PHOTO

Rising unemployment and government debt levels continue to be the main challenges for Saudi Arabia’s Vision 2030 economic plans, but a strong stock market performance, growing non-oil revenues and improved oil prices have contributed to an overall positive outlook for economic forecasts, according to a new report issued on Monday by National Bank of Kuwait. (Read the full report here).

Reining in unemployment

Job creation was a core goal of the kingdom’s Vision 2030 economic reforms, with authorities hoping to reduce the unemployment rate from 11.6 percent in 2015 to 7 percent by 2030. However, the NBK report said that the rate has instead risen to 12.9 percent in the first quarter of 2018, as the young labour force expands quicker than authorities can create new jobs.

On the bright side, there has been growth in the non-oil sector, which the governments hopes will spur growth job creation in the private sector. Non-oil revenues have doubled since 2014, reaching 256 billion Saudi riyals last year, now representing around a third of overall revenues, the NBK report said.

The government aims to increase this through its largest ever budget of 978 billion Saudi riyals ($260 billion) in 2018, rolling out a 72 billion Saudi riyal, five-year stimulus package for the private sector and setting up more public-private partnerships by privatising some key state assets, such as hospitals and airports.

“In the process, the government hopes to net 35-40 billion Saudi riyals in direct sales revenues and achieve savings of 25-35 billion Saudi riyals, while creating 10,000-12,000 jobs in the private sector,” the NBK report said.

More debt

Growing government debt is also a major factor to watch, with the NBK report estimating that debt levels will rise from 17.3 percent of gross domestic product (GDP) in 2017 to 24.6 percent of GDP by the end of 2019.

NBK expects Saudi authorities to issue $37 billion worth of bonds by the end of the 2018 as it increasingly looks to the debt market to fund its expenditure, rather than tap in its reserves.

“We expect the authorities will increasingly try to minimise reserve drawdowns and rely more on debt issuance to take advantage of the still relatively low global interest rates,” the NBK report predicted.

In a bid to rebalance government budgets and boost non-oil revenues, authorities reduced subsidies for citizens and introduced new taxation levels, such as a 5 percent value-added tax in January.

Controlling inflation

The introduction of new taxes initially led to inflation increasing to 6.8 percent year-on-year in January, with price rises in the transport, food and restaurant and hotel categories. However, NBK is confident that this will be a temporary surge and prices will stabilise going forward.

“We expect inflation to continue to ease to 2.9 percent (avg.) in 2018 as the one-off effects of January’s price hikes wear off and given that housing and rental costs, which continue to fall due to a combination of weaker demand and government efforts to make housing more affordable,” NBK said.

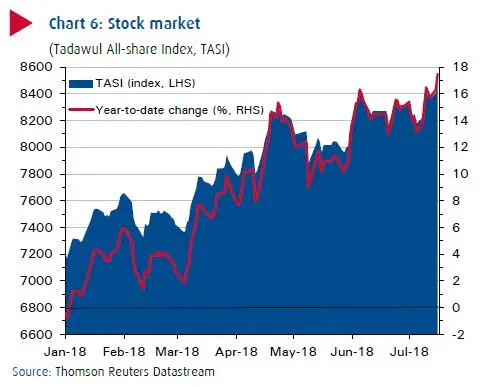

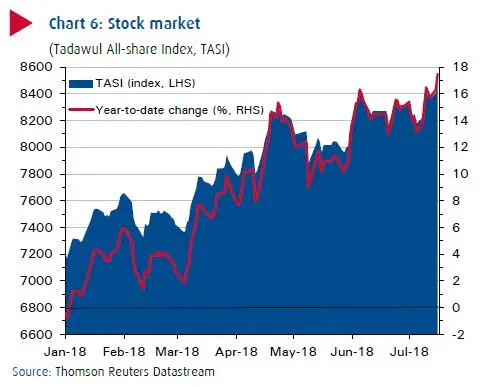

Strong stock market

On the stock market the 15.1 percent gain made by the Tadawul All Share Index in the first half of 2018 meant it has not only outperformed its regional peers, but was one of the top-performers globally.

“It’s one of the three best markets in the world in terms of performance in the first six months,” Mazen Al Sudairi, the head of research at Riyadh-based Al Rajhi Capital, told Zawya in a telephone interview.

Al-Sudairi attributed the gains to two main factors – the 19.3 percent increase in oil prices experienced over the first six months, and the twin boosts that exchange bosses received from index compilers FTSE Russell and MSCI – both of whom have announced that they will upgrade Tadawul to emerging market status next year. (Read more here).

General outlook

In addition to good news for the stock markets, the top level economic indicators have been positive, according to NBK. The fiscal deficit is expected to narrow from 9.0 percent of GDP in 2017 to 6.1 percent in 2018 and 4.6 percent of GDP next year.

With prices improving and production increasing, oil GDP is expected to rise from a decline of 3.1 percent in 2017 to 2.6 percent growth this year, while the non-oil sector is expected to grow from 0.9 percent last year to 1.9 percent in 2018, NBK said.

“The improved outlook occurs against a backdrop of continuing structural reforms under the ambitious Vision 2030 umbrella but at a pace that is less likely to impinge on consumer demand and private sector activity. Growth prospects will, however, be contingent on higher oil prices,” NBK concluded. (Read the full NBK report here).

Further reading

• GCC Equities Review: Investors pile into Saudi stocks after upgrades, but does the market still offer value?

• Potential worker shortage may put brakes on Saudi construction - analyst

• Saudi inflation falls to its lowest level this year, as the impact of new taxes wanes

• Entertainment creating jobs in Saudi Arabia

• Unemployment rate among Saudis rises to record 12.9% in Q1

• State budget deficit raises risks for Saudi economy

• Saudi finance minister says on track to cut budget deficit to 7% of GDP

(Writing by Shane McGinley; Editing by Michael Fahy)

(shane.mcginley@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018