United States President Donald Trump said on Friday he was pushing ahead with hefty tariffs on $50 billion (£37.6 billion) of Chinese imports.

China’s Commerce Ministry said it would respond with tariffs “of the same scale and strength” and that any previous trade deals with Trump were “invalid”.

The official Xinhua news agency said China would impose 25 percent tariffs on 659 U.S. products, ranging from soybeans and autos to seafood.

Global markets

Asian shares fell on Monday on trade tensions between the U.S. and China.

MSCI’s broadest index of Asia-Pacific shares outside Japan skidded 0.4 percent to its lowest level since May 31.

“The on-again off-again possible global trade war is looking to be back on again as the U.S. and China announced tariffs on each other’s imports,” Nick Twidale, Sydney-based analyst at Rakuten Securities Australia, told Reuters.

“This looks set to be the main theme that investors will focus on... with any further escalation in tension adding to the downside risk.”

Middle East markets

Stocks in the Middle East traded in low volumes last week ahead of the Eid Al Fitr holiday.

Markets in many Middle Eastern countries are still closed for Eid Al Fitr holiday, including Saudi Arabia, Egypt and Qatar and will reopen later in the week.

On Thursday, Abu Dhabi's main index jumped 1.8 percent, as shares in the United Arab Emirates' biggest lender First Abu Dhabi Bank (FAB) gained 3.3 percent and Etisalat rose 2.1 percent.

In Dubai, the index closed down 0.4 percent as Emaar Properties dropped 0.9 percent and shares in DAMAC Properties, another major Dubai developer, ended the day 1.2 percent lower.

Markets in the UAE reopen today after Eid Al Fitr holidays.

Qatar's index rose 0.2 percent on Thursday. Qatar Gas Transport shares surged 3.2 percent and Qatar Islamic Bank and Masraf Al Rayan each increased 1.5 percent.

Saudi Arabia's stock exchange was closed on Wednesday and Thursday and Oman's Muscat bourse was also closed on Thursday.

Kuwait’s index rose 0.3 percent, Bahrain’s index rose 0.9 percent, while Egypt’s index added 0.3 percent.

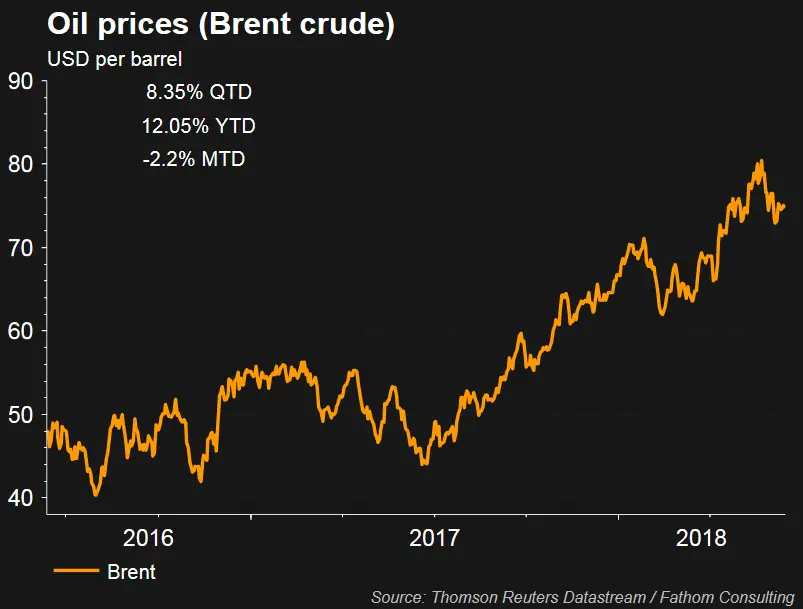

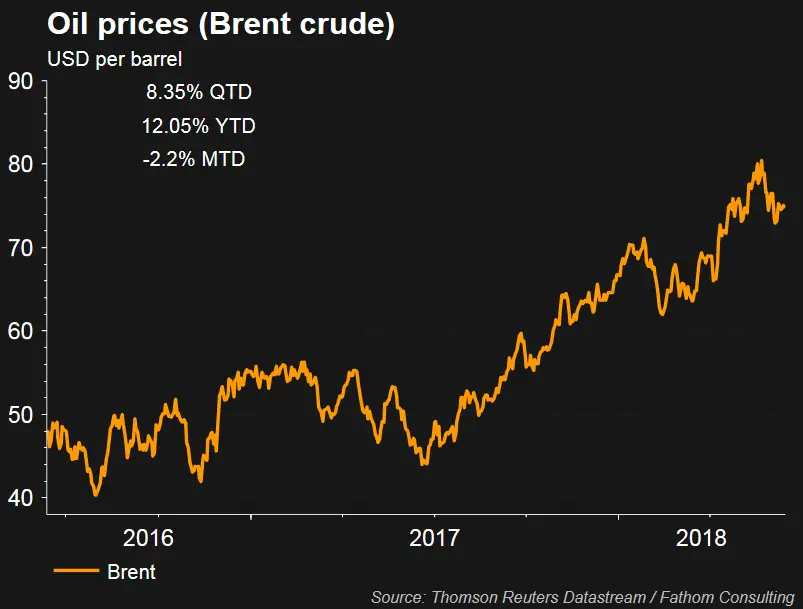

Oil prices

Oil prices fell early on Monday as trade tensions between the U.S. and China weighed on prices.

U.S. West Texas Intermediate (WTI) crude futures were at $63.84 a barrel, down $1.22, or 1.9 percent, from their last settlement.

International oil prices also fell, with Brent crude futures down 79 cents, or 1.1 percent, at $72.65 per barrel.

OPEC and its allies will meet in Vienna on June 22 to decide forward production policy.

“Most industry observers are expecting a production rise,” Stephen Innes, head of trading for Asia-Pacific at futures brokerage OANDA, told Reuters, although he added that “the magnitude and timing of the boost remain uncertain”.

The world's top oil producers will meet in Vienna on Friday and Saturday to review their production agreement.

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Currencies

The dollar index versus a basket of six major currencies edged up 0.1 percent to 94.862 early on Monday.

The euro fell 0.15 percent to $1.1592, extending losses after sliding 1.3 percent the previous week after the European Central Bank signalled it will keep interest rates at record lows well into next year.

Precious metals

Gold prices inched higher early on Monday as a trade dispute between the U.S. and China triggered safe-haven buying.

Spot gold had edged up 0.2 percent to $1,281.41 per ounce by 0045 GMT. It touched its weakest since late-December at $1,275.01 an ounce on Friday.

(Writing Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

A new version of the Trading Middle East newsletter is being launched on June 27, 2018. To keep receiving the newsletter after this date, please subscribe using this link.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018