PHOTO

Exports from the UAE are projected to grow at an average annual rate of over 6 percent to more than 1.1 trillion dirhams ($299 billion) by 2030, according to a report from Standard Chartered.

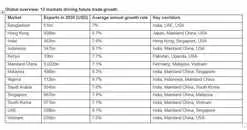

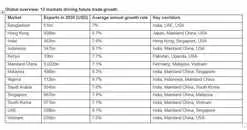

The report, titled ‘Future of Trade 2030: Trends and Markets to Watch’ said that total global exports will almost double over the next decade, from $17.4 trillion to $29.7 trillion, with 13 markets driving much of this growth.

Additionally, the research found that 22 percent of global corporates currently do or plan source in the UAE within the next five to 10 years. "This is evidence that the UAE will be a major driver of global trade growth over the next decade," the report, commissioned by Standard Chartered and prepared by PwC, said.

Based on surveys of top business leaders, the report identifies 13 major corridors, and five trends shaping the future of global trade.

India and Mainland China will continue to be among the largest export corridors for the UAE, accounting for 18 per cent and 9.5 per cent of total exports in 2030, respectively.

Singapore is a regional trade hub and strategic corridor for the UAE and is projected to grow at an average of 6.2 per cent per year until 2030.

The five key trends shaping the future of global trade are:

- the wider adoption of sustainable and fair-trade practices

- a push for more inclusive participation

- greater risk diversification

- more digitisation and a rebalancing towards high-growth emerging markets

The UAE is focusing on expanding its exports beyond petroleum and reinforcing its position as a gateway to MENA. The sectors that will dominate exports in 2030 are metals & minerals, gold, and machinery & electricals.

Asia, Africa and the Middle East will see a ramp-up in investment flows, with 82 percent of respondents to a survey saying they are considering new production locations in these regions in the next five to 10 years, supporting the trend towards rebalancing to emerging markets and greater risk diversification of supply chains.

(Reporting by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2022