PHOTO

Commercial real estate in the United Arab Emirates remains in demand among investors despite the fact that the market is continuing to soften, according to consultancy firm Knight Frank.

The firm's UAE Real Estate Investment Market 2019 report published on Sunday states that "there remains room for cautious optimism" in commercial real estate, despite growth slowing in the employment market as new economic stimulus measures are announced.

"Abu Dhabi has seen a net decline (in jobs) overall," Taimur Khan, Knight Frank Middle East's head of research said in a telephone interview with Zawya. "Dubai has seen maybe around 45,000 new jobs created, but actually the vast majority of those have been in the construction and real estate sector. We've seen a decline in financial and business services."

Knight Frank’s report highlighted that jobs growth in the UAE slowed to 0.6 percent in the third quarter of 2018 (the most recent for which data is available). This represents a decline from 3 percent in the same period a year earlier.

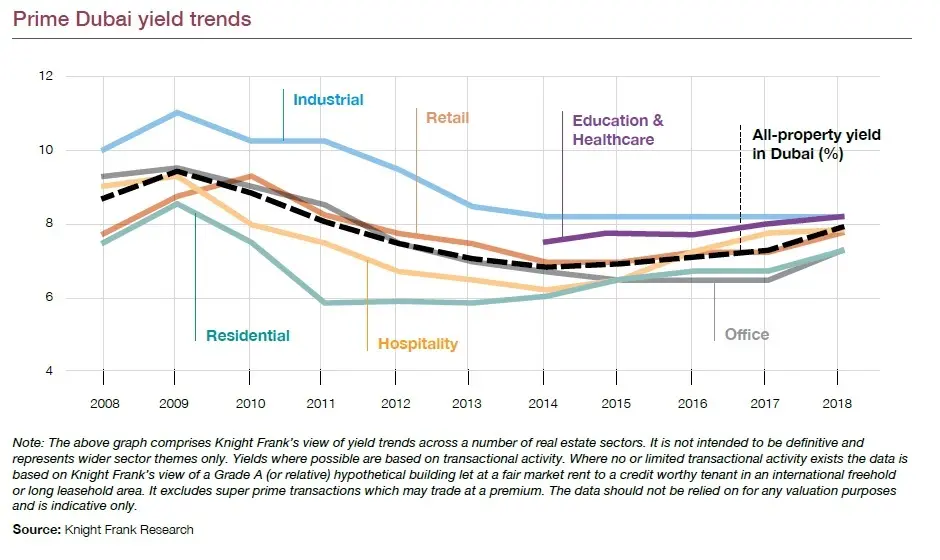

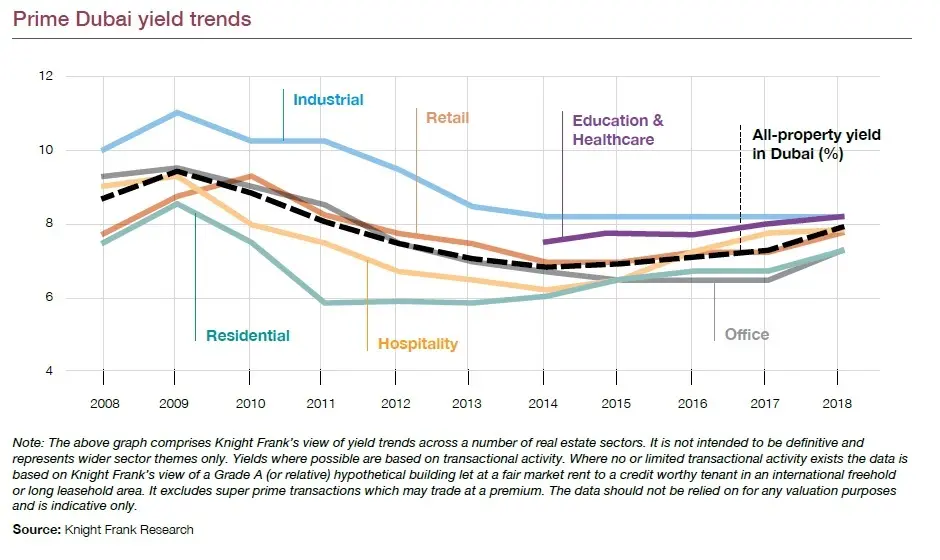

Despite this, the report said there is upwards pressure on commercial property yields. In the office market, yields are widening between primary and secondary offices, with the latter witnessing an increase mainly because prices are continuing to fall.

"All of a sudden, if primary stock is so much cheaper, why would you go and be an occupier in secondary stock?" Khan said.

Occupier demand for logistics space remains strong driven by ecommerce firms and the lack of suitable existing space to serve them. However, Khan said the ownership structure of many industrial estates - with a master developer retaining the land - made investor participation problematic

Healthcare and education assets are other areas that have attracted investor interest for real estate, despite the fact that the latter, particularly, has become a tougher space for operators recently, with “some recent insolvencies in the sector”, according to the report.

Khan said the advantage of both sectors is that operators tend to sign long, inflation-linked leases of up to 25 years, in a region where typical lease length is between 2-5 years. However, he added that success in both markets was “very area-dependent”.

“You wouldn't go building a hospital or clinic in Jumeirah, because obviously there's quite a lot already there. But new communities very soon build up (and) you're not always seeing the facilities, the social infrastructure coming alongside it.”

Just like the residential market, however, both hospitality and retail are areas where investor sentiment is tempered by the looming supply pipeline.

Khan said that with the amount of agreements already signed, “we expect 45,000 (hotel) rooms to come onto the market in the hospitality sector” in Dubai over the next few years. Figures published by consultancy firm STR last month showed that although demand for hotel rooms increased by 3.9 percent year-on-year in January, supply increased by 9.3 percent, placing pressure on room rates. Revenue per available room dropped 15.8 percent year-on-year to 586.79 UAE dirhams ($159.78) per night.

Spatial awareness

The retail property pipeline is also substantial, with supply expected to increase across Dubai by 111 percent over the next five years. Supply is set to grow to 7.1 million square metres by the end of 2023, up from 3.5 million sq m at the end of last year.

"What is interesting in the retail space is strip malls," Khan said. "That's where a lot of the demand lies. If you want to grab some milk or get a haircut, you don't want to go to a (large) mall. You'd rather go to a community mall," he argued.

Overall, he said that international investors remain interested in the Dubai market, but that “it's only there for the right assets”.

“It's not there for strata stock - it's there for wholly-owned assets. And they want the size as well. They don't want to spend $10 million.”

He said that there had been “a few bigger deals happening”, with the report highlighting the sale of U-Bora Tower in Business Bay for an undisclosed sum, Emaar Properties' sale of four hotel assets in Downtown Dubai to Abu Dhabi National Hotels for 2.2 billion dirhams and Aldar Properties' 658 million dirham purchase of International Tower in Abu Dhabi from Eastgate Capital Group as examples of sizeable recent transactions.

He also said the decline in commercial real estate prices over the past few years will mean that fund owners with a long-term horizon could see an opportunity to buy while valuations are low.

The only issue - both for global real estate investors and for local, family offices - is whether there are more attractive returns to be had elsewhere.

“There's a lot of money going out from this region into Europe and the US because there isn't enough stock here. If the risk-adjusted return was there and the stock was here, they would invest here,” Khan said.

“All of a sudden, in Europe now, if you're getting 5 percent (yield) in secondary cities... (investors) are going to be like, 'why am i taking risk for an emerging market?'”

In a report outlining its outlook for the UAE real estate market last month, consultancy Savills said that the mismatch between supply and demand “may continue to influence asset pricing over the next 12 months”.

It argued that lower pricing of assets “will help to improve occupancy levels”, with demand for office space in Dubai likely to come from the non-oil sector, and Abu Dhabi likely to witness “steady demand from infrastructure and logistics companies” following Abu Dhabi National Oil Company’s commitment to create 18.8 billion dirhams of "In-Country Value" through its investment programme.

(Reporting by Michael Fahy; Editing by Mily Chakrabarty)

(michael.fahy@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019