PHOTO

It's a rough ride for the Gulf states. The pandemic is cratering businesses and people are losing their jobs, creating the need for short-term liquidity. The Central Banks are rolling out one relief measure after another to mitigate the damage, but how will these easing measures trigger inflationary pressures in the GCC?

According to Dr. John Greenwood, Chief Economist at global asset management firm Invesco such liquidity injections, however, do not have an automatic inflationary effect.

"The driver of inflation is money in the hands of the public, not money in the books of the central bank," he said.

Actions of the central banks during the global financial crisis only stabilised broad money growth, with subsequent inflation remaining below 2 percent year-on-year in most developed economies.

“Historically when central banks have played this ‘lender of last resort’ role in a market panic, they were able to create the additional funds needed to calm the panic, and after the panic had subsided, they would gradually withdraw the excess cash or deposits from the banking system,” Greenwood explained.

Excess funds were gradually drained from the banking system after the panic subsided and before inflation could take hold.

Inflation Vs GCC

The plunge in oil prices along with fallouts in the various industries that drive GCC economies will likely result in disinflation for most of 2020 and 2021.

"For the Gulf states the steep fall in the price of oil and the collapse of tourism and international business travel inevitably mean that disinflation or even deflation will likely prevail in the short-term," Greenwood told Zawya.

On inflation, countries with fixed exchange rates tend to have a broadly similar profile of inflation to those whose currencies they are pegged to.

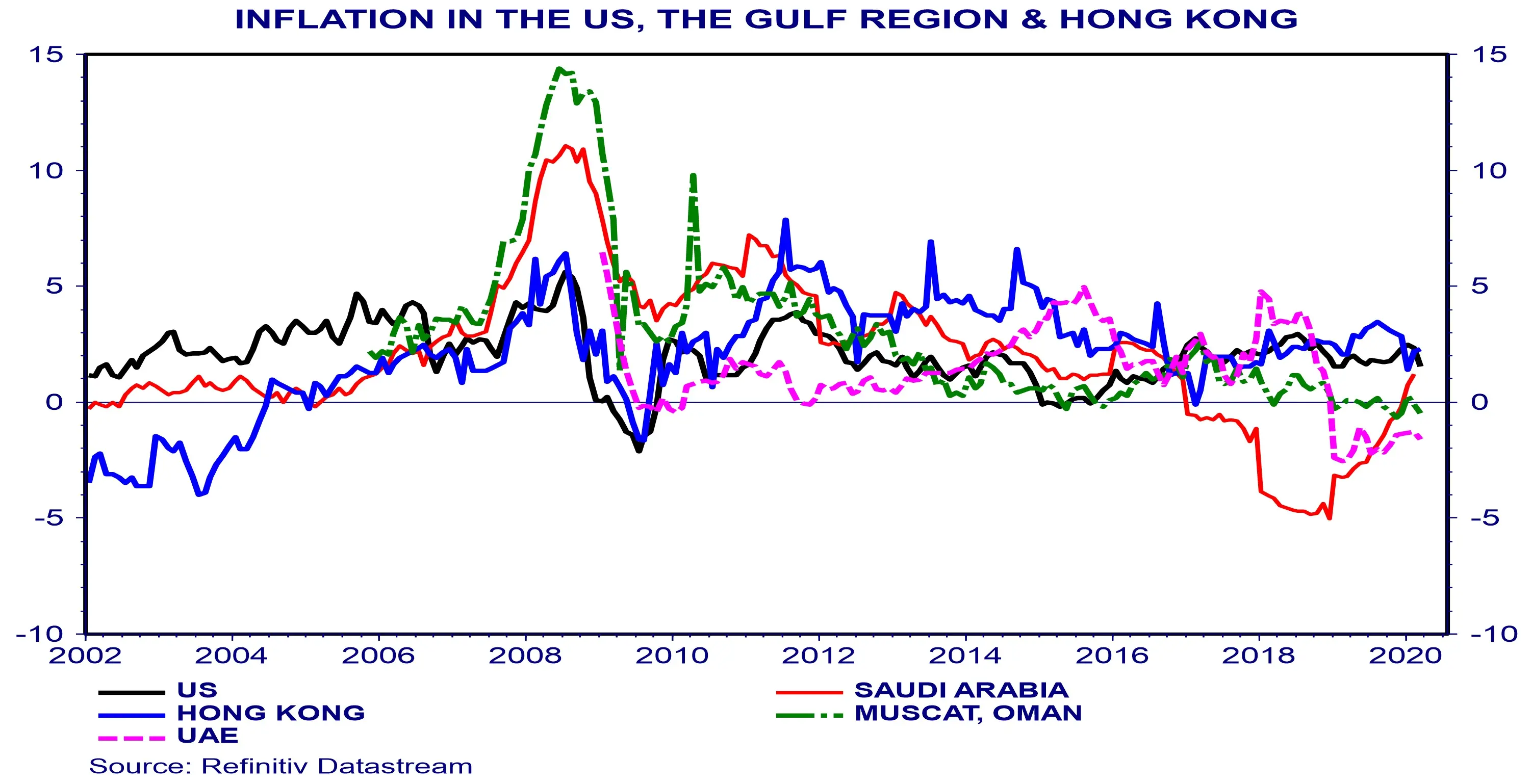

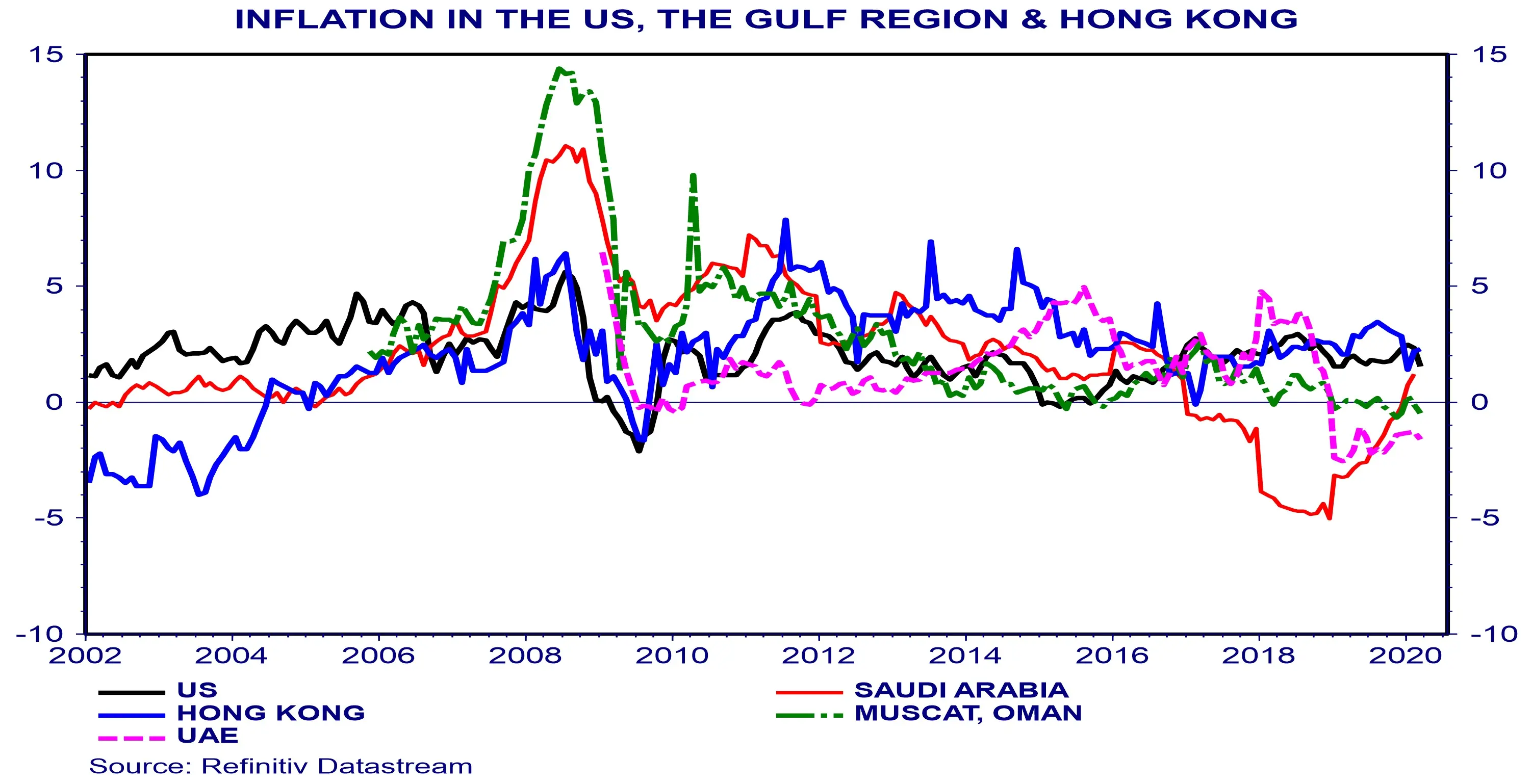

Inflation in the US, Gulf region, Hong Kong. Source: Refinitiv Datastream

Thus, in the attached chart, the general profile of inflation in those Gulf states pegged to the US dollar (Saudi, Muscat & UAE) follows inflation in the US in broad outline.

"However, there are some significant deviations due to administered price changes (e.g. for petrol or utilities) in individual countries from time to time. It is also true that the composition of the price indices varies from country to country, again introducing some degree of divergence," Greenwood said.

Separately, "expansionary monetary policies" only lead to inflation if the policy results in rapid growth of the broad quantity of money (e.g. M2 or M3). Lowering interest rates to zero alone does not guarantee rapid growth of money.

According to Greenwood, expanding the Fed's balance sheet does not guarantee rapid growth of M2 or M3, and therefore may not result in inflation. “This is what happened with quantitative easing in 2009-2019 after the great financial crisis. As a result, US inflation over that period remained below the 2 percent target most of the time,” he said.

(Reporting by Seban Scaria seban.scaria@refinitiv.com , editing by Daniel Luiz)

#GCC #Economy #Inflation #COVID-19 #Invesco

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020