PHOTO

Investment in solar energy projects in the Gulf Cooperation Council will "continue to increase quickly" over the next decade as governments look to invest even more in renewables to diversify energy sources, according to a new report from ratings agency S&P.

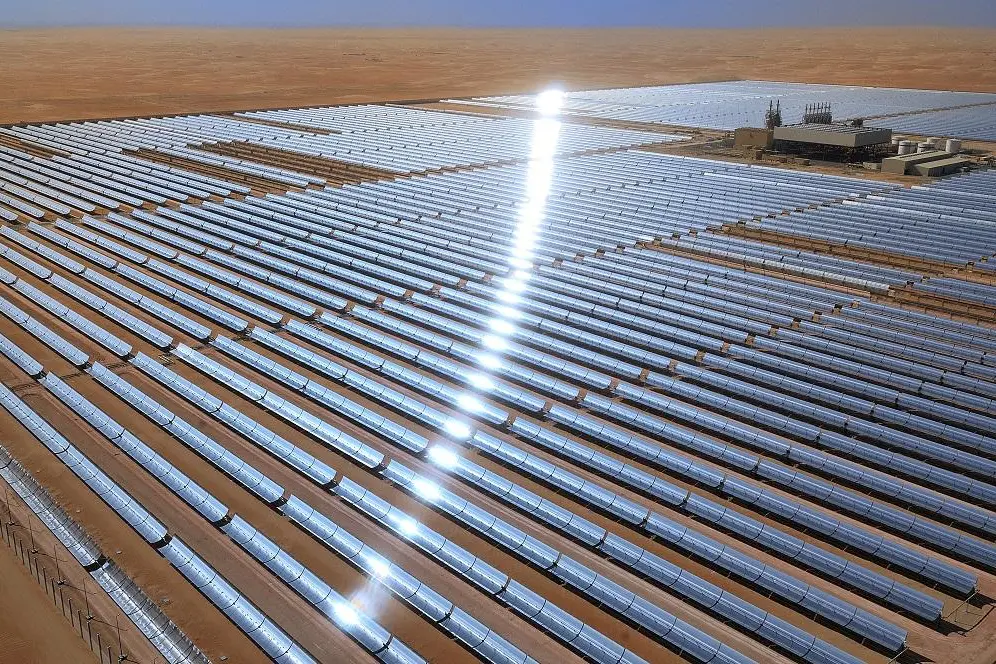

In a paper published on Monday, S&P said that renewables "represent a major opportunity" for GCC firms, given the amount of sunlight that most of the countries enjoy and the availability of reasonably cheap land.

Citing a recent paper by the Abu Dhabi-based International Renewable Energy Agency (IRENA), it said that close to 60 percent of the GCC's land surface area is suitable for solar photovoltaic (PV) power projects, and that if only 1 percent of this land were used it would have the capacity to generate almost 470 GW of additional power, compared to the region's current power generation capacity of 151GW.

Moreover, it said that, in other parts of the world, the land required for solar farms represents a big opportunity cost, but given the amount of barren land available in the GCC, most notably in the United Arab Emirates and Saudi Arabia, this cost is much lower locally.

If GCC nations meet their solar generation targets, it could lead to about 2.5 billion barrels of oil per year no longer being consumed for power use. This could then be diverted for higher-value use such as petrochemicals industries.

The report discussed current projects, including the four phases (two complete, two still under development) of the Mohammed Bin Rashid Solar Park project in Dubai, the 1,177MW Sweihan solar project in Abu Dhabi and Saudi Arabia's proposal to develop the biggest solar project in the world - a 200,000MW, $200 billion solar park that will be built in partnership with Japan's Softbank Group. This is on top of the $300 million, 300MW Sakaka solar project that the kingdom commissioned earlier this year, which is set to come into force next year.

It also pointed to efforts being made by other GCC nations to develop their own solar resources, including Oman's tender for a 500MW solar project that was announced in December 2017 and has yet to be awarded, and Bahrain's request for potential developers to produce concept designs for a new, $100 million solar park. Kuwait has also recently announced plans for a $1.2 billion, 1,000MW solar plant at Dibdibah, which is due to be tendered this year.

S&P's report states that given the scale of some of the projects announced and the levels of investment required, it is likely that capital markets will play a greater role in financing schemes.

"We have yet to see any major renewable projects funded by the capital markets, that is, by project bonds. This is because local and international banks remain very accommodative of large transactions, offering very attractive pricing levels and terms.

"However, looking at the size of more recently-announced projects, we believe the capital markets can play a more important role in funding some of these projects in the near future."

It said that this financing could be arranged either by refinancing some of the bank debt provided into project bonds, or by project developers tapping the market for green bonds, which has grown by 80 percent per year over the past five years.

In a separate paper published earlier this month, the Arab Petroleum Investments Corporation, APICORP, said that GCC states need to invest about $55 billion to create a further 43GW of both conventional and renewable power generating capacity over the next five years, and a further $108 billion on power transmission and distribution.

Mustafa Ansari, a senior economist at APICORP, said: “The GCC governments will continue to cope well with rising demand, using price reforms as an effective tool. Renewable energy projects will also continue to be at the forefront of long-term government plans to diversify generation capacity.”

(Writing by Michael Fahy; Editing by Shane McGinley)

Further reading:

- MENA solar power projects pipeline set to double in 2018

- Jordan on path to achieve 25 renewable energy contribution by 2021

- Abu Dhabi plans up to four new solar power plants

- Fuel for thought: Apicorp expects $919bln of MENA energy projects in five years

- WGES 2017: Region needs green bonds to fund renewable schemes, says bank project finance head

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018