PHOTO

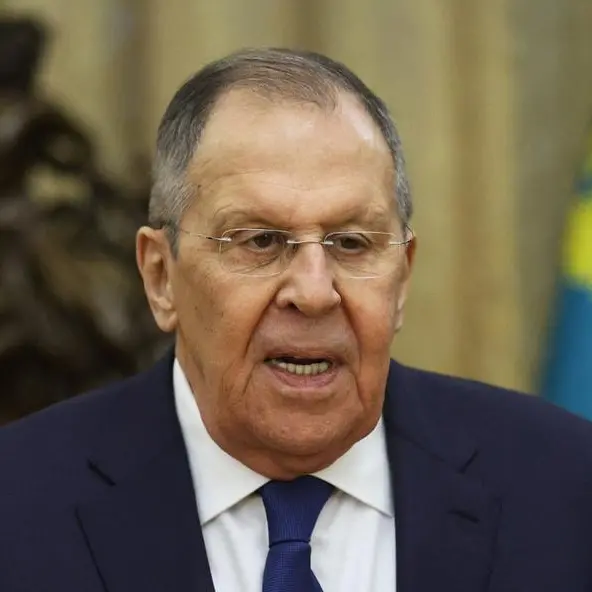

Russia's central bank on Friday held interest rates unchanged after President Vladimir Putin cautioned against cutting borrowing costs prematurely.

Moscow last year hiked its key interest rate to 16 percent to combat a surge in inflation, as the Russian currency wobbled under the pressure of Western sanctions.

The central bank said on Friday it was still too early to start cutting rates, with inflation currently running at an annual rate of 7.8 percent, above the official 4.0-percent target.

"Inflationary pressures are gradually easing but remain high," it said.

"Inflation will return to the target somewhat more slowly" than it expected in February, it continued, adding that higher rates would also be required for a longer time.

Speaking to business leaders on Thursday, Putin had stressed the need to be "careful" over when to start cutting rates.

"The threat of inflation, as the leaders of the central bank say, still hangs over us," the Kremlin leader told a business forum.

Russia has defied initial expectations of economic collapse amid its military offensive in Ukraine.

Earlier this month, the International Monetary Fund (IMF) upgraded its forecast for Russia's economic growth in 2024 to 3.2 percent.

A surge in defence spending and redirecting energy exports to the likes of China and India have protected the economy but pushed up prices at home.

Putin pointed to the example of Turkey -- which has hiked rates to 50 percent to battle a crippling inflation crisis -- as a cautionary tale.

"If we go the other way, we may have a situation like that in some neighbouring countries, where inflation is double digit... They have crossed some kind of threshold and now cannot deal with it," he told the forum.

Central bank Governor Elvira Nabiullina, a key economic ally of Putin, has been credited with keeping the Russian economy on track through emergency rate hikes and capital controls despite an onslaught of Western sanctions.