PHOTO

Abu Dhabi, UAE: Bayut, the premier property portal in the UAE, has conducted a comprehensive analysis of market dynamics and pricing trends within Abu Dhabi's sales and rental sectors for the first quarter of 2024. Several notable areas have witnessed a surge in sales prices, particularly in upscale neighbourhoods offering top-tier amenities and facilities, reflecting high demand in the market.

Trends for Buying Properties in Abu Dhabi

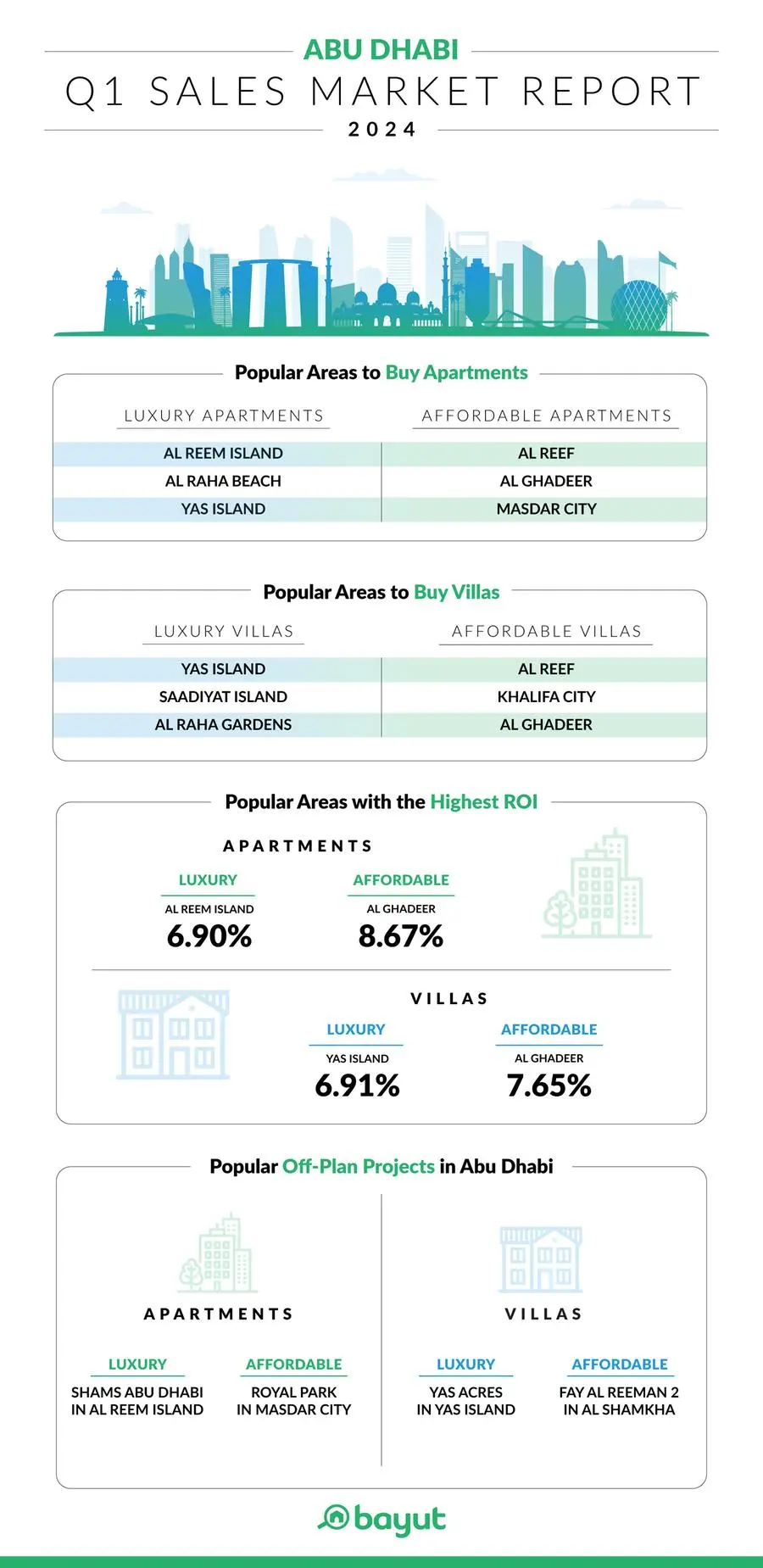

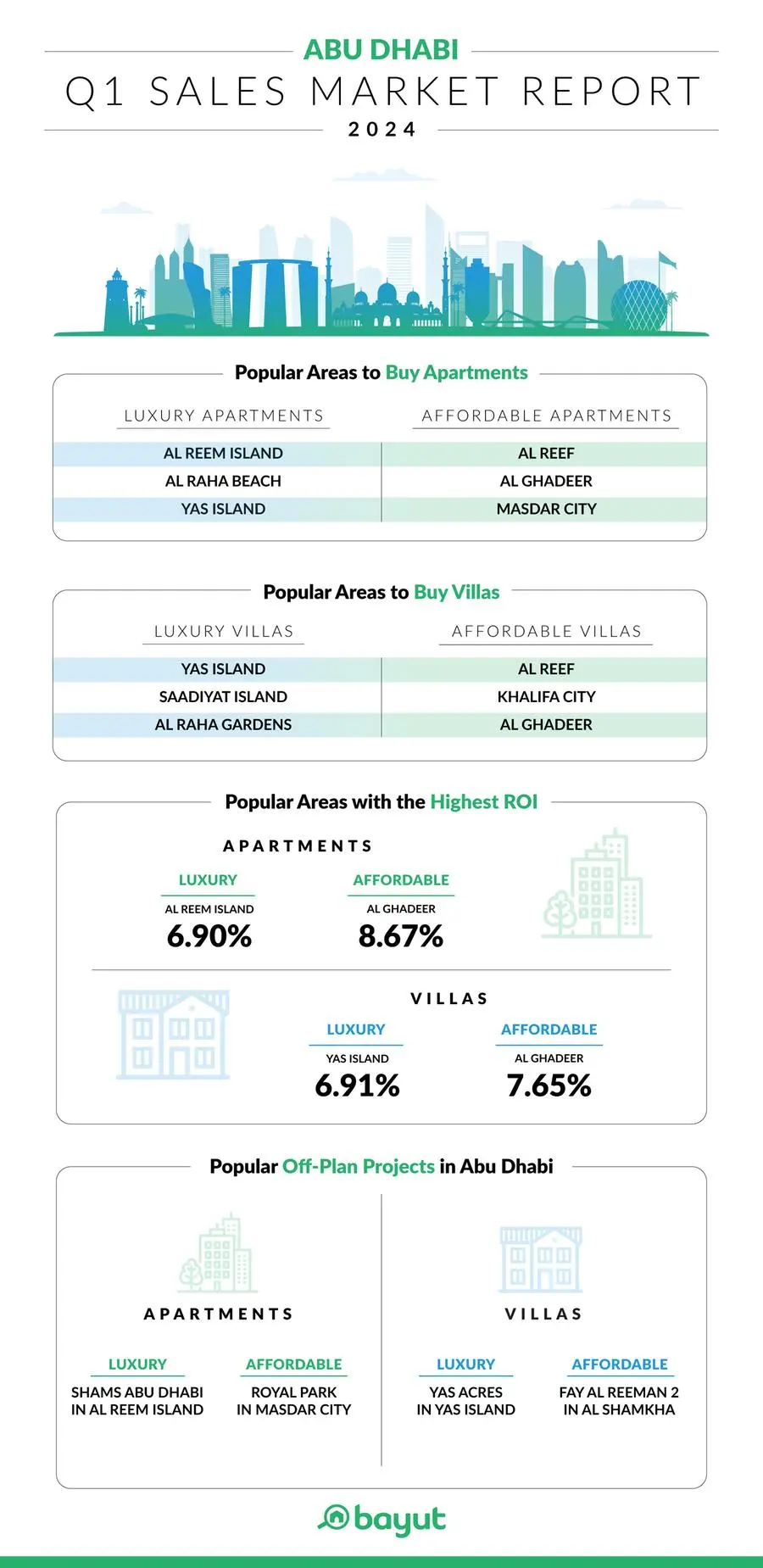

- The areas of Al Reef and Al Ghadeer have emerged as the top choices for those seeking affordable apartments. For luxury apartment purchases in Q1 2024, high searches have been recorded for units in Al Reem Island and Al Raha Beach. For villas, buyers on a budget have focused their interests in Al Reef and Khalifa City, whereas Yas Island and Saadiyat Island have been the preferred choices for luxury buy-to-let villas in Abu Dhabi.

- According to data from Bayut, sales prices for luxury apartments and villas in popular neighbourhoods have increased by up to 6% in the first quarter of 2024. Saadiyat Island has seen moderate price hikes, with luxury apartments experiencing a 3.64% surge and premium villas witnessing a 5.53% appreciation.

- The sales price-per-square-foot for affordable apartments and villas has generally declined moderately by up to 4%. However, Al Ghadeer has recorded a price appreciation of 6.02% for apartments and 5.19% for budget-friendly villas during the first three months of 2024.

- As per Abu Dhabi’s trusted digital real estate ecosystem DARI, there were over 4,674 residential property sales transactions valued at over AED 9.6B in Q1 2024 - a clear indication of the market's strong performance and investors' confidence in the city's real estate sector. This includes 1,167 ready properties and 1,752 off-plan units.

- The affordable apartments in Al Reef have been prominent investment options with high projected return on investment (ROI) of 8.30%. While Al Reem Island has maintained a strong 6.90% projected rental yield for investors interested in luxury apartments for sale in Abu Dhabi.

- According to Bayut's data analysis, Al Ghadeer has offered the highest ROI of 7.65% for affordable houses, while Yas Island had the highest ROI of 6.91% for luxury villas.

- Royal Park and Bloom Living have emerged as the top choices for affordable off-plan apartments in Abu Dhabi. Luxury property buyers were interested in island community developments like Yas Beach Residences and Saadiyat Cultural District. Bayut search trends analysis also revealed top villa projects among off-plan property buyers. Fay Al Reeman 2 was a popular choice for affordable off-plan purchases. Yas Acres and Murjan Al Saadiyat, which feature luxury off-plan villas, were buyer favourites.

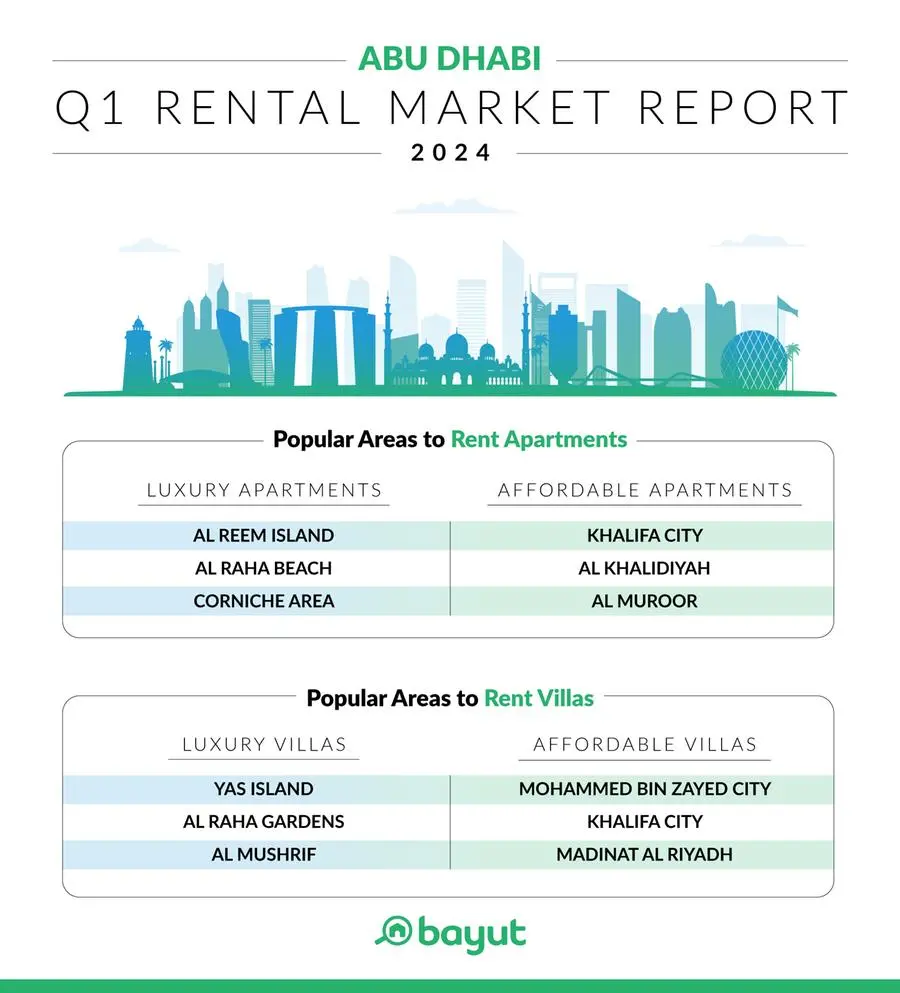

Trends for Renting Properties in Abu Dhabi

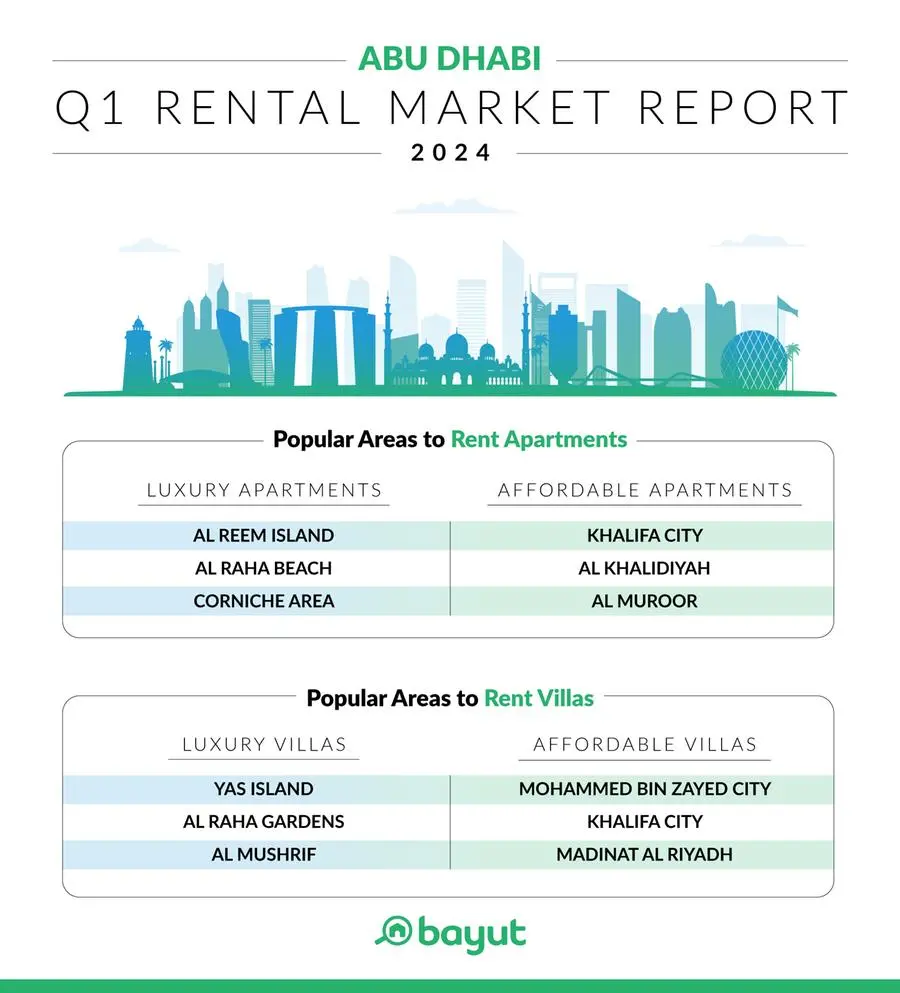

- Khalifa City and Al Khalidiyah have been popular choices for affordable apartments, while Mohammed Bin Zayed City (MBZ City) and Khalifa City were top picks for affordable villas in the rental segment. In the luxury categories, Al Reem Island and Al Raha Beach have emerged as the favourite locations for apartments, while Al Raha Gardens and Yas Island have been the top choices for high-end villas.

- The rental rates for apartments in highly sought-after luxury neighbourhoods have seen noticeable growth, up to 9%, primarily in Saadiyat Island and Al Raha Beach communities. Similarly, affordable apartment rentals witnessed price hikes of nearly 7% in certain areas like Al Muroor and Al Khalidiyah.

- According to Bayut's analysis, there has been a moderate increase of up to 5% per cent in the rental rates of affordable villas. One exception is the neighbourhood of Madinat Al Riyadh, which recorded an uptick of 12.9% in rents, where landlords have listed properties at higher price points. Conversely, high-end villas have seen a minor to moderate rental price surge. Al Bateen, in particular, experienced a considerable surge of 8.15% for luxury homes, potentially due to strong demand in the market.

The data analysis for the first quarter of 2024 indicates a steady growth trajectory in Abu Dhabi's real estate market. The rise in property prices, transaction volume and total transaction value reflects the market's robust and consistent performance. These trends are anticipated to persist in the subsequent quarters, solidifying Abu Dhabi's position as an attractive destination for real estate investments.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and CEO of Dubizzle Group MENA, said:

“Abu Dhabi’s real estate market has carried the momentum of its strong 2023 performance into the first quarter of 2024. When we look at the current market trends, it’s quite clear that there is increasing confidence among both local and international HNWIs that Abu Dhabi real estate is abundant with opportunity and is a prime market for investment. Looking to the future, with mega-projects projects such as Jubail Islands and Ramhan Islands coming to fruition, it’s fair to say that exciting times lie ahead for the capital’s thriving property sector.

At Bayut, we remain committed to the development of Abu Dhabi’s world-class real estate industry. To that end, we were immensely proud to recently sign a Memorandum of Understanding (MoU) with the Abu Dhabi Real Estate Centre (ADREC), aimed at enhancing transparency and efficiency across the capital’s real estate sector. By providing innovative services and accessible, accurate data, we are dedicated to ensuring stakeholder trust and driving future growth of the market.”

Note to Editor: For an accurate representation of price changes, this report compares the average price-per-square-foot in an area to analyse sales trends for villas and apartments in Q4 2023 to those observed in Q1 2024. These prices are, however, subject to change based on the building, amenities, developer and other deciding factors. For the rental properties, the report compares the average cost for individual unit types between the two periods in popular Abu Dhabi neighbourhoods.

Disclaimer: The above report is based on prices advertised by real estate agencies on behalf of their clients on Bayut.com and is not representative of actual real estate transactions conducted in Abu Dhabi.

About Bayut

Bayut is the uncontested market-leader when it comes to real estate portals in the UAE. With 4000+ real estate agencies choosing Bayut as their advertising partner, with over 400 Million page views per year. +87.2 Million visits, Bayut has successfully established itself as the number one platform people trust when it comes to property search.

A technology driven platform, Bayut is known to keep innovation at its core with updated, detailed transactional and advertised insights, extensive area and building guides, and revolutionary new products and features, allowing end-users to make the most well-researched decisions when searching for properties in the UAE.

Since Bayut was established in 2008, the company has seen accelerated growth, by focusing on increasing not only the number of real estate partners it works with, but also obtaining substantial traffic growth to claim the status of market leaders in the competitive real estate portal landscape in the UAE, with an extensive portfolio across all seven emirates.

Haider Ali Khan joined Bayut in 2014 as the CEO and the company has continued to showcase very high growth over the past years including closing multiple rounds of funding from top Venture Capital firms such as Naspers, KCK, Exor, and other notable names.

Bayut is a part of the Dubizzle Group, Formerly known as Emerging Markets Property Group (EMPG), which also operates the largest property classified sites in. In April 2020, the group merged with the Netherlands-based OLX group in certain key markets, and was valued at $1 Billion, giving it the coveted unicorn status. The group now also owns and operates dubizzle in the UAE, Our bespoke classifieds portals are among the strongest brands in our markets, primarily encompassing the Greater MENA and South Asia regions. Our flagship ventures include dubizzle and Bayut in the UAE and the Greater MENA Region, as well as Zameen and OLX in Pakistan.

For media enquiries, please contact: bayut@houseofcomms.com