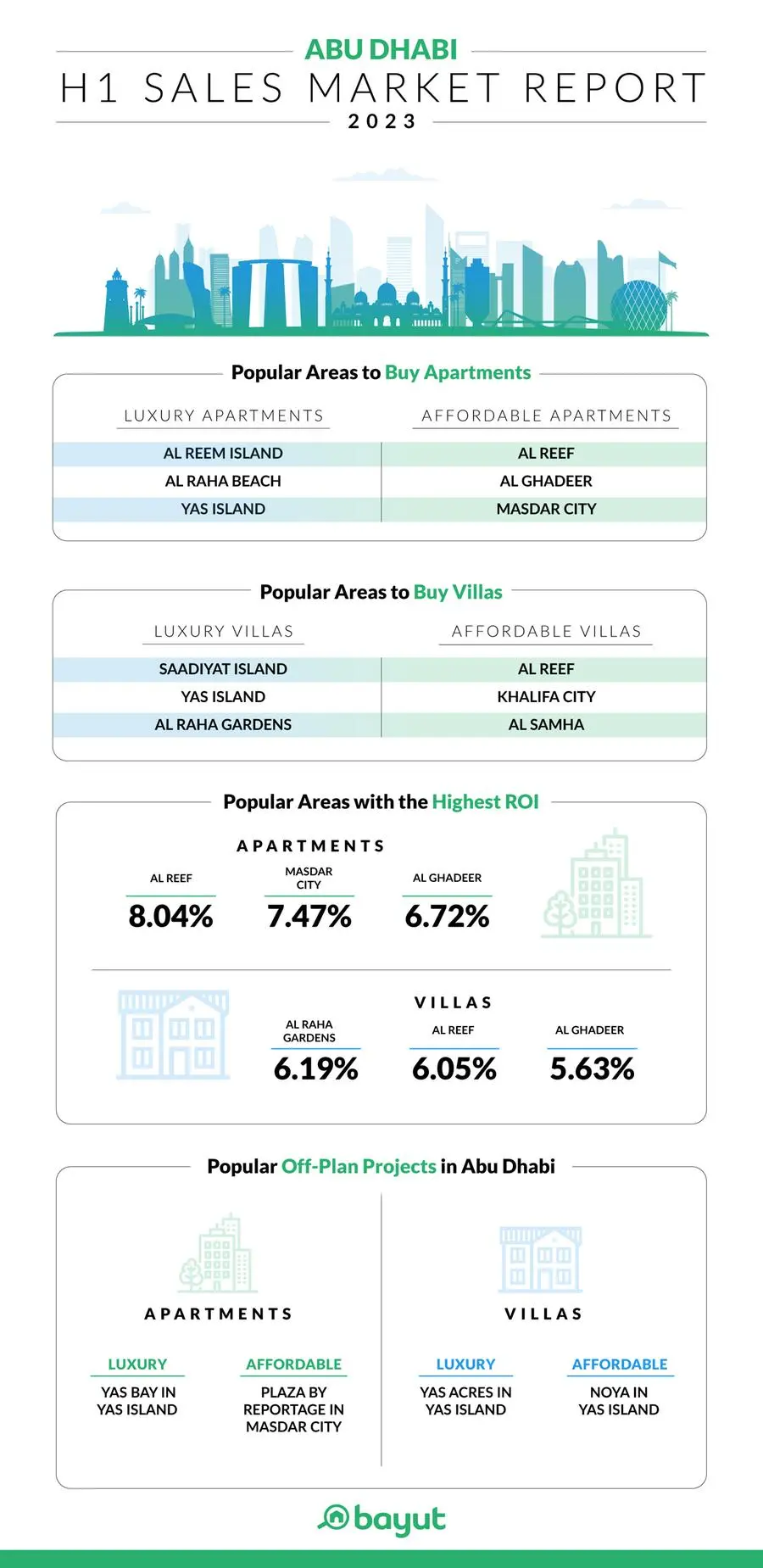

- Prospective buyers seeking affordable apartments have exhibited a preference for popular suburban areas like Al Reef and Al Ghadeer. On the other hand, high-net-worth individuals have gravitated towards waterfront communities such as Al Reem Island, Al Raha Beach, Yas Island and Saadiyat Island.

- In terms of villas, those on a budget have shown a preference for Al Reef and Khalifa City. Saadiyat Island, Yas Island and Al Raha Gardens have been popular with high-income buyers.

- In the rental market, tenants in pursuit of affordable apartments have shown keen interest in well-established communities like Khalifa City and Al Khalidiyah. On the other hand, tenants with a higher income have preferred upscale waterfront districts such as Al Reem Island and Al Raha Beach for luxury flats.

- Mohammed Bin Zayed City has been the most popular area to rent affordable villas in Abu Dhabi, whereas luxury renters have preferred Al Raha Gardens.

Properties For Sale in Abu Dhabi

Villas

As per the data presented in Bayut’s Abu Dhabi sales market report H1 2023, Saadiyat Island has been the most coveted destination for luxury properties.

- The average price-per-square-foot for villas in Saadiyat Island has recorded a modest appreciation of 7.3% to stand at AED 1,818. This increase reflects the growing demand for premium waterfront properties in the first half of 2023.

- Houses in Yas Island have witnessed a slight decrease of 0.53% in their average price-per-square-foot, standing at AED 1,176 in H1 2023.

- In contrast, the sales price-per-square-foot for houses in Al Raha Gardens has averaged at AED 836, with a negligible decline of 0.43% recorded in the first half of 2023.

On the affordable front, Al Reef has emerged as the prime choice for budget-conscious buyers seeking villas during the first half of 2023.

- The average sales price-per-square-foot for villas in Al Reef experienced a slight increase of 1.52% during H1 2023, going from AED 704 in H2 2022 to AED 715 in H1 2023.

- Alternatively, price-conscious investors have expressed interest in Khalifa City, Al Samha, Mohammed Bin Zayed City and Al Ghadeer, where prices have generally risen by up to 3.42%.

Apartments

When it comes to luxury apartments for sale, High-Net-Worth Individuals (HNWI) have predominantly favoured waterfront and island communities to buy lavish apartments in Abu Dhabi:

- As per our data, Al Reem Island has been the top choice for investors seeking luxury apartments in Abu Dhabi. The average price-per-square-foot for apartments in Al Reem Island has reported a minor uptick of around 0.31%, increasing from AED 1,016 in H2 2022 to AED 1,019 in H1 2023.

- Alternatively, buyers have been drawn to Al Raha Beach, Yas Island and Saadiyat Island when looking for luxury apartments in Abu Dhabi. The average price-per-square-foot for these areas has increased by 0.5% to 4.4% during Q1 2023.

In the affordable segment, buyers have primarily sought out family-friendly suburbs based on search trends on Bayut.

- Al Reef has been the favourite choice for budget-category flats among investors. The average price-per-square-foot for apartments in Al Reef has recorded a decline of 2.57%, to stand at AED 655 in H1 2023.

- Al Ghadeer has also appealed to budget-conscious investors during H1 2023. The average price-per-square-foot for flats in Al Ghadeer has increased slightly, averaging at AED 715.

- Apartments in Masdar City and Baniyas also appealed to small-ticket investors. While sales-price-per-square-foot in Masdar City has reported a 4.88% decline, the prices in Baniyas have increased by 0.14%.

Rental Yields in Abu Dhabi

- When it comes to rental yields in Abu Dhabi, Al Reef has recorded the highest projected ROI of 8.04% for affordable apartments in H1 2023, while Al Reem Island has offered impressive rental yields of 6.70% in the luxury segment.

- Al Reef has boasted the highest ROI of 6.05% for budget-friendly villas, while luxury houses in Al Raha Gardens have offered excellent rental returns of 6.19%.

Off-Plan Projects in Abu Dhabi

- Regarding off-plan apartments in Abu Dhabi, Plaza by Reportage in Masdar City has been the preferred choice in the affordable segment, whereas Yas Bay in Yas Island has continued to attract High-Net-Worth (HNW) investors.

- Noya in Yas Island has emerged as a popular choice for budget-friendly villas in Abu Dhabi, while Yas Acres has gained traction among affluent investors.

Properties For Rent

Villas

According to the data collected by Bayut, Mohammed Bin Zayed City (MBZ City) has been the most sought-after area for affordable villas in Abu Dhabi:

- The average rents for 3-bed houses in MBZ City have increased by 6.15%, whereas the cost of 4-bed villas has appreciated by a minor 1.51%. The rental cost of 5-bed houses in MBZ City has increased marginally by 0.36%.

- The asking rent for 3-bed villas in MBZ City has averaged at AED 96k, whereas 4 and 5-bed houses have been priced for AED 128k and AED 148k, respectively.

- Tenants have also been attracted to other well-known communities in Abu Dhabi, such as Khalifa City, Madinat Al Riyadh and Al Reef. The average prices for most properties in these areas have experienced decreases of 0.52% to 9.71%, with the highest reduction recorded for 3-bed villas in Madinat Al Riyadh.

When it comes to luxury villas, tenants have largely favoured Al Raha Gardens in Abu Dhabi.

- The asking rents in Al Raha Gardens have reported a decline of 9.51% for 4-bed homes and a 3.44% increase in the rent for 5-bed houses during the last six months.

- The average yearly rent for 4-bed houses in Al Raha Gardens has been AED 168k, whereas the asking rents for 5-bed houses have averaged at AED 227k in H1 2023.

- Besides Al Raha Gardens, higher-income tenants have directed their focus towards upscale areas like Yas Island, Al Mushrif, Al Bateen and Saadiyat Island in the first half of 2023. The asking rents in these areas have largely increased by 7.93%, with the exception of 4 and 6-bed villas in Al Bateen, which became more affordable by up to 10.1%.

Apartments

Those searching for affordable apartments in Abu Dhabi have shown maximum interest in Khalifa City

- The average rents for studios and 2-bed apartments in Khalifa City A have remained unchanged, whereas the cost of 1-bed flats has increased by 1.44% from H2 2022.

- The asking rents for studios in Khalifa City have averaged at AED 28k, whereas the cost of 1 and 2-bed flats stood at AED 42k and AED 61k, respectively.

- Additionally, tenants have preferred family-friendly neighbourhoods like Al Khalidiyah, Al Muroor, Hamdan Street and Al Shamkha, where average rents have generally increased by up to 8%.

For luxury apartment rentals, Al Reem Island has gained maximum traction from tenants in H1 2023, witnessing an increase of up to 2% in average rents:

- The asking prices for rental flats in Al Reem Island have increased across the board, with the rents for 1-bed apartments averaging at AED 59k, 2-bed flats at AED 87k and 3-bed apartments for AED 128k.

- In addition to these areas, tenants have paid attention to prominent areas like Al Raha Beach, Corniche Area, Yas Island and Saadiyat Island, where prices have generally increased by 0.4% to 12.4%.

Commenting on the trends, the CEO of Bayut and Head of Dubizzle Group MENA, Haider Khan, said:

“Six months into 2023, it’s pretty clear that the market is at one of its best stages ever. The much-discussed millionaire migration is a very real factor, with HNWIs from around the globe dedicating significant budgets for investment in UAE real estate. For those investors, the lure of Abu Dhabi’s luxurious island communities is obvious. Highly-desired and established locales such as Yas Island and Saadiyat Island, along with upcoming master-projects like that of Jubail Island, look set to ensure that investor interest will remain significant for some time yet.

It’s also interesting to note that according to DARI, Abu Dhabi’s digital real estate ecosystem, there were a total of 2,047 sales transactions for ready properties in the emirate during the first half of 2023. Whilst investors taking advantage of favourable market conditions is undoubtedly a factor in that high number, it’s also likely that holistic increases across Abu Dhabi’s rental sector are bearing an influence. It could be that rising rental prices are encouraging tenants to favour purchasing a property over continuing to rent, in order to ensure their money is filtered towards securing an actual long-term asset.

At Bayut, we are constantly looking to evolve our platforms, product and services to parallel the ever-shifting dynamics of the UAE real estate market. As part of that commitment to excellence that we continued to proactively pursue when we recently launched a Chinese version of Bayut. It is just one of the many exciting innovations to come from us in the near future. We’re very much looking forward to sharing those upcoming additions with our users over the upcoming months.’’

-Ends-

Note: For an accurate representation of price changes, this report compares the average price-per-square-foot in an area to analyse sales trends for villas and apartments in H1 2023 to those observed in H2 2022. These prices are subject to change based on the building, amenities, developer and other deciding factors. For the rental properties, the report compares the average cost for individual unit types between the two years in popular Abu Dhabi neighbourhoods.

Disclaimer: The above report is based on prices advertised by real estate agencies on behalf of their clients on Bayut.com and is not representative of actual real estate

About Bayut

Bayut is the UAE’s most trusted property website for buying, selling and renting homes. Bayut provides detailed insights, extensive content resources and updated statistics allowing end-users to make the best decision when searching for properties in the UAE.

Since Bayut was established in 2008, the company has seen accelerated growth, increasing not only the number of real estate partners it works with, but also obtaining substantial traffic growth over the past few years. Haider Ali Khan joined Bayut in 2014 as the CEO and the company has continued to showcase very high growth over the past five years including closing multiple rounds of funding from top Venture Capital firms such as Naspers, KCK, Exor, and other notable names. To further expand their reach in this region, Bayut also launched Bayut.sa in 2019, with its headquarters in Riyadh.

Bayut is a part of the Dubizzle Group which also operates the largest property classified sites in Pakistan, Bangladesh and Morocco. In April 2020, the group merged with the Netherlands-based OLX group in certain key markets, and was valued at $1 Billion, giving it the coveted unicorn status. The group now also owns and operates Dubizzle in the UAE, OLX Pakistan, dubizzle Egypt and dubizzle Lebanon, in addition to several other OLX platforms in the broader Middle East region including Bahrain, Oman, Kuwait and Qatar.

For further information, please contact:

Stephen Nixon

Media lead

Stephen.nixon@dubizzle.com