PHOTO

Makkah, KSA: Jabal Omar Development Company (“JODC” or the “Company”) (Tadawul: 4250), one of the largest real estate developers in Saudi Arabia, today announced its financial results for period ending 31 March 2022 (Q1 2022).

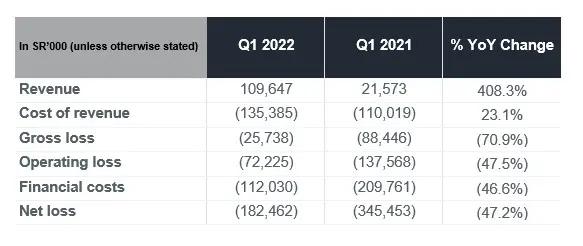

Financial Performance Highlights

- In Q1 2022 revenue surged 408% year-on-year (YoY) driven by increased activity in operational hotels and retail outlets. During Q1 2022, a greater number of visitors returned to Jabal Omar as Covid-19 related restrictions related to travel and the Hajj & Umrah segment were eased:

- Revenue from hotel assets increased 4 times compared to the same prior year period.

- Revenue from retail assets surged 11 times compared to the same prior year period.

- Gross loss for the period narrowed considerably to SAR 25.7 million compared to Q1 2021. Given a large portion of the company’s cost of doing business are fixed nature of the business’s the cost of revenue will continue to weigh on gross profit performance until the company’s operating assets return to full capacity.

- In Q1 2022 the Company recorded operating loss of SAR 72.2 million, significantly narrowing losses incurred in Q1 2021. This is mainly owed to JODC’s aggressive rollout and implementation of cost containment measures and operational efficiency enhancing initiatives.

- Financial costs in Q1 2022 decreased 46.6% YoY, driven by the positive realization of initiatives within the Company’s capital structure optimization plan. For the three-month period, the decrease was mainly attributable to the settlement of loans and the conversion of Ministry of Finance’s SR 1.5 billion loan into perpetual debt.

- Net loss for the period narrowed substantially from Q1 2021, when the Company suffered significantly from Covid-19 related tourism, mobility and Hajj & Umrah sector specific restrictions.

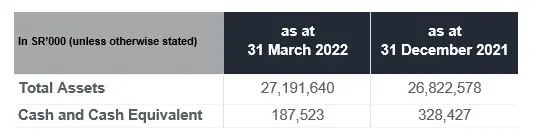

Financial Position Highlights

- The Company enjoys a sizeable asset base made up predominately of strategically and uniquely located infrastructure-enabled land. By the end of Q1 2022, total assets increased 1.4% quarter-on-quarter (QoQ) with Property, Plant and Equipment increasing 1.1% QoQ.

Khalid Al Amoudi, CEO of Jabal Omar Development Company, said:

“Our first quarter in 2022 has shown promise, progress and the continued positive impact the implementation of our ongoing transformation measures have had across the Company. We have seen 408% year-on-year revenue growth, driven in part, by the lifting of Covid-19 restrictions with over three quarters of the Kingdom fully vaccinated against the virus. Looking ahead, we remain optimistic, especially as the Hajj season approaches and the increasing number of Umrah pilgrims we have seen, setting a strong indicator for what to expect going forward post-COVID.

Nevertheless, as we look to the year ahead, we remain resolute on forging ahead with the optimization and performance enhancement efforts across the Company. With a more optimal capital structure in place, we have reported a significant decrease in our financial costs which continues to showcase our positive trajectory, increasing financial stability and sets the stage for our sustainable growth going forward.”

Key Messages:

Continued execution on JODC’s transformation

JODC has undergone a significant financial, operational and organizational transformation which has allowed it to become a more financially sustainable, and operationally resilient and efficient company. Through its disciplined, aggressive and measured approach towards optimizing the Company’s capital structure and cost base while also maximizing revenue opportunities, JODC has delivered robust performance during Q1 2022, building on the strong momentum from previous quarters. As the Company continues to progress on its transformation journey, the Company will carry this momentum for the remainder of the year.

Strong discipline and focus on expenses and costs continues to reap rewards

As part of our transformation, we continue to take a disciplined approach to both cost control and reducing our cost base through both restructuring and performance enhancements across the Company.

Project construction for Phase 2 & 3 set for timely delivery

JODC continues to expedite project delivery as part of the Company’s strategic and transformation priorities. JODC has made numerous improvements in this regard over the last two years including greater visibility on cost and completion dates as well as a holistic organizational restructuring of the project management teams to enhance efficiency.

These enhancements have led to Phase 2 being almost 85% completed and is expected to be fully operational during Q1 2023. Similarly, Phase 3 is almost 90% completed with an operationally effective date expected during Q3 2023. In line with the influx of visitors expected during the upcoming Hajj season both N1 Mall in Phase 3 and the malls and apartments in Phase 2 will be operational ahead of Hajj to ensure JODC is able to capitalize on the significant number of visitors expected.

Revenue momentum to continue gathering pace as Hajj & Umrah sector recovers

The Company expects the positive revenue momentum seen over the past 2 quarters to continue with the removal of Covid-19 restrictions, the increase of travel and the effective efforts of the Government in the management of the pandemic. We expect to see a very strong recovery in the number of visitors over the year and the upcoming Hajj season in particular. The Company has already seen this recovery take place and bear fruit with over 6.6 million pilgrims performing Umrah during Ramadan 2022, according to official figures, which is highly encouraging and is a positive indicator for the remainder of 2022.

-Ends-

Contact:

Brunswick Group

Celine Aswad / Ibrahim Anabtawi

JODC@Brunswickgroup.com