PHOTO

MADRID- Abu Dhabi state investor Mubadala aims to value Spanish oil major Cepsa at up to 8 billion euros ($9.22 billion) after setting the price range for the company's initial public offering, according to the prospectus filed on Tuesday.

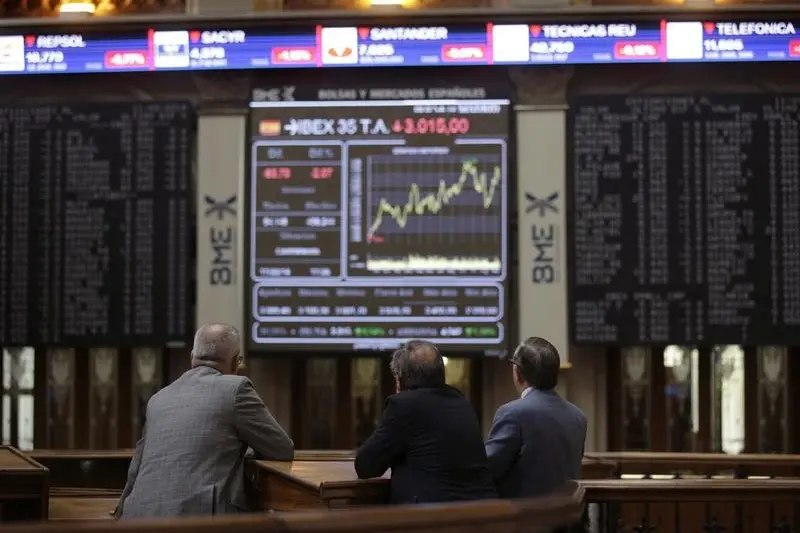

Mubadala announced plans to float Cepsa on the Madrid stock exchange two weeks ago, putting it on track for a listing in late October. The final share price is expected be set on October 16, with the floating taking place two days later.

The Abu Dhabi investor is expected raise around 2 billion euros with the sale of a 25 per cent stake, taking into account the highest price from a range of between 13.1 euros to 15.1 euros per share.

The floatation also includes an over-allotment option of a 3.75 per cent to the joint-global coordinators of the issue.

If completely exercised, Mubadala would additionally raise 300 million euros.

($1 = 0.8677 euros)

(Reporting by Andres Gonz?lez; editing by Jes?s Aguado and Louise Heavens) ((andres.gonzalez@thomsonreuters.com; 0034 647 69 49 89; Reuters Messaging: andres.gonzalez.thomsonreuters.com@reuters.net))