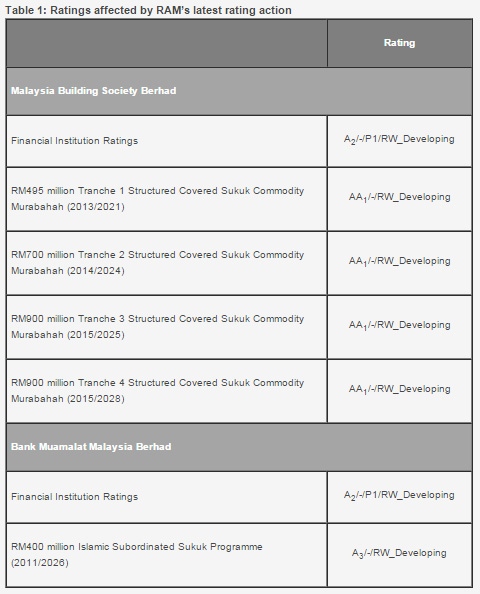

RAM Ratings has placed Malaysia Building Society Berhad and Bank Muamalat Malaysia Berhad as well as their rated debt issues on Rating Watch, with a developing outlook. The rating action had been triggered by the announcement on 1 October 2015 that MBSB had obtained Bank Negara Malaysia's (BNM) approval to commence negotiations for the merger of its operations with those of Bank Muamalat.

The ratings have been placed on a developing Rating Watch as details of the proposed funding plan, capitalisation levels, integration time line and approach as well as the final group and shareholding structures are still unavailable. These matters are expected to be the subject of negotiations over the next 3 months. The largest shareholders of MBSB and Bank Muamalat are the EPF (64%) and DRB-HICOM (70%). At present, MBSB has to comply with BNM's requirements vis-à-vis certain prudential ratios on capital, funding and liquidity. It is uncertain whether such requirements will still be compulsory after the proposed merger. RAM will assess the impact on each entity's ratings when more concrete information becomes available.

A merger between MBSB and Bank Muamalat could result in Malaysia's second-largest Islamic bank, with more than RM60 billion of assets (as at end-June 2015). As both entities are mainly focused on personal financing (PF), the merged entity would also be a key PF player. In addition, both entities are predominantly focused on consumer financing.

Alongside the benefits from an enlarged business franchise and a sharper competitive edge for both entities, the merger will also increase MBSB's funding sources; it currently does not have access to low-cost current-account deposits due to the absence of a banking licence. Meanwhile, Bank Muamalat's largest shareholder, DRB-HICOM, is required to pare down its 70% stake in the bank to 40%, as required by BNM as a condition precedent to its purchase of the bank in 2008.

In terms of asset quality, both MBSB and Bank Muamalat share similar characteristics; their personal financing portfolios show better credit quality than their non-personal financing segments. On this note, more than 90% of the merged entity's personal financing portfolio will be repaid through direct salary deductions. Its gross impaired-financing ratio and credit cost are estimated to come in at around 5.7% and 1.0%, respectively. MBSB has been striving to align its policies with the banking industry's norms, e.g. a more stringent impairment provisioning policy. As such, we expect the credit-cost ratio of the merged entity to remain elevated over the next 1-2 years.

RAM's Rating Watch highlights a possible change in an issuer's ratings. It focuses on identifiable events such as mergers, acquisitions, regulatory changes and operational developments that place a rated debt under special surveillance by RAM. In a broader sense, it covers any event that may result in changes in the risk factors relating to the repayment of principal and interest.

Issues will appear on RAM's Rating Watch when some of the above events are expected to or have occurred. Appearance on RAM's Rating Watch, however, does not inevitably mean that the rating will be changed. It only means that a rating is under evaluation by RAM and a final rating decision will be announced in due course. A "positive" outlook indicates that a rating may be raised while a "negative" outlook indicates that a rating may be lowered. A "developing" outlook refers to those unusual situations in which future events are so unclear that the rating may potentially be raised or lowered.

Media contact

Choong Andrea

(603) 7628 1115

andrea@ram.com.my

© Press Release 2015