Jeddah, Saudi Arabia : SEDCO Capital, a global Shariah-compliant and ethically led asset management and investment advisory firm (or “the Fund Manager”), announced today the commencement of the additional offering of its SEDCO Capital REIT Fund (or “the Fund”).

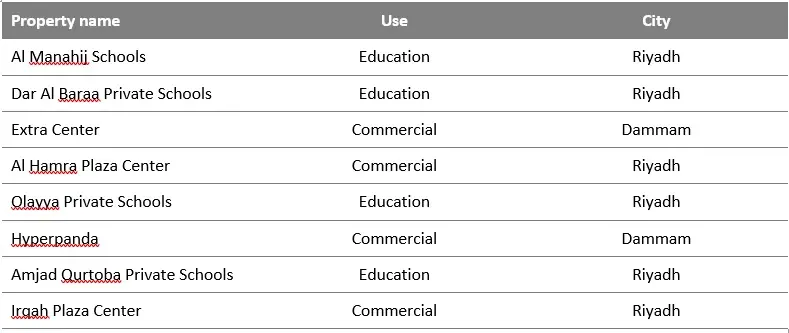

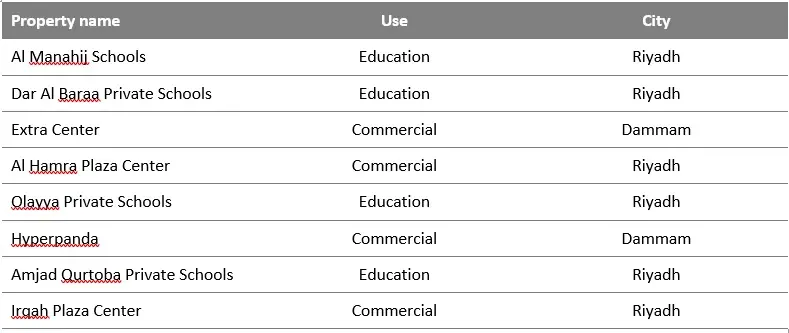

The additional offering will seek to increase the total asset value of the fund by SAR 702 million and raise an additional equity up to SAR 575 million consisting of 32.5 million units for the in-kind subscription and 25 million units for the cash subscription. As a result, the Fund size will increase by 64% to reach a total value of SAR 1.80 billion through in-kind subscriptions, cash subscriptions and additional shariah-compliant financing. The offering period will be for five working days, from 12 December 2021 to 16 December 2021. The proceeds from the additional capital raise will be used to acquire and settle the related transaction cost for the investment portfolio which consist of eight properties in the Education and Commercial sectors, located across Riyadh and Dammam (or “the Portfolio”). The Portfolio is owned by SEDCO Capital Real Estate Income Fund II – a private closed-ended Shariah-compliant investment fund – which is managed by SEDCO Capital. The below table shows the details of the Portfolio:

The Portfolio is expected to generate gross rental income of SAR 49.4 million per annum, which translates to a rental yield of 7.5%. The net targeted return post increase in total asset value is expected to exceed 7.0%.

The price of the additional offering will be SAR 10 per unit. The unit’s allocation will be in accordance with the allocation mechanism mentioned in the supplementary appendix of the Fund’s Terms and Conditions – in which there will be a priority allocation to the unitholders registered on the day of the general assembly meeting.

Samer Abu Aker, CEO of SEDCO Capital, said: “The additional offering of the SEDCO Capital REIT Fund reflects our belief in the Education and Commercial sectors of Saudi Arabia, the success-to-date of the Fund, and the Fund’s strategy of building and managing a well-diversified portfolio of prime real estate assets to enhance returns to investors. We believe that the Portfolio is well-positioned to benefit from the overall growth of the Saudi real estate industry, driven mainly by the Kingdom’s youthful demographics, increased demand for higher-quality education, and supportive government initiatives for economic transformation.”

Launched in 2018, the SEDCO Capital REIT Fund is a closed-ended, Shariah-compliant real estate investment traded fund (REIT), which aims to achieve periodic cash distribution for investors by investing in high quality income-generating real estate assets across various sectors, including Hospitality, Commercial, Office, Residential and Education – to name a few. Investments a mainly focused in the main Saudi cities of Jeddah, Riyadh, and Dammam.

-Ends-

About SEDCO Capital

SEDCO Capital is a global, Shariah-compliant, and ethically led asset management and investment advisory firm. Our investment philosophy is underpinned by three Ps: principles, partnership, and performance. We provide clients with investment solutions through a dynamic asset allocation process across diversified asset classes that deliver strong risk-adjusted returns. By adopting a global view to investing while looking through the lens of our proprietary Prudent Ethical Investment (PEI) approach, an integration of Shariah-compliant and Responsible Investment principles, we provide our clients with unparalleled global access to investments across developed and emerging markets, including Saudi Arabia, in alignment with their investment objectives. In 2014 we proudly became the first Saudi company and the world’s first Shariah-compliant asset manager to become signatory to the UN Principles of Responsible Investment (UNPRI) and we continue to be recognized for our commitment to responsible investments. SEDCO Capital oversees more than $5 billion in total assets under management (AUM) and is headquartered in Jeddah with offices in Riyadh, Dubai, London, and Luxembourg.

Find out more at www.sedcocapital.com.

Press Contacts:

SEDCO Capital

Maha Abul-Ola

Phone: +966 126906864

Email: mahaa@sedcocapital.com

Brunswick Group

Jamil Fahmy & Radwa El Taweel

Email: sedcocapital@brunswickgroup.com

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.