PHOTO

TUNIS — The Islamic Development Bank (IDB) Group and the World Bank Group today jointly launched the second edition of the Global Report on Islamic Finance, which highlights the potential of Islamic finance in mobilizing resources to meet long-term financing needs for sustainable development.

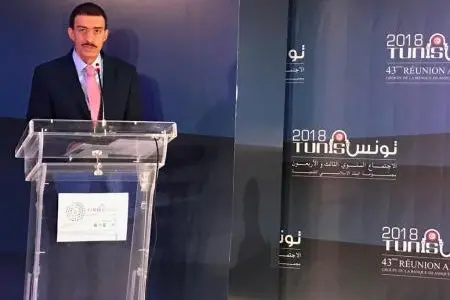

The report – entitled, “The Role of Islamic Finance in Financing Long-Term Investments” – was unveiled by IDB Group President Dr. Bandar Hajjar during the 13th IDB Global Forum on Islamic Finance, held on the sidelines of the 43rd Annual Meeting of the IDB Group in Tunis, Tunisia.

The report presents a global perspective on the need for long-term investments in the Sustainable Development Goals (SDGs), and proposes the use of Islamic finance, which is based on risk sharing rather than risk transfer, towards overcoming the challenge of underfunding.

In a speech during the launch of the report, Dr. Hajjar said Islamic finance has an important role in mobilizing resources for long-term investments to achieve sustainable development. “With adequate policy interventions, enabling financial infrastructure and diversity of innovative products, Islamic finance could become a catalyst for bridging the funding gap for long-term investments,” he added.

Resources mobilized by traditional development partners, including governments and multilateral development institutions, for long-term financing of development remain insufficient. Among the major reasons for this, according to the report, are the over-allocation of savings to short-term and medium-term instruments, excessive leveraging, and incentives for risk transfer.

The report finds that risk-sharing finance can play a key role in mobilizing funds to long-term investments, and provides examples of the ways that Islamic finance can be utilized to release the potential of long-term financing that advances social, environmental, and economic goals.

Despite the huge potential in Islamic finance, the report notes that the Islamic financial sector is a small player in the global financial markets and requires a concerted push for the regulatory and legal changes to take root.

It therefore recommends strengthening the Islamic financial system by developing a supportive legal, administrative, and regulatory environment, and enhancing the institutional framework and diversity of instruments for long-term financing.

The report makes recommendations to promote Islamic finance to make the provision of long-term financing more efficient, and also to encourage a global paradigm shift away from overreliance on short-term instruments toward making investments that add economic value.

The biennial Global Report on Islamic Finance is a joint initiative of the Islamic Research and Training Institute (IRTI) of the IDB Group and the World Bank. The first edition of the report was released in 2016.

Other recommendations in the new report include:

• Introduce a supportive legal, administrative, and regulatory infrastructure that establishes and protects investors’ rights, provides effective mechanism for dispute resolution, institutes a sound insolvency framework, and strengthens financial supervision for the efficient mobilization of resources on the basis of risk sharing.

• Adhere to strong corporate governance values that increase the accountability and transparency of the financial system.

• Enhance coordination among standard-setting bodies to provide unified shari’ah, regulatory, and accounting treatments.

• Develop secondary markets to provide liquidity in the markets for long-term financing instruments.

• Enhance the institutional framework and diversity of instruments for long-term financing

• Promote the development of capital markets for shari’ah-compliant instruments to mobilize resources for long-term projects by engaging institutional investors, including pension funds, sovereign wealth funds, asset management firms, venture capitalists, and private equity firms.

• Engage Islamic banks in shari’ah -compliant syndicated financing to finance long-term and larger projects.

• Introduce regulations to unlock the potential of Islamic banks to provide long-term financing using investment accounts.

• Provide incentives for Islamic financial innovation based on FinTech solutions, especially for mobilizing the Islamic social sector to support investments with environment and social as well as economic impacts.

• Capitalize on blended finance and public-private partnerships by developing new products and expanding existing ones to increase the use of Islamic finance for projects of mutual benefit to the public and private sectors.