PHOTO

Abu Dhabi, UAE: Abu Dhabi Islamic Bank (ADIB), a leading financial institution, has announced the publication of its debut Sustainable Finance Framework with the report from the Second Party Opinion from ISS Corporate Solutions. The framework establishes criteria and eligibility requirements that determine which projects are labelled “green”, “social”, or “sustainable”. The framework will determine eligibility of projects for the bank to finance or refinance, including the issuance of Green, Social and Sustainability Sukuks.

Emphasis is placed on projects with environmental benefits across renewable energy, energy efficiency, green buildings, pollution prevention and control, sustainable water and wastewater management, clean transportation and projects supporting social objectives, including access to healthcare and education, employment generation and affordable housing.

Nasser Al Awadhi, ADIB Group Chief Executive Officer, said: "The development of our Sustainable Finance Framework is an important step on our journey to embedding sustainability as a cornerstone for ADIB. Having a clear and structured criteria for assessing the quality of projects from a sustainability standpoint is essential for informing our decision-making capabilities. It is our hope and belief that by integrating ESG risk assessment into the bank’s credit processes, ADIB will provide added value to both our clients and to the society.”

ADIB issued its ESG strategy, which is seamlessly integrated into ADIB’s sustainability framework, encompassing key pillars such as maximizing positive impact, becoming a lifelong partner of customers, fostering a strong economic footprint, maintaining a people-centric organizational culture, upholding governance excellence, and remaining a steadfast lifelong partner for communities.

ADIB received a Second Party Opinion from ISS Corporate Solutions (“ISS”) for the framework, which ensured alignment of the framework with the ICMA Green Bond Principles, Social Bond Principles, Sustainability Bond Guidelines, as well as the Loan Market Association Green Loan Principles and Social Loan Principles. Standard Chartered Bank is the sole sustainability structuring bank in the development of ADIB’s Framework with the support of ADIB.

- To view the framework, please click here

- To View the SPO Click here

-Ends-

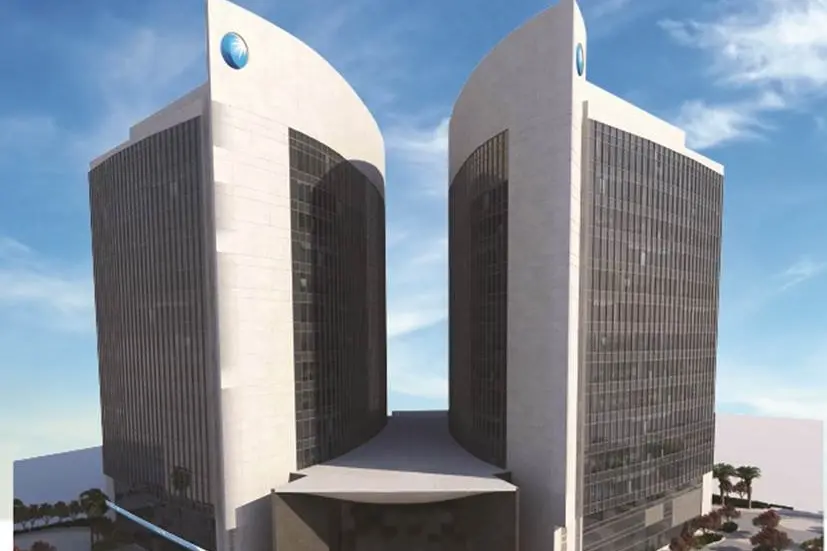

About ADIB

ADIB is a leading bank in the UAE with more than AED 184 billion in assets. The bank also offers world-class online, mobile and phone banking services, providing clients with seamless digital access to their accounts 24 hours a day. ADIB provides Retail, Corporate, Business, Private Banking and Wealth Management Solutions. The bank was established in 1997 and its shares are traded on the Abu Dhabi Securities Exchange (ADX).

ADIB has a strong presence in six strategic markets: Egypt, where it has 70 branches, the Kingdom of Saudi Arabia, the United Kingdom, Sudan, Qatar, and Iraq.

Named the Best Islamic Retail Bank by The Digital Banker, and Best Bank in the UAE by Global Finance Awards, ADIB has a rich track record of innovation, including introducing the award-winning Ghina savings account, award-winning co-branded cards with Emirates airlines, Etihad and Etisalat and a wide range of financing products.

For media information, please visit www.adib.ae