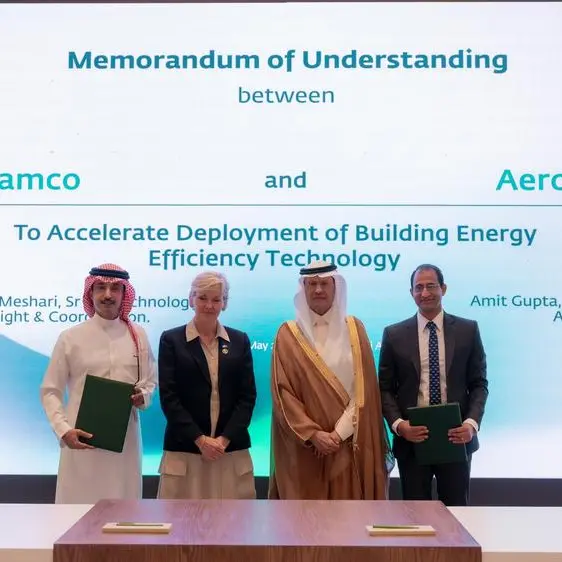

PHOTO

Abu Dhabi, UAE: Mubadala Investment Company, the Abu Dhabi sovereign investor, through its issuing entity Mamoura Diversified Global Holding (MDGH) announced the successful secondary listing of its dollar- and dirham-denominated bonds totaling US$4.5 billion and AED 750 million respectively, with a bell ringing ceremony at the Abu Dhabi Securities Exchange (ADX), one of the fastest growing exchanges in the world.

The listings on ADX included Mubadala’s highly oversubscribed debut Green Bond and Mubadala’s inaugural dirham-denominated bond, the first such dirham bond by a corporate in the United Arab Emirates. The listing of Mubadala’s green bond marks the seventh listing of a green debt instrument on ADX.

With interest from both local and international investors, the listing of Mubadala’s bonds on the ADX helps contribute to the growth of ADX’s bond market, diversifying financing resources and providing safe investment alternatives for investors.

On the listing of the bonds, Abdulla Salem Alnuaimi, Chief Executive Officer of ADX, said “We are delighted to see the listing of Mubadala’s Dollar and Dirham bonds on ADX, alongside their debut green bond, marking a great addition to our diverse bond offering. The strong interest in this listing demonstrates the confidence that investors have in the UAE's thriving capital markets. At ADX, we are committed to providing a robust and dynamic platform for companies like Mubadala to achieve their capital raising and investment objectives”

Commenting on the listing of the bonds, Carlos Obeid, Chief Financial Officer of Mubadala Investment Company, said: “This remarkable achievement strongly aligns with the Government’s strategic economic vision and objective of diversifying the economy of Abu Dhabi and making it globally integrated. It also underscores the resilience and dynamism of Abu Dhabi’s ever evolving Capital Markets.

“We recognize the significant role that the ADX plays in fostering economic development in Abu Dhabi and we are immensely proud to be contributing to the vibrancy and robustness of our financial markets through these new listings, which builds on our first ADX listing back in 2021”

-Ends-

About Mubadala Investment Company

Mubadala Investment Company is a sovereign investor managing a global portfolio, aimed at generating sustainable financial returns for the Government of Abu Dhabi.

Mubadala’s $276 billion (AED 1015 billion) portfolio spans six continents with interests in multiple sectors and asset classes. We leverage our deep sectoral expertise and long-standing partnerships to drive sustainable growth and profit, while supporting the continued diversification and global integration of the economy of the United Arab Emirates.

For more information about Mubadala Investment Company, please visit: www.mubadala.com

For media enquiries, please contact:

Roland Buerk - Senior Vice President, Corporate Communications

E: rbuerk@mubadala.ae

About Abu Dhabi Securities Exchange

Abu Dhabi Securities Exchange (ADX) was established on November 15 of the year 2000 by Local Law No. (3) Of 2000, the provisions of which vest the market with a legal entity of autonomous status, independent finance and management. The Law also provides ADX with the necessary supervisory and executive powers to exercise its functions. On 17th March 2020, ADX was converted from a “Public Entity” to a “Public Joint Stock Company PJSC” pursuant to law No. (8) of 2020. ADX is part of ADQ, one of the region’s largest holding companies with a broad portfolio of major enterprises spanning key sectors of Abu Dhabi’s diversified economy.

ADX is a market for trading securities; including shares issued by public joint stock companies, bonds issued by governments or corporations, exchange traded funds, and any other financial instruments approved by the UAE Securities and Commodities Authority (SCA).

ADX is the second largest market in the Arab region and its strategy of providing stable financial performance with diversified sources of incomes is aligned with the guiding principles of the UAE “Towards the next 50” agenda. The national plan charts out the UAE’s strategic development scheme which aims to build a sustainable, diversified and high-value added economy that positively contributes to transition to a new global sustainable development paradigm.

ADX

Abdulrahman Saleh ALKhateeb

Manager of Corporate Communication

Email: ALKhateebA@adx.ae