PHOTO

The final proof, for anybody still requiring it, that financial markets are totally divorced from the everyday world most people inhabit has come in the past week. Call it the Insurrection Boom.

As rioters stormed the Capitol in Washington DC last week, the S&P 500 Index down the road in New York hit new highs. The old market adage “buy on the sound of gunfire” never seemed more appropriate.

Since then, the stock market rally has accelerated. The S&P seems to have taken 3,800 points as its new normal, and looks to be powering on toward a historic breach of the 4,000-point level.

But against the background of the past year, maybe the equities markets’ behavior is not that shocking. Apart from a month-long bear market in February and March last year, when Wall Street dropped around 30 percent on the first impact of the pandemic lockdowns, stock markets have taken the subsequent year of economic recession and human casualty in their stride.

Around the turn of the new year, there was a clamor of voices among equity experts that it could not go on. Some warned of an “epic bubble” in stock markets that was bound to pop in 2021.

Others warned of “frenzied issuance and hysterical speculative investors” amid “frothy prices and greedy positioning” in global stocks.

Two indicators of this market mania have been consistently cited: Bitcoin and Tesla. The cryptocurrency soared to above $40,000 a piece, with the price starting to look a bit like the graphic for COVID-19 cases for some European countries — vertiginously vertical.

Tesla, meanwhile, completed a 10-fold increase in share price since the beginning of 2020, and made Elon Musk the richest man in the world. Its market value is now more than Ford, GM, BMW, Mercedes and Toyota combined, despite making just a miniscule fraction of the number of cars, and profits, those traditional companies do.

Will it all end in market misery this year? Some analysts are calling the top now, but as they are largely the same people who called it virtually every week of the Lockdown Year of 2020, their warnings do not necessarily carry much weight.

There are plenty of external risk factors for sure, ranging from “American carnage” to new virus variants through to the complicated logistics of vaccinating more than 7 billion people.

But Wall Street appears to be taking these with a pinch of salt. More threatening for the equity traders is the possibility that the US Federal Reserve will call a halt to the pandemic stimulus packages that kept the S&P buoyant last year, or that rising inflation will impact government bonds and equities too.

The Democratic victory in the state of Georgia and control of the US Senate reduce that risk, with President-elect Joe Biden apparently capable now of putting in place his multitrillion-dollar stimulus and getting it through Congress.

On top of that relatively sanguine prospect for Western markets (led by the US), there is another global trend underway that could just mean the financial markets can maintain their high-wire act for another year.

Asia has, by all the evidence, handled the pandemic and the resulting economic recession much better than the West. China, in particular, has got the virus under control rapidly, and injected trillions of yuan into its economy to stave off the downturn.

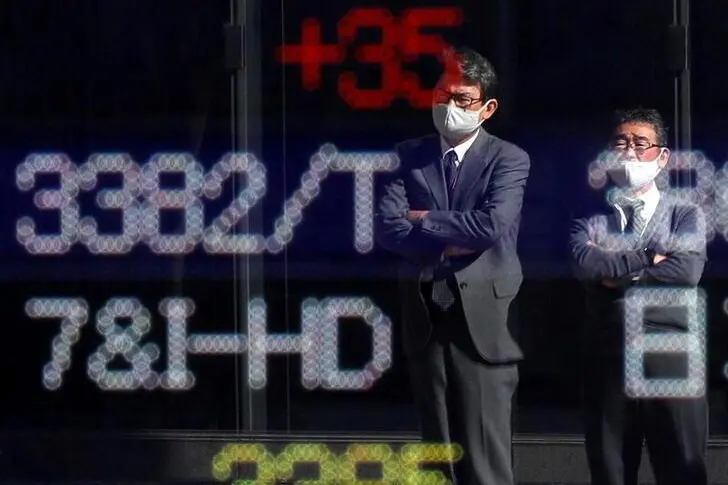

The result has been a resurgence in Asian stock markets, with even Japan back to levels last seen 30 years ago. Global investment is heading eastward at an accelerating rate, and the Middle East could be well positioned to benefit from the rising emerging market tide.

Maybe the big crash foretold for 2020 will take place this year. What goes up must go down, of course. But there are just as many reasons why the bubble can continue inflating for a good while longer.

- Frank Kane is an award-winning business journalist based in Dubai. Twitter: @frankkanedubai

Copyright: Arab News © 2021 All rights reserved. Provided by SyndiGate Media Inc. (Syndigate.info).