PHOTO

According to the latest Macro report from CréditAgricole Private Banking

• UAE new orders grow, and job creation hit three-month high in May'15

• Saudi Arabia's output and new orders expanded, but the growth rate eased

• GCC consumers to benefit from the recent softening of world food prices, but is subject to risks associated with any El Niño occurrence

Dubai -The latest CréditAgricole Private Banking research report, 'Macro Comment - MENA Update', noted that the UAE and Saudi Arabia continues to witness growth despite lower oil prices. The UAE even recorded high levels of job creation during this period.

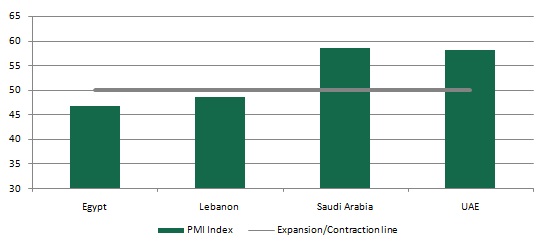

"Interestingly in the UAE, once again new orders and new export orders components reflected strong growth, while job creation hit a three-month high. This is reflected in the UAE's non-oil private sector PMI which did not decline significantly in May (56.4) compared to 56.8 in April. On the other hand, input costs rose contrasting with a slight decline of the output prices charged by companies.

In this background, it is too early to infer from this latest change that a downward trend in the CPI indices has started. We can see that the UAE's CPI was +4.2% year-on-year in April, which is the same as in Dubai where inflation can be an issue. Nevertheless, we can say that the UAE is yet to fully feel the pinch of the lower oil price across its relatively diversified economy in comparison to GCC peers", saidDr. Paul Wetterwald, Chief Economist, CréditAgricole Private Banking.

PMI Indices May 2015

Source: Markit, CréditAgricole Private Banking

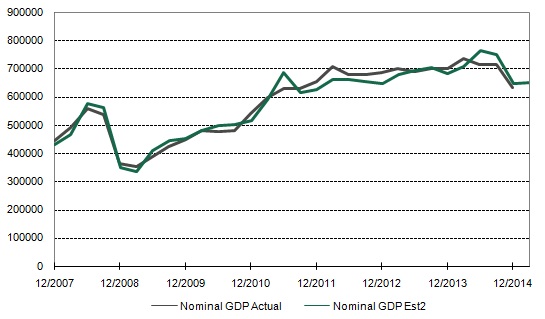

Dr. Paul Wetterwald continued, "Similarly in Saudi Arabia, output and new orders expanded but the rate of growth and pace of job creation eased somewhat during the month. It was interesting to note that the Kingdom's headline PMI last month (57.0) was at its lowest level since May 2014. Whilst the most recent data in the PMI series still depicts a growing non-oil private sector economy, our estimate of growth in Saudi Arabia is more conservative.

For example, based inter alia on the latest Saudi Arabia Monetary Authority statistics, we get a Q1 2015 nominal GDP growth estimate which is only slightly positive as illustrated in the graph below."

Saudi Arabia Quarterly Nominal GDP Actual vs. Estimate (SAR millions)

Source: SAMA, Crédit Agricole Private Banking

Dr. Paul Wetterwald concluded,"In regards to food inflation, the recent softening of world food prices should bring significant benefits to GCC consumers. This is indicated by the FAO food price index in May 2015, which was down 20.7% year-over-year and 1.4% month-on-month. Given the large weightage on food items in consumers' baskets, this lower food price scenario will be positive for consumers in the GCC countries where most of the food requirements are imported from other places.

This situation will prevail provided no strong El Niño episode occurs. El Niño is a natural phenomenon which is a key factor worldwide for the agricultural sector, as it contributes to extreme weather. A strong El Niño would put the crops of some agricultural commodities at risk, leading to higher food prices during and after its occurrence."

-Ends-

About CréditAgricole Private Banking

Crédit Agricole Private Banking comprises all of the Crédit Agricole Group subsidiaries specialised in wealth management. Backed by the financial strength of the Crédit Agricole Group, Crédit Agricole Private Banking has operations in all the major international financial markets:

- Europe: France, Belgium, Spain, Italy, Luxembourg, Monaco and Switzerland

- Asia: Hong Kong and Singapore

- Middle East: Abu Dhabi, Beirut, Dubai.

- Americas: Brazil, Miami, Uruguay.

Crédit Agricole Private Banking employs a total of nearly 2,800 people in 15 countries and manages over €100 billion in financial assets, which places the group among the leading European players in the sector (December 31, 2014).

For more information, visit www.ca-privatebanking.com

About CréditAgricole (Suisse) SA

A subsidiary of CréditAgricole Private Banking that operates under this brand name for its wealth management activities. Crédit Agricole (Suisse) SA, Geneva-headquartered company, is one of the top-five foreign banks in Switzerland in terms of client wealth, total assets and shareholders' equity. With some 1,400 employees, Crédit Agricole (Suisse) SA has three branches in Switzerland - Lausanne, Lugano and Zurich - and numerous international private banking business locations, including Abu Dhabi, Beirut, Dubai, Hong Kong, Montevideo and Singapore.

For more information, visit www.ca-suisse.com

Media Contacts:

FTI Consulting

Manash Bhuyan, +971 50 8419631, manash.bhuyan@fticonsulting.com

Tamara Khoury, +971 56 3485507, tamara.khoury@fticonsulting.com

CréditAgricole Private Banking

Julie Castille, +41 58 321 9103, julie.castille@ca-suisse.com

Melinda Raverdy, +41 58 321 9597, melinda.raverdy@ca-suisse.com

© Press Release 2015