PHOTO

The funds market in the Middle East and North Africa has been through turbulent times since the financial crisis, but there are still more than than 1,000 funds domiciled in regional markets, with just over 375 of these housed in the GCC, and 266 of these in Saudi Arabia, according to Eikon data.

Although this still makes the region a relative minnow globally, with the European Fund and Asset Management Association counting 131,994 funds globally at the end of 2018 (of which over 58,000 were domiciled in Europe, 37,551 in the Americas and 34,342 in the Asia-Pacific region), the MENA region is one where concerted efforts are being made to grow a funds industry in various territories as part of wider capital market reforms in the region as governments look to diversify away from oil revenues.

Speaking at a recent event organised by funds administrator Ocorian looking at the funds ecosystem in the Dubai International Financial Centre, Philip Dowsett, a partner at law firm Morgan, Lewis said that there was “a real mix” of fund types being established, with many being created with a view to attracting investors from the GCC.

“We’re seeing a lot of money on real estate going into India – we’ve worked on a number of funds for Indian real estate investment - and Middle East real estate investment as well. Venture capital is such an area of growth here. Everyone wants to invest in tech and in the emerging business side of things,” he said.

However, when it comes to the more traditional funds investing in MENA equities, these have witnessed an outflow of investor capital for several years, according to Jean-Paul Pigat of Lighthouse Research. Citing Lipper funds data, Pigat said that $75 million worth of funds had flowed out of MENA-focussed funds during the first two months of this year, compared with inflows of $80 million in the same period last year.

The first half of 2018, when there were net inflows of $127 million into MENA-focussed equity funds, proved the exception rather than the rule. In the second half of the year, the same funds witnessed outflows of $284 million.

“It’s been a long-term trend of outflows for several years,” Pigat said in a phone interview.

There are a number of reasons for this. The oil price shock, which hit most Gulf countries in 2014-15 led to a slowdown in spending and generally worsening economic prospects.

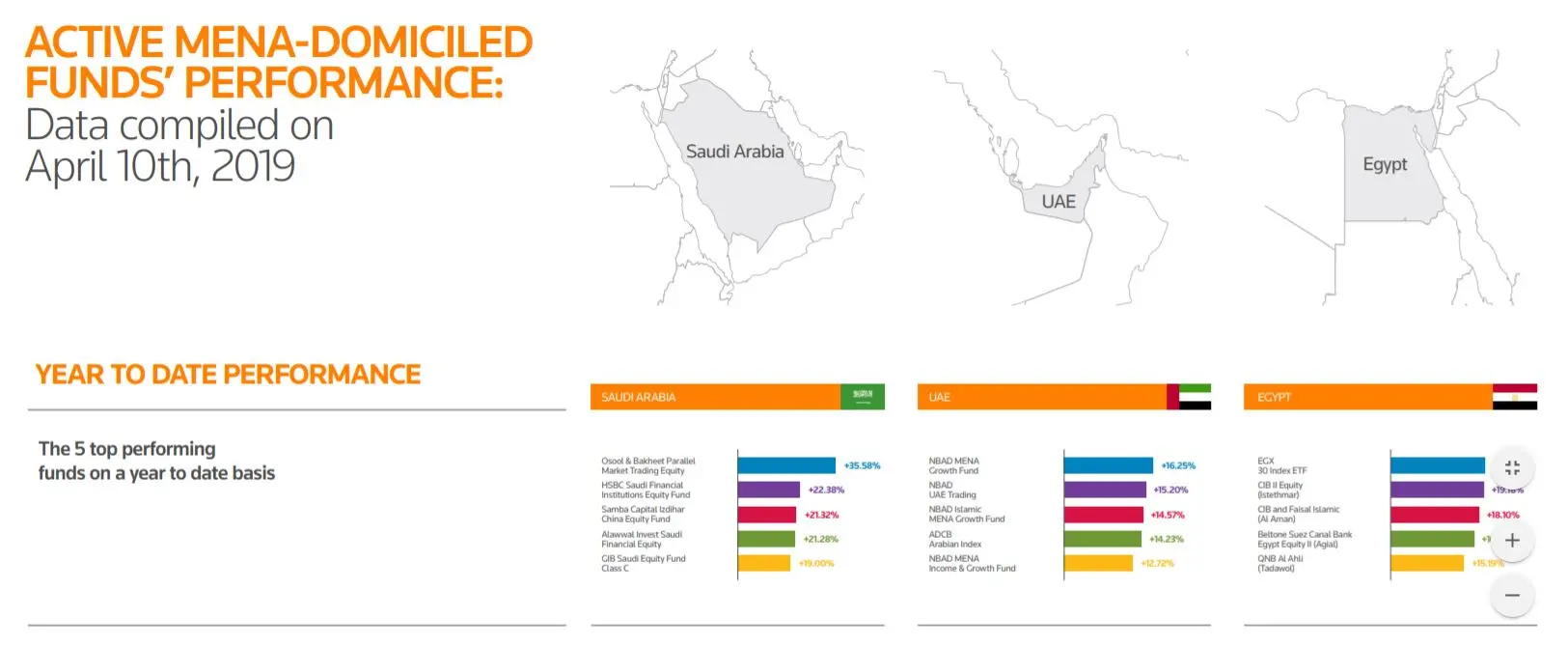

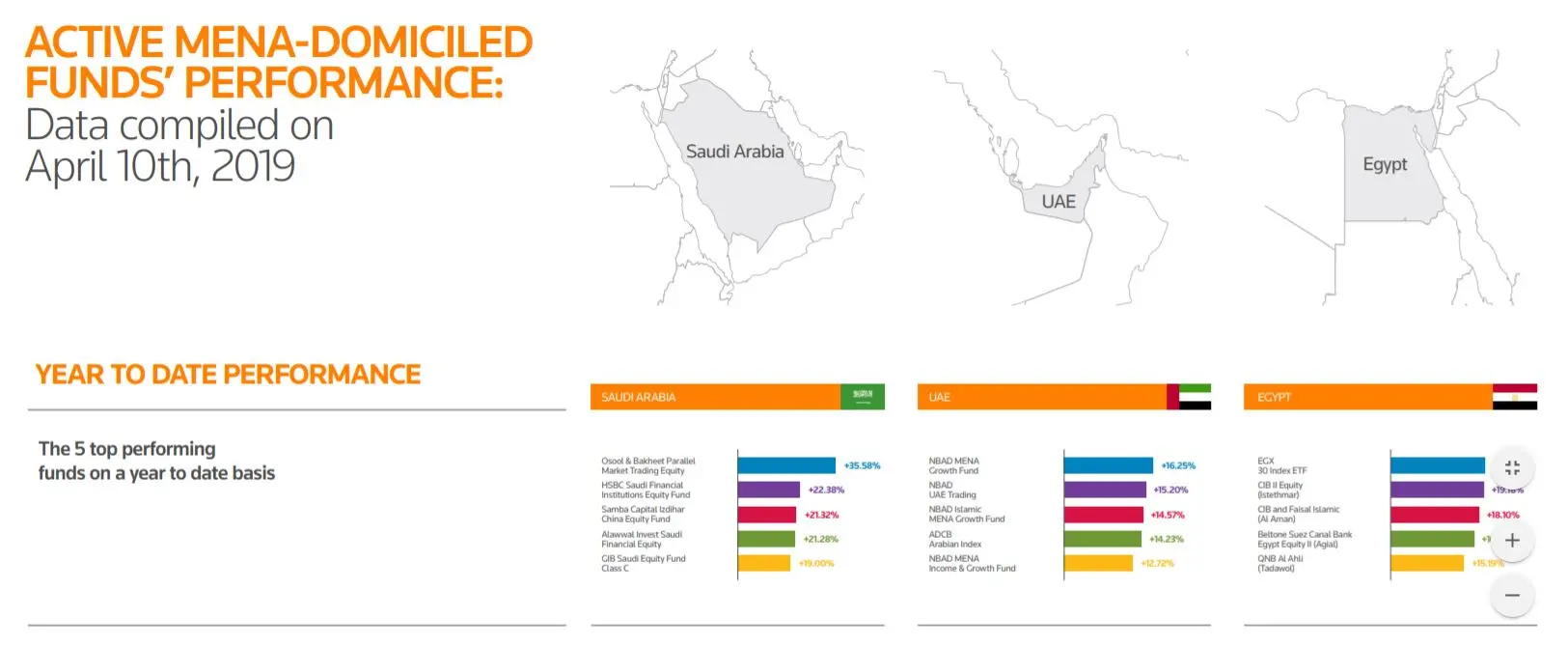

Zawya’s Infograph using Eikon data showing year-to-date and five-year MENA funds performance shows that over the longer period, the worst-performing funds in Saudi Arabia were generally linked to the construction and real estate markets, which is understandable given the turmoil that was caused in the kingdom’s construction market when the government temporarily halted payments to contractors in 2015.

Click on the image above to open a high-resolution PDF version in a new tab.

Even for the year-to-date, all of the worst-performing funds in the kingdom are real estate-linked, although these are mainly the Real Estate Investment Trusts(REITs), which were in vogue 12-18 months ago when several local asset managers launched IPOs targeting retail investors seeking real estate income.

While the Saudi stock exchange index was up 18.5 percent for the year at the end of April, Raya Majdalani, research manager at Knight Frank Middle East, pointed out that an index of listed Saudi REITs is basically flat at -0.2 percent .

“This can be attributable to a variety of factors including: softening performance of the underlying asset class (real estate) and investors’ increased focus on the underlying fundamentals of the REITs,” she told Zawya via email.

Majdalani added that investors were now assessing REITs more closely, looking at the individual merits of each one, including the tenant mix, asset quality, the management and financial performance.

“The market performance of REITs on the Tadawul seems to have stabilised in 2019, following a phase of steep correction in valuations,” Majdalani said, adding that in early March Saudi REITs were, on average, trading at a 16 percent discount to net asset values.

Macroeconomics has also played a significant part in the five-year performance of Egyptian funds, with only two posting positive returns and the worst performers displaying declines of more than 60 percent.

Although this sounds poor, fund performance is calculated in U.S. dollars as we are comparing cross-border performance, and the devaluation of Egypt’s pound which took place when the currency was freely floated on the open market in 2016 has knocked around 59 percent off the value of its currency in the same period.

In the UAE, most of the worst-performing funds on a five-year basis have mainly been UAE or MENA equity market funds, although ironically these are among the best-performing funds for the year-to-date both in Saudi Arabia and the UAE, as most MENA markets have posted strong gains this year. Alongside Saudi Arabia’s 18 percent increase, Egypt’s EGX30 is up by around 14.5 percent, and the Dubai Financial Market is up by around 9.4 percent.

As a result, Pigat said that the investor outflows that have beset MENA-focussed funds in recent years could also soon hit a turning point.

“The economic slowdown looks like it might slowly start to reverse, you have the Saudi index inclusion story (and) there’s a lot more foreign investors coming in as well,” he said.

(Reporting by Michael Fahy, additional reporting by Gerard Aoun; Editing by Mily Chakrabarty)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019