PHOTO

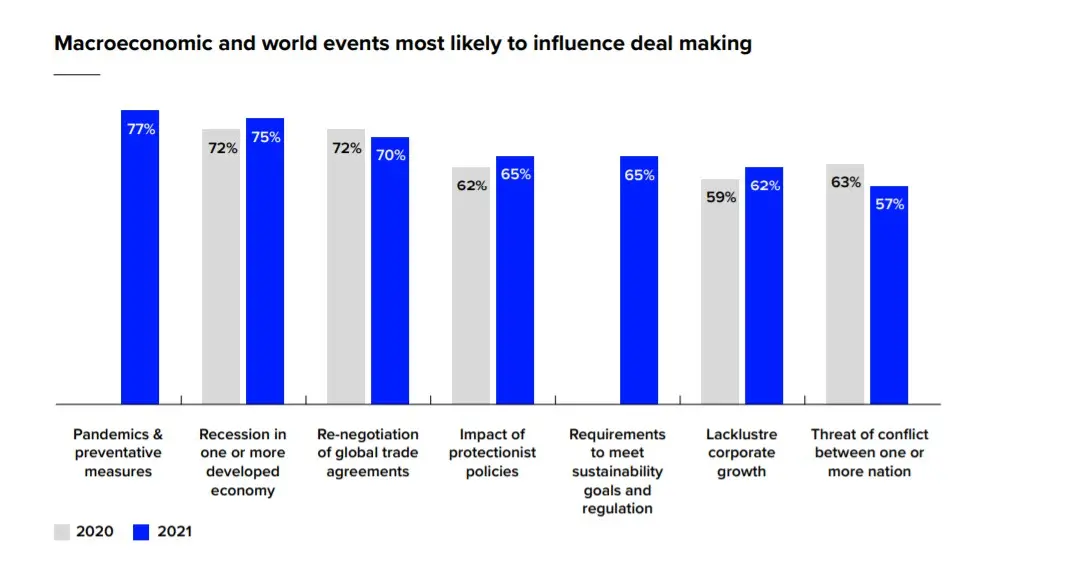

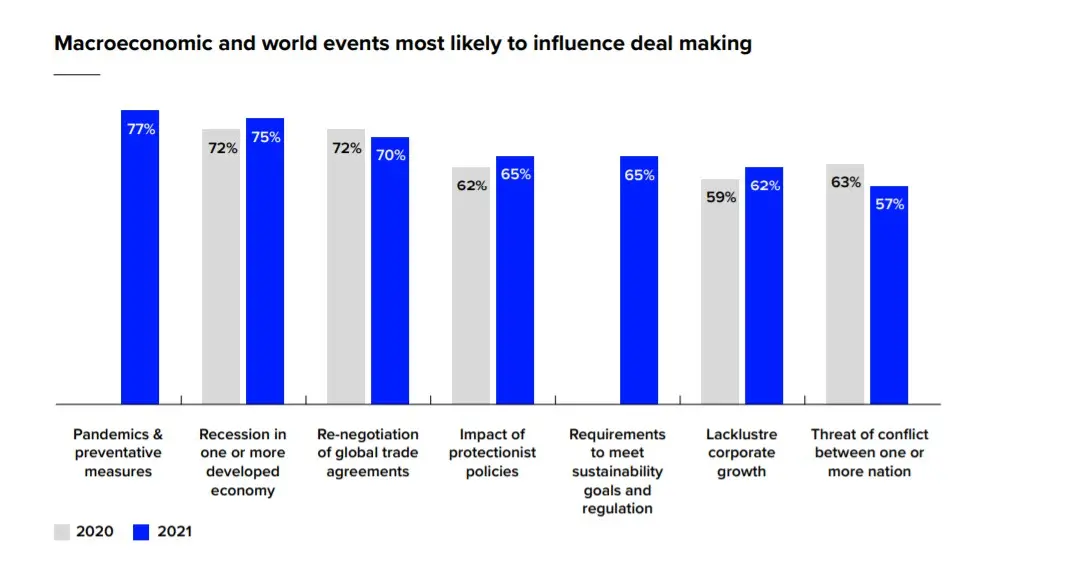

Global data provider Refinitiv asked more than 460 deal makers about external risks that could dent deal-making in 2021. It should come as no surprise that "pandemics and preventative measures" were the most commonly cited external risks. Requirements for meeting sustainable goals and regulation were also cited by respondents as a deterrent to deal-making.

The threat of recession in one or more developed economies, the impact of protectionist policies, and concerns about lacklustre corporate growth, remain important at 75 percent, 65 percent and 62 percent respectively. In addition, the renegotiation of global trade agreements remains front-of-mind for 70 percent of deal makers, Refinitiv said in its report that focued on external and macro risks for deal makers in 2021.

"On top of these, a new factor is mentioned: the requirement to meet sustainability goals and regulation, cited by 65 percent of respondents. However, unlike other exogenous factors, sustainability is just as likely to be a driver of deals as a deterrent," the report noted.

Similar to last year, majority of deal makers believe Brexit will lessen the attractiveness of UK companies, while a significant minority of 21 percent disagree that UK companies’ targets will be less attractive. Meanwhile, 65 percent of deal makers agree that European targets will become more attractive.

Notably, banks (73 percent) and Americas-based respondents (71 percent) are particularly bullish on European companies.

According to 56 percent of respondents, the economic environment remains the factor most widely expected

to influence M&A during 2021. 'External factors’ – chiefly pandemic- and vaccine related concerns – spiked from single digits to 32 percent, the report said.

Globally M&A activity surged in Q1 2021. Around half the deals came from the US where volumes were up 160 percent year on year at $654.1 billion.

While the number of deals was up only 6 percent from a year ago, the total value of pending and completed deals rose 93 percent to $1.3 trillion, according to Refinitiv.

Completed M&A advisory fees registered a 1 percent downtick compared to a year ago with $7.7 billion in fees globally, the weakest annual period since 2016. Syndicated lending activity reached $5.5 billion, posting an 6 percent increase compared to a year ago.

M&As with MENA involvement reached $17.1 billion during the first three months of 2021, according to a Q1 report from global data provider Refinitiv.

MENA M&As saw a 19 percent increase in value compared to the same period in 2020, reaching a record number of deals at 270, the highest ever start to a quarter.

(Writing by Seban Scaria ; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021