PHOTO

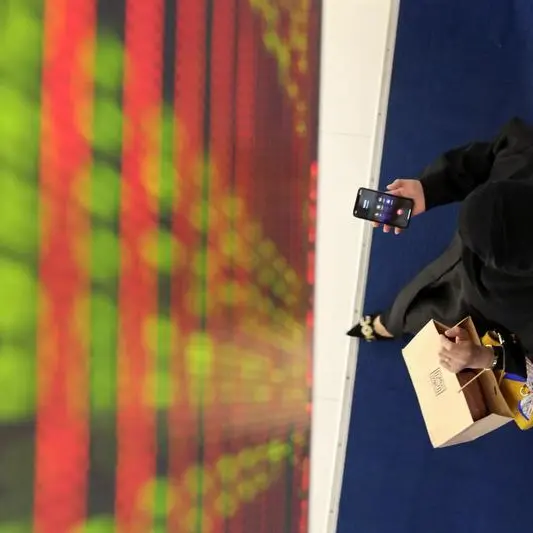

Most major Gulf stock markets were subdued in early Tuesday trading as investors booked profits and oil prices softened, while Qatar's index rose on upbeat annual earnings.

Oil prices - a catalyst for the Gulf's financial markets - edged down as traders gauged the potential for supply disruptions after U.S. guidance for vessels transiting the Strait of Hormuz kept attention squarely on tensions between Washington and Tehran.

Iran along with fellow OPEC members Saudi Arabia, the United Arab Emirates, Kuwait, and Iraq export most of their crude via the Strait, mainly to Asia.

Saudi Arabia's benchmark index was down 0.1%, hit by a 0.8% fall in Al Rajhi Bank.

Separately, the kingdom's $925 billion Public Investment Fund (PIF) plans to announce a new five-year strategy this week, two people with direct knowledge of the matter said, in the biggest reset yet of Crown Prince Mohammed bin Salman's economic transformation plan.

Dubai's main share index dropped 0.6%, on course to snap a six-day winning streak, with toll operator Salik Co losing 2.2%.

Elsewhere, Dubai Investments retreated 3.2%, trimming part of the prior session's advance of 4.3% that followed a substantial increase in its annual profit.

In Abu Dhabi, the index, which had risen for six consecutive sessions, slipped 0.1%.

The Qatari index gained 0.8%, with Qatar Navigation jumping 3.2%.

Among other gainers, telecoms firm Ooredoo was up 2%, after reporting a rise in 2025 profit.

(Reporting by Ateeq Shariff in Bengaluru; Editing by Harikrishnan Nair)