DXB Entertainments PJSC (DFM:DXBE) announced today its audited financial results for the year ended 31 December 2017 showing continued progress against its strategic plan and improvement in visitation numbers, revenue and EBITDA loss.

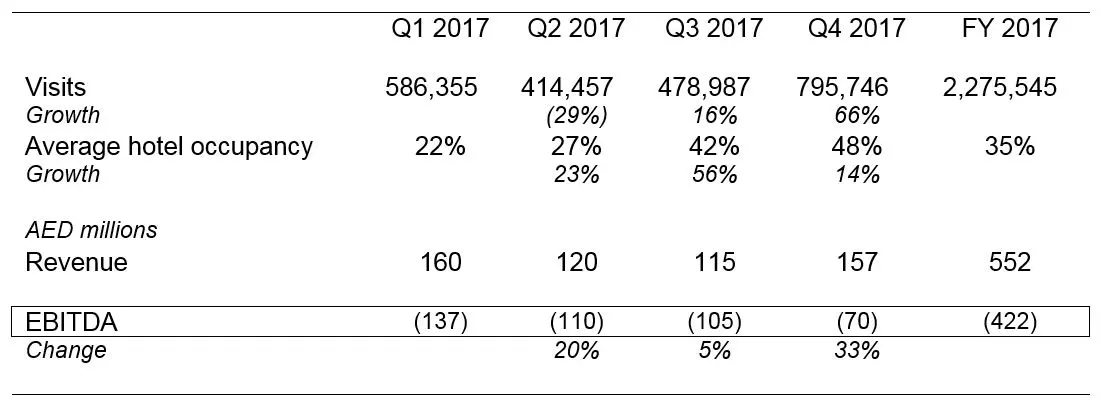

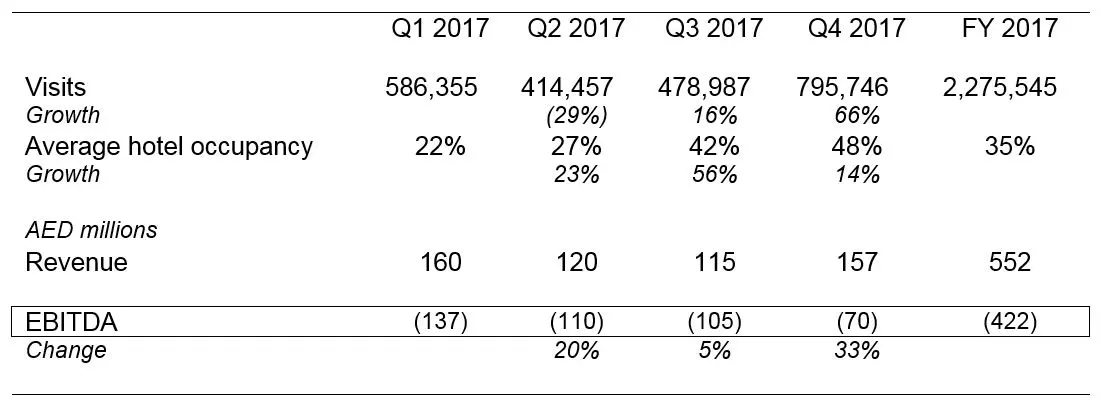

Financial Highlights (1 Jan 2017 – 31 Dec 2017)

Q4 2017 Highlights

- Q4 2017 visits reached 795,746, an increase of 66% compared to the third quarter. Total visits for the year approached 2.3 million.

- Q4 2017 revenue was AED 157 million, an increase of 37% compared to the third quarter. Revenue for 2017 was AED 552 million.

- Continued EBITDA loss improvement due to visitation and revenue growth and cost efficiencies. Q4 2017 EBITDA loss has improved by 33% compared to Q3 2017, and 49% since Q1 2017.

- Lapita™ Hotel occupancy increased during Q4 2017, averaging 48% for the quarter and reaching over 90% in the last week of December 2017.

- As a response to customer feedback, a new pricing strategy was introduced in September designed to increase visitation numbers, which resulted in marginally lower theme park revenue per capita of AED 138 in Q4 2017 (Q3 2017: AED 142)

- December delivered the highest daily visitation to date, with an average of over 20,000 visits in the last 10 days and peak daily visits approaching 27,000

Post period highlights:

- Agreement reached with financing partners of Phase I debt to realign key terms of the debt, including a 3-year moratorium on covenant testing and principal repayments.

- Board of Directors recommends entering into an AED 1.2 billion convertible instrument with the Company’s majority shareholder, Meraas, subject to regulatory and shareholder approval.

Mohamed Almulla, CEO and Managing Director, DXB Entertainments PJSC, said: “We have a great asset in the form of Dubai Parks and Resorts, which brings unparalleled entertainment and leisure activities to the region. In 2017 we focused on revising our pricing and marketing strategy to ensure we continue to drive footfall and are well positioned to generate long-term returns. Simultaneously, we optimised our cost structure and delivered operational synergies.

“During 2017 we announced an agreement with Meraas, our majority shareholder, to manage a select portfolio of their leisure and entertainment offerings which means we are now managing key Dubai leisure and entertainment assets under one group. This provides us with a diversified portfolio of leisure experiences that we can use for cross selling and marketing purposes in high footfall destinations within the city of Dubai such as City Walk and The Beach.

“We made good progress during the fourth quarter of the year against our strategic plan. The company increased visits by 66% in Q4 2017, compared to Q3 2017, bringing the total number of visits for the year to close to 2.3 million. Revenue for the fourth quarter of the year increased 37% to AED 157 million, compared to the previous quarter and reached a total of AED 552 million for the year. Our operating costs have been steadily decreasing each quarter from AED 284 million in Q1 2017 to AED 211 million in Q4 2017, and this is a testament to our commitment to generate value for our shareholders.

“The net loss for the year was AED 1,116 million. Part of the loss is due to AED 478 million in non-cash depreciation expense which is normal for a large-scale project of this nature. We also incur costs relating to the AED 4.2 billion debt we have taken on for constructing and delivering Phase I of Dubai Parks and Resorts. Therefore, to accurately measure the operational performance of the business we continue to focus on improving our operational EBITDA.

“I am pleased to report that EBITDA showed a steady improvement across the year, with an EBITDA loss of AED 422 million during 2017, a 33% improvement in the fourth quarter compared to the third quarter.

“It is clear from our results that the business is ramping up but that we still have some more work to do. In this regard we are very lucky to be based in the city of Dubai, with access to the most visited international airport in the world and support from our partners such as Emirates, flydubai and Jumeirah, as well as from Dubai’s Department of Tourism and Commerce Marketing authority.

“It is important to remember that our business is still in its infancy, having just completed the last rides and attractions at the end of last year. The staggered opening of the parks has had an impact on the target contribution of overseas visitors to our visitor mix, which has impacted revenue. Therefore, we believe that while we saw significant progress in the last quarter, our 2017 results are not indicative of our ability to drive future performance. 2018 will be the first year of full operations for the destination and should be the year we are judged on.”

Financial summary

For the year ended 31 December 2017, DXB Entertainments reported total revenues of AED 552 million. Q4 2017 revenue increased 37% to AED 157 million, compared to the previous quarter, of which AED 110 million was generated through the theme parks, AED 15 million through retail and AED 25 million through hospitality.

Within the theme parks, 59% of revenue in Q4 was driven through admissions and 30% through in-park spend, reflecting a lower admissions’ yield due to the revised pricing strategy as well as higher annual pass and Lapita™ Hotel visits.

Retail revenue was up 38% for the fourth quarter to AED 15 million, which reflects the ramp up in Riverland™ Dubai leasing revenue which was lower during the peak summer months as result of rent relief offered to tenants.

Lapita™ Hotel revenue increased by 67% to AED 25 million in Q4 2017, compared to Q3 2017. Average occupancy was 48% and the average daily rate was AED 831 for the fourth quarter of 2017.

Operating expenses have been successfully reduced over the year and totalled AED 932 million, of which employee expenses account for over 40%. EBITDA loss for the year was AED 422 million with EBITDA losses decreasing to AED 70 million in the fourth quarter. Adjusted EBITDA loss for the year was AED 342 million, which excludes AED 80.6 million in pre-operating and non-recurring expenses.

Operational highlights

Q4 2017 marked the completion of all rides and attractions at Dubai Parks and Resorts, with “The Hunger Games” rides in the LIONSGATE zone, at MOTIONGATE™ Dubai officially inaugurated on 20 October 2017.

Total visits during the year approached 2.3 million, with the fourth quarter delivering close to 796 thousand visits, an increase of 66% compared to the third quarter. December 2017 was a record month, clearly demonstrating the new strategy is working, and delivered the highest daily visitation to date, with an average of over 20,000 visits in the last 10 days and peak daily visits approaching 27,000.

Of the 795,746 visits to the parks during the quarter, 37% were multi-park tickets, 31% were single park tickets and 25% were annual pass visits, demonstrating the increased sales of the annual passes during the last quarter of the year. Tour and travel contributed 19% of the visits in fourth quarter and 17% in total for 2017.

Riverland™ Dubai continues to focus on driving footfall through regular events “on the River” to position Dubai Parks and Resorts as top of mind in the resident market.

Construction on Six Flags Dubai, Dubai Parks and Resorts’ fifth theme park, and the region’s first LEGOLAND® Hotel is progressing according to plan, both due to open in 2019.

Strong financial support

Post-period, DXB Entertainments announced the successful realignment of its AED 4.2 billion debt facility which has been drawn down for Phase I of Dubai Parks and Resorts. DXB Entertainments has agreed with its financing partners a three-year moratorium on principal repayments and covenant testing as well as a revised repayment schedule aligned to the Groups’ strategic plan. The Company will continue paying interest on the debt as per the original agreement.

Following approval from the General Assembly on 28 November 2017, DXB Entertainments has agreed a AED 700 million subordinated shareholder loan with its majority shareholder Meraas. Subsequent to the year end, and to meet working capital requirements, routine capital expenditure and debt servicing through to cash flow breakeven, the Board of Directors of the Company has proposed to enter into an agreement with Meraas to provide total financing of AED 1.2 billion in the form of a convertible instrument, subject to regulatory and shareholder approvals. The existing AED 700 million subordinated facility will be rolled forward into the convertible. This will be presented to shareholders at the General Assembly on 25 April 2018.

With the strong support received from the Company’s financing partners as well as its majority shareholder, Meraas, the Company is now well positioned to deliver on its target of cash flow breakeven.

Outlook

Mohamed Almulla, CEO and Managing Director, DXB Entertainments PJSC, said: “We will continue to work to increase visitor numbers to our destination, with a focus on increasing the overseas visitor segment especially from India, the UK, China and Russia, where we have dedicated sales people on the ground as well as partnerships with the key tour and travel agencies.”

“With our debt realigned, and the proposed increase in financial support from our majority shareholder we are a fully funded business. The promising trends seen at the end of 2017 make us optimistic about our strategy to continue to drive footfall to Dubai Parks and Resorts. We expect further growth in 2019 as we open the region’s first LEGOLAND® Hotel and Six Flags theme park. These two new additions will further enhance customer experience and help strengthen DXB Entertainments’ long-term strategy, while also capitalising on the influx of tourists expected for Dubai EXPO 2020.”

For further information, please contact:

Marwa Gouda, Head of Investor Relations, DXB Entertainments PJSC

+97148200820

IR@dxbentertainments.com

Jon Earl, Managing Director, FTI Consulting

+97144372104

jon.earl@fticonsulting.com

Anca Cighi, Director, FTI Consulting

+97144372111

anca.cighi@fticonsulting.com

DXB Entertainments PJSC

DXB Entertainments PJSC (previously Dubai Parks and Resorts PJSC) is a Dubai-based operator of leisure and entertainment destinations and experiences. The Company is traded on the Dubai Financial Market (DFM) under the trading symbol DXBE. We bring together a diverse portfolio of world-class brands to offer entertainment in the areas of theme parks, family entertainment centres and retail and hospitality.

DXB Entertainments is the owner of Dubai Parks and Resorts, the region’s largest integrated theme park destination, with five Theme Parks (Six Flags Dubai under development), two Hotels (LEGOLAND® Hotel under development), and one retail and dining facility all spread over 30.6 million sq.ft of land, with an estimated AED 13.2 billion in development costs.

DXB Entertainments also manages six Dubai-based mid-way attractions in addition to a chain of cinemas, all owned by Meraas.

With a diverse portfolio of 16 leisure and entertainment assets, DXB Entertainments is the largest leisure and entertainment company in the region.

For more information, go to: www.dxbentertainments.com

© Press Release 2018