PHOTO

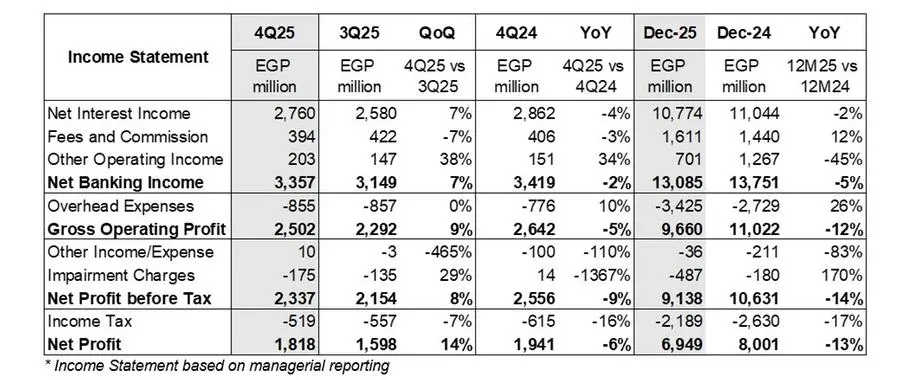

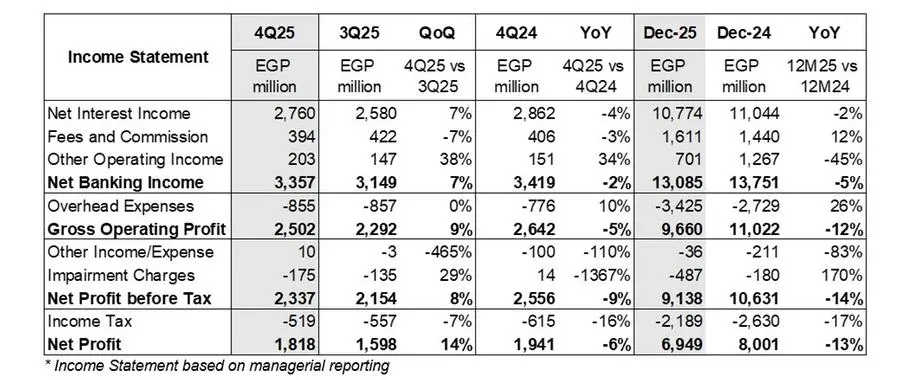

- Net Profit at EGP 6,949 million, down -13% Year-on-Year (Exceptional FX Income* in 1Q24);

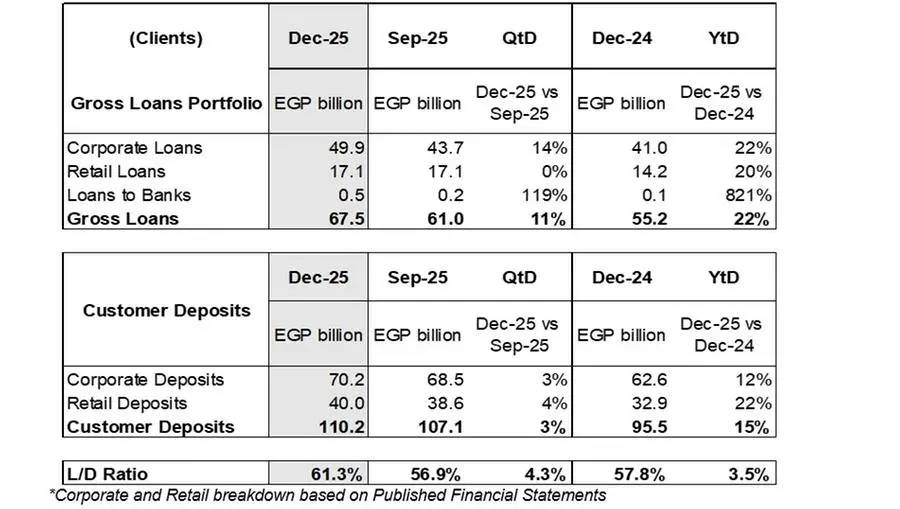

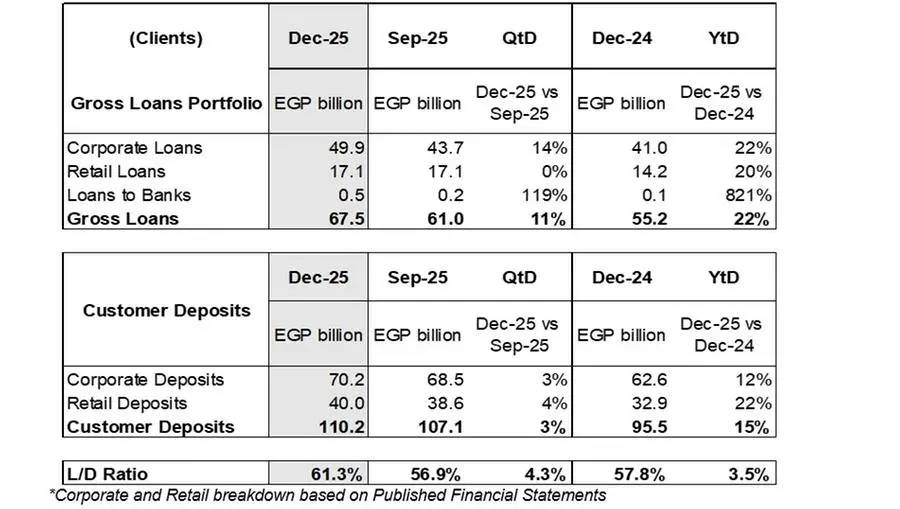

- Customer Deposits reached EGP 110.2 billion, up 15% Year-on-Year;

- Gross Loans reached EGP 67.5 billion, up 22% Year-on-Year;

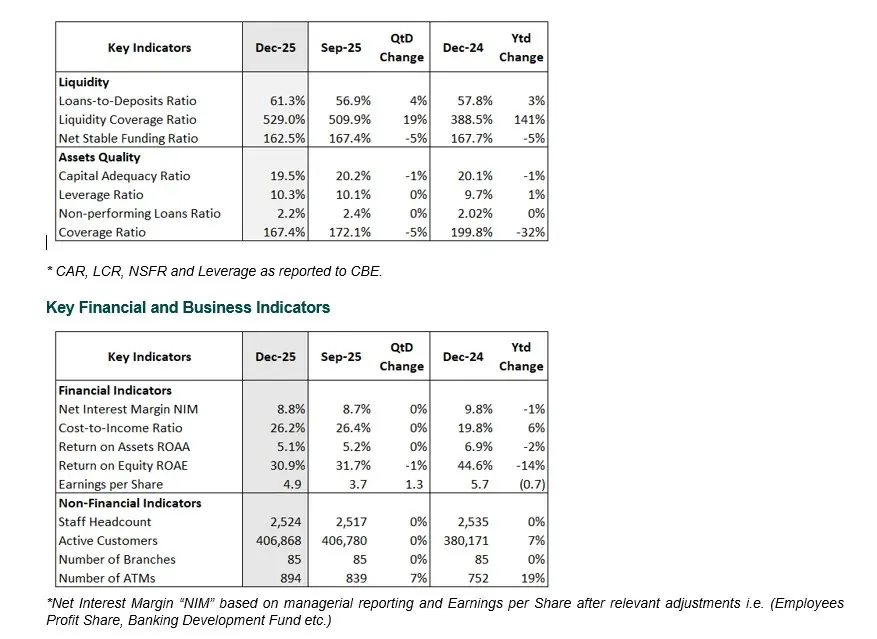

- Loans-to-Deposit Ratio at 61.3%, up 3.5% Year-on-Year;

- Current and Saving Accounts to Total Deposits reached 54.6%, down 2.5% Year-on-Year;

- NPL ratio at 2.2% up 0.2% Year-on-Year and Coverage Ratio at 167.4% down 32.4% Year-on Year;

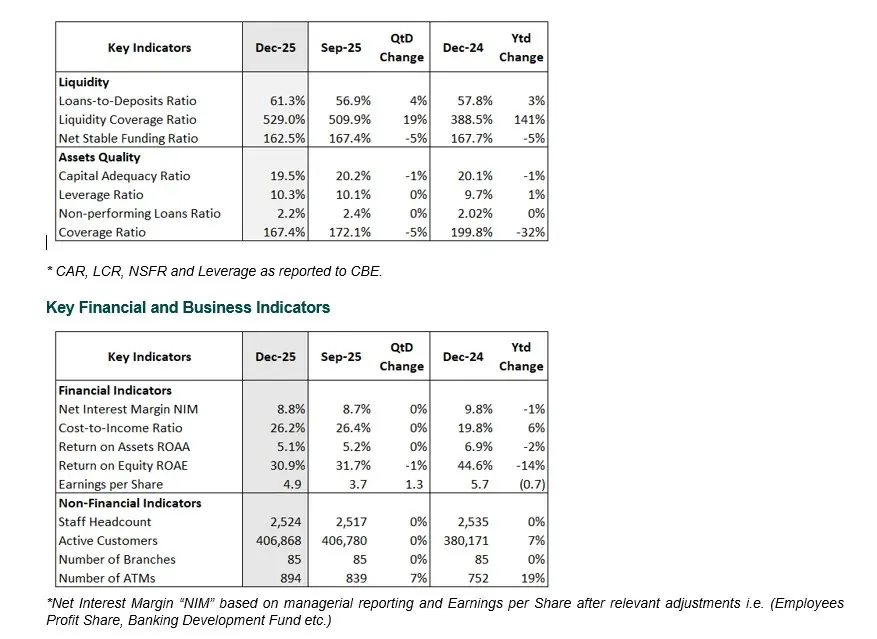

- Return on Average Assets (ROAA) at 5.1% down 1.8% Year-on-Year and Return on Average Equity (ROE) at 30.9% down 13.7% Year-on-Year;

- Cost Income Ratio at 26.2% Up by 6.3% Year-on-Year indicating regularization trend;

- Resilient Capital Structure, Capital Adequacy Ratio of 19.5% down 0.6% Year-on-Year;

* CAE benefitted from an exceptional volume of FX transactions in 1Q24 post devaluation due to clearance of import payments backlog which generated exceptional FX income impacting positively Net Profit, ROAA, ROE in 12M24.

Economic Dynamics:

The outlook for global economy has been relatively resilient, though exposed to persistent trade uncertainty, geopolitical tensions and slower demand growth. Meanwhile, inflation dynamics have been broadly stable, with central banks in both advanced and emerging market economies maintaining a cautious approach through gradual monetary easing. Nevertheless, the outlook is still subject to risks, particularly from limited rate reversals, possible supply-chain disruptions, commodity prices and resurgent geopolitical tensions.

Domestically, Egypt recovered well on economic activity in 2025 (+5% real GDP growth) with elevated business confidence driven by continued reforms, strong tourism, stable & liquid FX market, normalization of import & trade activities along with support from IMF and strategic partners (EU and GCC). The average headline Inflation reversed to 14.2% in 2025 (supported by base year) in line with its anticipated trajectory leading to real interest rates in the market thereby facilitating the Central Bank of Egypt (CBE) to reverse interest rates by 725 bps in 2025.

Crédit Agricole Egypt achieved good commercial growth as of 12M25

Commercial growth was good for all business lines during 2025 with the gross loan portfolio increasing by 22% YoY to reach EGP 67.5 billion and customer deposits increasing by 15% YoY to reach EGP 110.2 billion.

Corporate banking continues to deliver good performance in 12M25 driven by growth in lending portfolio by EGP 8.9 billion (22% YoY) while maintaining high asset quality and deposits portfolio growth by EGP 7.6 billion (12% YoY). The growth is catalyzed by strong customer engagement, dynamic liability profile management and high-value capital infusion flows. CAE continues to meet evolving client needs by having strategic focus on providing tailored financial & digital solutions and enhancing its product offerings to achieve diversified income streams which reflect quality of service delivered and emphasizes CAE role as a strategic partner in supporting clients’ sustainable growth objectives.

Retail banking demonstrated strong portfolio growth in 12M25 with loans increasing by 20% and Deposits by 22% YoY. This performance was driven by successful marketing campaigns, introduction of new products, and active client acquisitions, despite the competitive (CDs) market. Cash loans production remained good supported by campaigns and strategic cross-selling efforts. Auto loans exhibited robust growth of 90% YoY driven by higher number of tickets and ticket size.

Good growth in active customer base of 7% YoY resulting from key initiatives focused on customer acquisition (payroll), reactivation, loan campaigns, and cross-selling. This included launching new products i.e. new current account (EVE) tailored for women empowerment, AHLAN accounts (for non-digital and digital acquisition), Excellence Accounts for private banking customers, Cash Loan Program (Drive Cash), New FCY debit Card, Floating CDs (Elite, Golden and Platinum). The bank participated in events hosted by clubs, universities and closed communities.

Dynamic Commercial Activity and Solid Balance Sheet Structure

Commercial activity remained robust and above expected levels. This enabled the bank to effectively serve both corporate and individual customers with appropriate financial & digital solutions, contributing to growth in the active customer base. This positive outcome is evident in the key performance indicators: gross loans (including loans to banks) increased by 22% YoY to EGP 67.5 billion and customer deposits grew by 15% YoY to EGP 110.2 billion.

Profitability Performance

Net Banking Income (NBI) recorded anticipated decline in 12M25, decreasing by -5% YoY to reach EGP 13,085 million mainly due to decline by -45% YoY in other operating income (Exceptional FX income post EGP devaluation in March 2024). Excluding the exceptional FX income, NBI would have decreased by only -2% despite the reversing interest rate cycle. The Net Interest Income decreased by -2% resulting from interest rate cuts and increase in cost of funds. Commissions increased by 12% driven by customer service fees and bancassurance.

Operating expenses increased 26% YoY driven by inflation and tight labor market effect on compensation (including minimum wage regulations), IT related payments and marketing activities. Cost to Income Ratio (C/I) increased to 26.2% from 19.8% in 12M24 (regularizing trend) and Gross Operating Income (GOI) decreased by -12%, reaching EGP 9,660 million.

Higher cost of risk at EGP -487 million in 12M25 vis-à-vis EGP -180 million in 12M24 driven by retail risk charges plus higher good cost of risk on increased volumes and lower recoveries in 12M25.

As a result, the net profit has decreased by -13% YoY mainly driven by high exceptional FX income in 1Q24.

Sequentially, Net Banking Income (NBI) and Gross Operating Income (GOI) increase by 7% and 9% respectively QoQ. This outcome driven by increase in net interest income by 7% driven by higher commercial activities (despite interest rate cuts/higher cost of funds) and good FX/Trading business, operating expenses remained stagnant QoQ which reflect good control over expenses despite higher cost of risk.

High Quality of Assets, Strong Solvency and Liquidity

CAE's NPL ratio at 2.2% as of 4Q25, continues to rank among the best within the sector. This low ratio, coupled with a good coverage buffer, indicates the high quality of the bank's credit portfolio and its commitment to prudent risk management practices. This is strongly supplemented by the bank's robust liquidity and capital positions (exceeding regulatory requirements) indicating resilience against potential market shocks.

Digital Journey

Credit Agricole launched a transformed version of its banki Mobile app with extensive focus on UX (user experience) and optimized customer journey. An entirely revamped, secure, and user-centric one stop shop app offering intuitive navigation and advanced features. This transformation is part of CAE’s broader OMNI channel strategy, aimed at delivering a 100% human, 100% digital model that prioritizes convenience, innovation and seamless self-care user experience. With an agile infrastructure and open innovation approach, CAE continues to invest in digital capabilities, reinforcing its market-leading position and supporting national goals of inclusion and sustainability.

In 4Q25, Crédit Agricole Egypt (CAE) reaffirmed its leadership in digital banking with continued growth in customer adoption and engagement, processing over 6Mn digital transactions +45%in 4Q25 vis-à-vis 4Q24. With 99% of domestic transfers done digitally and over 30Mn outgoing INSTAPAY transactions since 2Q23, CAE remains a key player in Egypt’s evolving digital ecosystem.

For Corporate and SME customers, 48% are digitally active and 50% of the domestic transfers are digitally processed through the platform. Digital transactions grew +8% in 4Q25 vis-à-vis 4Q24 and +7% in 12M25 vis-à-vis 12M24. Online governmental payments increased in +21% in 4Q25 vis-à-vis 4Q24 and +26% in 12M25 vis-à-vis12M24.

CAE continues to capitalize on its unique onboarding journey for the payment acceptance product “banki Commerce” to achieve the twin objective of enabling clients to optimize their inflows and also contribute towards the Central Bank efforts for a "less cash society". "banki Commerce" has generated more than +100K e-commerce transactions processed through the new gateway since inception.

Top Employer Award

CAE has been certified as a Top Employer for two consecutive years by Top Employer Institute. The certification encompasses CAEs HR practices and policies on People Strategy, Talent Acquisition, Learning, Diversity, Equity & Inclusion, Well Being and Work Environment. This confirms the commitment of CAE towards employee development and the human-centric culture of empowerment, engagement and trust.

Sustainability and CSR Activities

The 4th CAE Sustainability Report was published during 4Q25 using the Integrated Reporting framework approach and in accordance with the Global Reporting Initiative (GRI) standards.

On CAE’s Annual Sustainability Day, cleanup activity was organized at WADI DEGLA Protectorate, where more than 100 employees (including families) joined forces to create a positive impact and preserve one of Egypt’s natural landmarks. It was followed by an awareness session on waste management, trash sorting and upcycling activities.

In solidarity with Breast Cancer Awareness Month, CAE proudly joined the global Pink October movement by lighting the Head Office in pink. CAE partnered with BAHEYA Foundation to commit to raising awareness on the importance of early detection and prevention. CAE donated 2 vital signs devices serving more than 18K patients per year.

CAE Foundation collaborated with AHL Masr Hospital for setting up and equipping 3 isolation rooms which will attend to at least 350 severely injured patients every year.

About Credit Agricole Egypt

CAE is the sole French Bank in Egypt established in 2006 and is listed in the Egyptian Stock Exchange. CAE has one subsidiary Egyptian Housing Finance Company (EHFC) licensed by the Financial Regulatory Authority (FRA) for Mortgage and Leasing business with 99.99% percent stake. EHFC has one subsidiary Just Finance S.A.E. licensed by the Financial Regulatory Authority (FRA) for Consumer Finance business with 99.99% percent stake.

Credit Agricole Egypt continues to leverage on its universal customer focused model, digital infrastructure, diversified expertise, solid balance sheet structure, prudent risk management, strong liquidity position and adequate capital buffer allowing the bank to pursue its strategic profitable growth by serving its customers as well as the economy.