PHOTO

Global markets

Global markets retreated overnight and early on Wednesday after surging in the previous session on optimism over easing trade tensions between the United States and China.

MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.2 percent on Wednesday.

“The market probably became overly optimistic on Monday. The reality is the talks are still continuing as they haven’t made headway on various issues, including intellectual property,” Norihiro Fujito, senior investment analyst at Mitsubishi UFJ Morgan Stanley Securities, told Reuters.

“There are many uncertainties in the air, we still don’t know whether U.S.-North Korea summit is possible and scandals continued to drag Prime Minister (Shinzo) Abe’s popularity,” Yasuo Sakuma at Libra Investments told Reuters.

On Wall Street, the S&P 500 lost 0.31 percent overnight, losing steam after hitting a two-month high.

Middle East markets

Stock markets in the Middle East were mixed on Tuesday. United Arab Emirates stocks outperformed the region.

Dubai’s index added 0.9 percent, boosted by an 8.4 percent rise by Emirates NBD after it agreed to buy Turkish lender Denizbank for $3.2 billion.

Arabtec Holding added 3 percent after announcing that it has secured a contract worth 157 million UAE dirhams ($42.75 million) to build two phases of a development in the Uptown Cairo master project.

In Abu Dhabi, the index added 1.5 percent, as First Abu Dhabi Bank, the emirate's largest bank, gained 3.1 percent and telecommunications operator Etisalat rose 0.9 percent.

Saudi Arabia’s index closed 0.6 percent higher. Saudi Basic Industries (SABIC) and Al Rajhi Bank, two of the largest stocks on the index, finished up 3.4 percent and 0.7 percent, respectively.

Qatar’s index added 0.6 percent. Doha Bank's stock ended 1.9 percent higher and Commercial Bank added 1 percent.

Egypt’s index lost 0.7 percent, Bahrain’s index dropped 0.2 percent, while Kuwait’s index fell 0.3 percent and Oman’s index was down 0.4 percent.

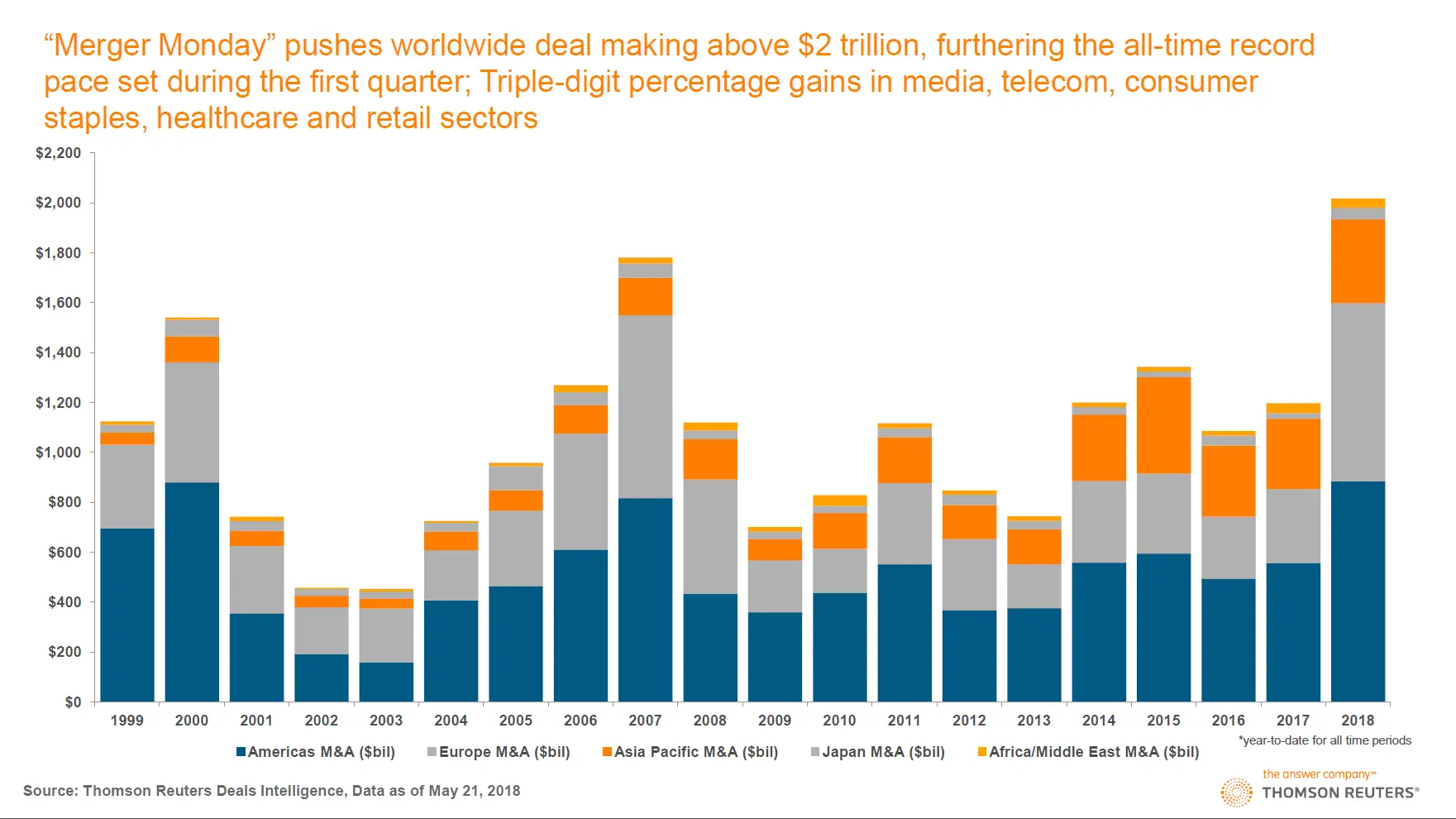

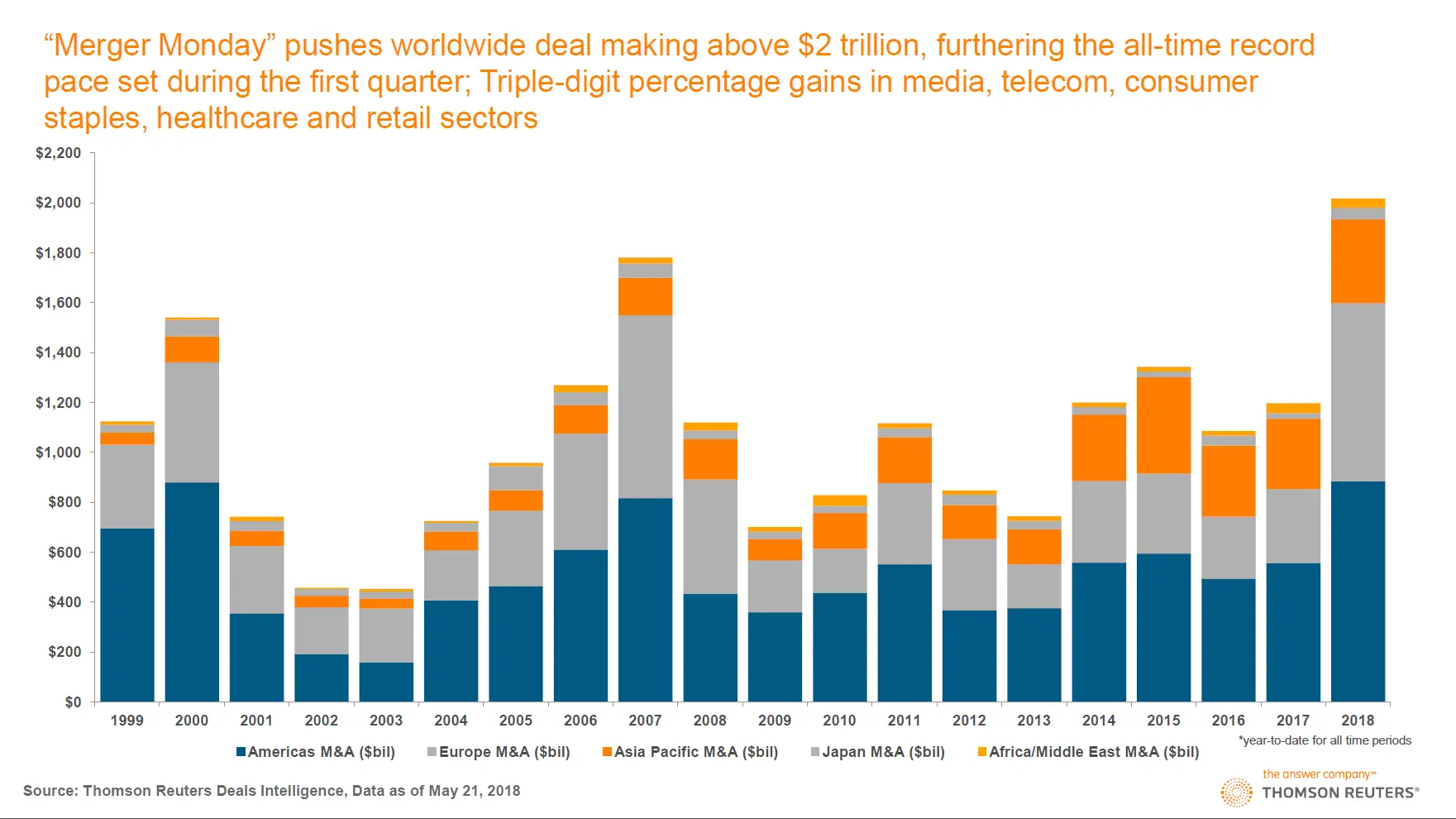

Commentary: According to Thomson Reuters data, global mergers and acquisitions have already reached $2 trillion this year.

Please click here to gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Oil prices

Oil prices retreated early on Wednesday as investors factored the possibility of higher OPEC output.

Brent futures fell 43 cents, or 0.5 percent, to $79.14 a barrel by 0218 GMT, after climbing 35 cents on Tuesday. Last week, the global benchmark hit $80.50 a barrel, the highest since November 2014.

U.S. West Texas Intermediate (WTI) crude futures eased 25 cents, or 0.4 percent, to $71.95 a barrel, having climbed on Tuesday to $72.83 a barrel, which was also the highest since November 2014.

“Looks like the market is pausing at current levels,” Michael McCarthy, Chief Market Strategist at brokerage CMC Markets, told Reuters.

“If sanctions are introduced against Iran, most of the OPEC producers would like to be pumping more oil, particularly giving the higher prices.”

Currencies

The dollar was trading higher early on Wednesday, with investors awaiting the minutes of the Federal Reserve’s last policy meeting for hints on the pace of further U.S. monetary tightening.

The dollar index, which measures the currency against a basket of six major peers, rose 0.1 percent to 93.681. On Monday, the index set a five-month high of 94.058.

“We hope to have a bit more clarity on the inflation outlook from the Fed. The second dimension is basically how tolerant the Fed (policymakers) are of a possible inflation overshoot above 2 percent,” Heng Koon How, head of markets strategy for UOB in Singapore, told Reuters.

Precious metals

Gold prices rose on Wednesday as equities retreated on uncertainty over the outcome of U.S.-China trade talks.

Spot gold was up 0.1 percent at $1,292.56 per ounce, as of 0329 GMT. U.S. gold futures for June delivery were unchanged at $1,291.90 per ounce.

In other news…

Morocco’s High Planning Authority said on Tuesday that the country’s annual consumer price inflation rate rose to 2.7 percent in April from 2.5 percent in March, mainly due to higher food prices.

(Writing Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

For access to market moving insight, subscribe to the Trading Middle East newsletter by clicking here.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018