Oil prices

Oil prices edged up early on Thursday, with Brent crude nearing $80 a barrel on strong demand and as ongoing production cuts led by OPEC boosted prices.

Brent crude futures were at $79.32 per barrel at 0027 GMT, up 4 cents from their last close.

United States West Texas Intermediate (WTI) crude futures were at $71.68 a barrel, up 19 cents, or 0.3 percent, from their last settlement.

U.S. crude inventories dropped by 1.4 million barrels in the week to May 11, to 432.34 million barrels.

U.S. bank Morgan Stanley said it had raised its Brent price forecast to $90 per barrel by 2020, due to a steady increase in demand, according to a Reuters report.

The International Energy Agency (IEA) said on Wednesday that it had lowered its global oil demand growth forecast for 2018 from 1.5 million barrels per day (bpd) to 1.4 million bpd.

The IEA said global oil demand would average 99.2 million bpd in 2018.

Global markets

Asian shares firmed on Thursday, tracking a rise in U.S. shares overnight, as retail and technology shares led gains on Wall Street.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.1 percent, while Japan’s Nikkei gained 0.7 percent.

“In general, Asian equities are buffered from rising U.S. yields by the constructive tone of the U.S.-China trade talks as well as strong earnings numbers,” Heng Koon How, head of markets strategy for UOB in Singapore, told Reuters.

The U.S. and China start trade talks start later in the day.

Middle East markets

Most Middle East markets dropped on Wednesday as geopolitical tensions weighed on markets.

Saudi Arabia’s index lost 1 percent with Saudi Basic Industries Corporation (SABIC) dropping 1 percent.

Saudi British Bank (SABB) and Alawwal Bank agreed on a merger that, once completed, will create the country’s third-largest bank, with assets of around $77 billion.

Shares in Alawwal jumped 10 percent to 13.92 riyals in its heaviest trade since April 2017, while SABB shares sank 4.5 percent.

"Over the last 12 months we have seen a wave of consolidation announcements across the GCC banking sector, as the industry struggles to identify areas of growth following reduced economic activity due to lower oil prices," Salman Bajwa, senior executive officer at Emirates NBD Asset Management, told Reuters.

"In most M&A exercises, the smaller parties tend to benefit from being paid premiums by the bigger partners or acquirers. That is certainly true in this case," Bajwa said.

In Dubai the index slipped 0.2 percent as Dubai Islamic Bank dropped 1 percent to 4.83 dirhams ($1.32). Trading of the bank’s rights issue began on Wednesday, allowing the purchase of the stock at 3.11 dirhams; the rights plunged 11.0 percent to 1.62 dirhams.

In Abu Dhabi, where the index edged down 0.1 percent, Dana Gas rose 1 percent after saying it received a dividend payment of $22.8 million from Pearl Petroleum Co, which produces natural gas in Iraqi Kurdistan.

Egypt’s index was flat, Qatar's index rose 0.3 percent, Oman’s index lost 0.7 percent, while Kuwait edged down 0.1 percent and Bahrain dropped 0.1 percent.

Currencies

The dollar index against a basket of major currencies dropped 0.2 percent to 93.187 early on Thursday after touching a five-month high of 93.632 on Wednesday.

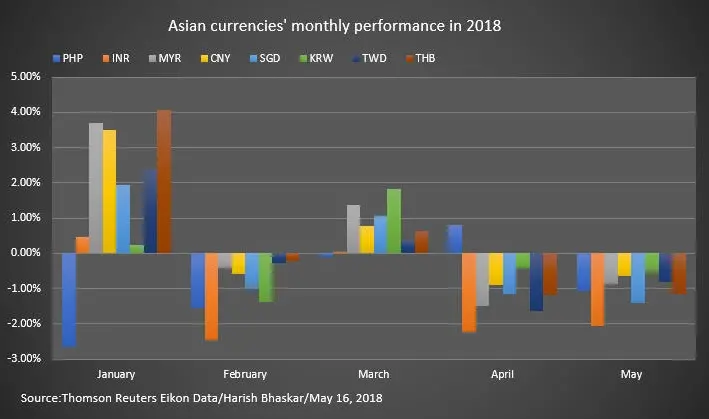

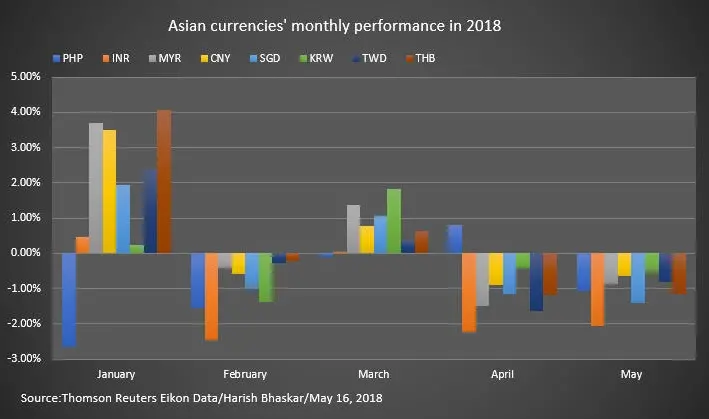

Commentary: Asian currencies have fallen sharply in April and May on rising foreign outflows from Asia.

Please click here to gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Precious metals

Gold prices edged higher on Thursday as the dollar marginally retreated.

Spot gold had risen 0.25 percent to $1,293.43 per ounce by 0255 GMT, after touching its lowest level since December 27 in the previous session at $1,286.20.

(Writing Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

For access to market moving insight, subscribe to the Trading Middle East newsletter by clicking here.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018