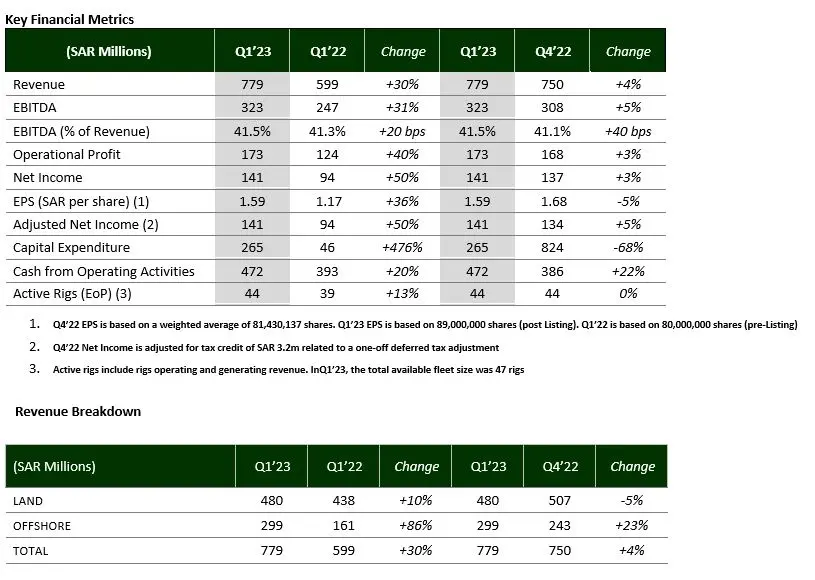

- Q1’23 Earnings before Interest, Tax, Depreciation and Amortization (“EBITDA”) percentage increases by +40 basis points

- Q1’23 Cash from Operating Activities is +22% higher than Q4’22

- Q1’23 Capital Expenditure (“Capex”) of Saudi Riyals (“SAR”) 265 million was mainly due to the ongoing shipyard activities of the three latest acquired Jackups (named AD130, AD140 and AD150)

- Q1’23 Backlog was in excess of SAR 8 billion, with a Book-to-Bill ratio of 2.8x

Al-Khobar, KSA: Arabian Drilling, or the “Company”, (Tadawul symbol: 2381), the onshore and offshore drilling National Champion in Saudi Arabia, announced its Q1’23 financial results with a +5% increase on its Adjusted Net Income compared to Q4’22, on a similar rig activity level.

FINANCIAL HIGHLIGHTS

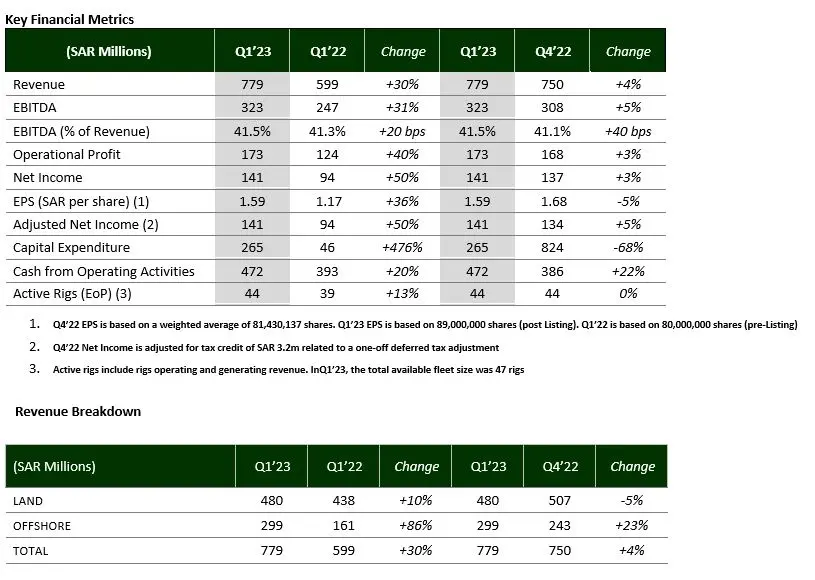

Arabian Drilling closed Q1’23 period with a consolidated revenue of SAR 779 million, reflecting a quarter-on-quarter (“QoQ”) increase of +4%, on a similar rig activity level. The revenue increase was mainly driven by the full quarter impact of our two recently acquired Jackups (named AD110 and AD120) that started their three-year contract in Q4’22.

Q1’23 EBITDA was SAR 323 million, with a margin of 41.5%, representing a 40 basis points (“bps”) increase over that of Q4’22, mainly due to the full quarter impact of AD110 and AD120, as mentioned above.

Q1’23 Operating Cash Flows of SAR 472 million includes the collection in Q1’23 of the mobilization fee for AD110 and AD120. Net Working Capital of SAR 255 million is approx. 9% of the last 12-month trailing revenue, in line with expectations.

Q1’23 Capex of SAR 265 million (including SAR 18 million of capitalized interest) mainly related to the ongoing shipyard activities and contract readiness of our three contracted Jackups AD130, AD140 and AD150. Two of the rigs (AD130 and AD140) are currently located in Dubai while AD150 is currently based in Singapore. All three Rigs are expected to commence operations in the Third Quarter of 2023. In comparison, Q4’22 Capex was significantly higher as it included the acquisition of the offshore rig AD150.

Q1’23 Cash and Short-Term Investment balance was approx. SAR 2 billion with a +8% increase compared to Q4’22. The available cash is planned to be utilized to finance future growth opportunities.

Q1’23 Net Debt was SAR 713 million which represents a Quarter-on-Quarter -20% decrease and the Q1’23 Leverage Ratio (Net Debt / EBITDA) was 0.6 compared to 0.8 in Q4’22.

OPERATIONAL HIGHLIGHTS

At the end of Q1’23, Arabian Drilling reported a fleet utilization rate of 94% (44 active rigs out of a total available fleet of 47 units), in line with what we reported last quarter. During Q1’23 period, one Land Rig (AD63), which was reactivated, started its new 3-year contract with Baker Hughes. At the same time, another Land Rig (AD29) was released by Saudi Arabian Oil Company (“Aramco”) to drill a “pro bono” well for the Saudi Arabian Drilling Academy (“SADA”) as part of the Company’s support to train and qualify Saudi nationals drilling crews. By the end of SADA well completion, we expect to utilize AD29 as a training facility for the onboarding of new hires to support our anticipated growth.

Aramco’s Rig Efficiency Index (“REI”) based on a 36-month rolling average remained strong at the end of Q1’23 with a score of 93.7% across the fleet. Overall, Q1’23 Non-Productive Time (“NPT”) was at 1.05%, showing a -70 bps decrease compared to Q4’22 NPT of 1.75%.

During Q1’23, the Company completed 41 land rig moves, with a cumulated net saving of 8 days compared with Aramco’s target.

At the end of Q1’23, the Company’s backlog was SAR 8.1 billion with an average remaining contract tenure of 2.2 years per rig. The ratio of current backlog to the last 12-month trailing revenue (Book-to-Bill ratio) was 2.8x.

At the end of Q1’23, the 12-month rolling average of the Total Recordable Incident Frequency (“TRIF”) was 0.84 compared to 0.33 in Q4’22. The Company will continue to strengthen its focus on the prevention of injuries across all our work locations with an emphasis on management visibility on site, training of new hires, risk management and our “Stop Work Authority” safety policy.

GUIDANCE

Full Year 2023 (“FY’23”) Revenue guidance remains unchanged and is expected to be in the range of SAR 3.3 billion to SAR 3.5 billion.

FY’23 Capital Expenditure remains unchanged and is expected to be in the range of SAR 1.2 billion to 1.4 billion, reflecting the ongoing shipyard activities for the three newly acquired jackups, as well as discretionary refurbishment and upgrade projects for certain land rigs and facilities.

The Company expects to continue maintaining a healthy leverage ratio (Net-Debt/EBITDA) below 1.0x, however, both Capex guidance and leverage ratio are subject to change based on potential growth opportunities and/or potential contract awards.

The Company intends to distribute its first cash dividend post listing in the Fourth Quarter of 2023, and its amount will be determined based on the financial performance of the half-year results ending on June 30th, 2023.

COMMENTS

Ghassan Mirdad, Chief Executive Officer of Arabian Drilling, commented:

“We delivered a strong quarter with an increased bottom line, despite a similar rig activity level. Our operational focus is on the completion on time and on budget of the AD130, AD140 and AD150 shipyards so they can all commence their 5-year contract with Aramco within the targeted deadline. We remain extremely engaged in our safety culture and records, especially at a time when we are starting up more rigs with new crews.

For the rest of 2023, we are focusing on operational excellence while actively participating in key tenders and scouting expansion opportunities. We believe the Company is ideally placed to capitalize on some opportunities to grow both our internal Saudi fleet as well as become an important regional player.

We remain excited about the Company’s growth trajectory and expect another strong financial performance in FY’23 reflecting the Market positive outlook. “

Hubert Lafeuille, Chief Financial Officer of Arabian Drilling, commented:

“We achieved good results this Quarter with a strong EBITDA Margin and a robust Cash Flow from Operating Activities which was almost twice as much as our Capex spending. We closed the Quarter with a liquidity position of SAR 2 billion and we reduced our Net Debt Position by almost SAR 200 million in the Quarter. Our healthy and strong Balance Sheet puts us in a prime position to seize any growth opportunity coming our way and ensuring, at the same time, good returns for our Shareholders.”