PHOTO

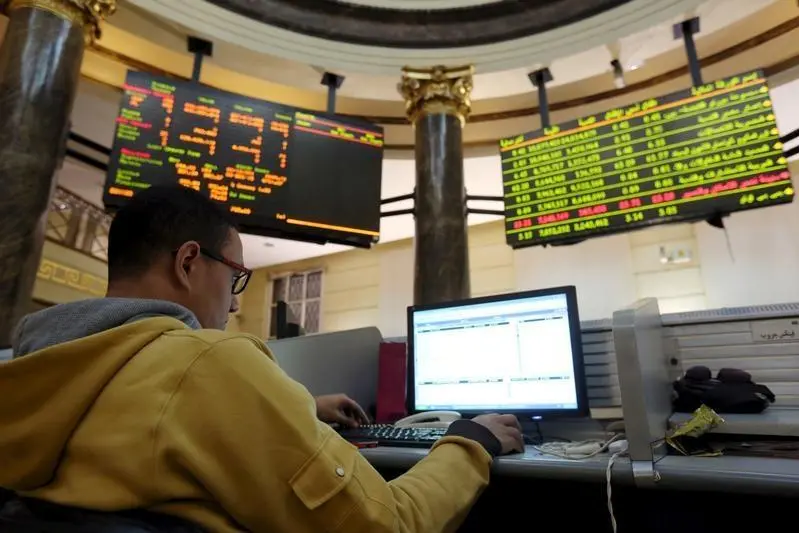

Egyptian shares dropped to a six-week low on Thursday as investors fled stocks across the board, while the Saudi index was little changed after OPEC and its allies agreed to taper record oil supply curbs from next month.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, a group known as OPEC+, agreed on Wednesday to scale back production cuts from August as the global economy slowly recovers from the COVID-19 pandemic.

The benchmark index in Saudi Arabia, the world's top crude oil producer, edged up 0.1% with Saudi British Bank advancing 2.6% while petrochemicals group Saudi Basic Industries eased 0.2%.

Egypt's blue-chip index fell by 1.7%, hitting its lowest since June 4, with 22 of 30 stocks ending in negative territory. Commercial International Bank retreated 2.5%.

Dubai's main index ended 0.2% up, supported by a 1.9% fall in Emaar Properties, ending four straight sessions of losses.

A downgrade last week of Dubai's flagship real estate company, Emaar Properties, is likely to push up the emirate's borrowing costs if it decides to refinance $750 million in bonds due in October, Reuters reported, citing bankers and analysts.

The credit ratings of government-related entities are often seen by investors as a proxy for Dubai, which is not rated by any of the major ratings agencies.

S&P Global Ratings downgraded Emaar to a BB+ "junk" rating from an investment grade BBB-, saying it expected a 30-40% slump in the company's earnings this year.

The Abu Dhabi index, which lost 1.6% in the previous session, rebounded 1.3%, buoyed by a 2.6% gain for the country's largest lender First Abu Dhabi Bank .

In Qatar, the index eased 0.9% as petrochemicals company Industries Qatar lost 3.6% and Qatar Islamic Bank declined 2.3%.

(Reporting by Ateeq Shariff in Bengaluru Editing by David Goodman ) ((AteeqUr.Shariff@thomsonreuters.com; +918061822788;))