PHOTO

Dubai’s prime residential properties have witnessed above-average capital growth over the last six months, according to real estate services provider Savills.

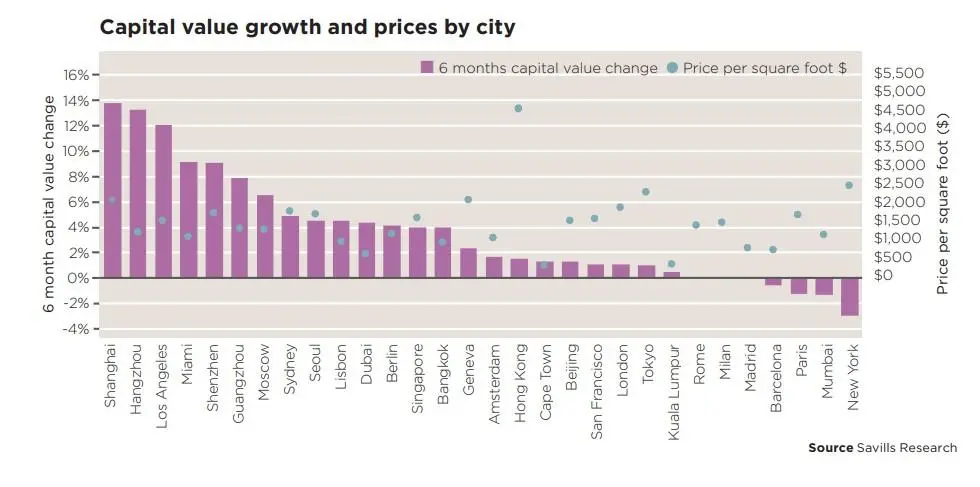

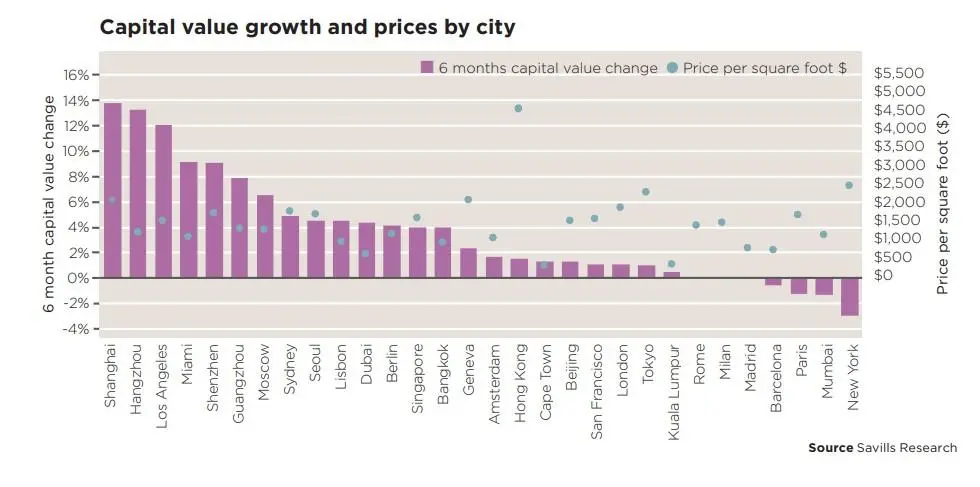

The city’s residential property market saw its capital values grow at more than four percent against an average of 3.9 percent across 30 major cities in the Savills World Cities Index, in the first six months of 2021, which was the fastest rate of growth since 2016.

Shanghai saw the highest capital growth of almost 14 percent, while Barcelona, Paris, Mumbai and New York saw values reducing per square foot. New York saw the steepest decline at three percent.

Dubai’s success in handling the pandemic and proactive policy measures to jump start the economy played a crucial role in driving demand for prime residential, Savills said.

“Availability of good quality stock, low lending rates and relatively affordable real estate prices led to strong transaction activity which drove capital values higher across prime properties,” Savills said in its latest report World Cities Prime Index.

Click on image to enlarge

“Return of international travel to world cities is likely to provide an increase in supply of buyers for prime properties,” the report added.

From June 2018 to December 2020, the average growth in capital values across cities was only 0.7 percent, due to changes in tax policies and overwhelming international uncertainty, with the pandemic then exacerbating slow growth, Savills said.

However, with offices closed and working from home increasing, there was also an increased need for space which helped to push up capital values in locations including Dubai, Cape Town, Moscow and Lisbon.

Swapnil Pillai, associate director research at Savills Middle East, added: “The return of international travel is likely to provide an increased supply of buyers for prime properties.

“Furthermore, the economic recovery and growth led by increasing vaccination rate in the UAE is expected to further support buyer confidence and boost demand.

“Though a degree of pandemic-related uncertainty remains, the prime residential sector is likely to remain strong through the rest of the year.”

(Writing by Imogen Lillywhite; editing by Seban Scaria)

Imogen.lillywhite@refinitiv.com

This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021