PHOTO

Saudi Arabia’s insurers have reported weak profitability in H1 2019, encouraging mergers and acquisitions in the sector, Moody’s Investors service said.

According to the ratings agency, profitability of insurance companies was dragged lower due to intense competition, which drove up business acquisition costs, weighing on the industry's underwriting performance.

Saudi insurers’ average return on capital (ROC) in the first half of the year was 2.4 percent, compared to 4.6 percent in 2018 and 8.4 percent in 2017, reflecting a weaker underwriting performance.

“The weaker underwriting result is largely due to an increase in business acquisition and other costs, which drove a 2.9% increase in the industry's H1 2019 expense ratio,” Moody’s said in a report.

“This in turn reflects highly competitive conditions that forced market participants to offer higher commissions and discounts to secure business,” the report added.

The ratings agency expects competition to remain intense for now, but said that larger and more sophisticated insurers focused on underwriting profitability and good brand recognition are best equipped to withstand the pressure. This is reflected in an average ROC of 6 percent in H1 2019 for Saudi Arabia's 12 most profitable operators, well above the industry average of 2.4 percent, it said.

Moody’s does not foresee a significant improvement in the industry’s capitalisation as long as current profitability pressures persist.

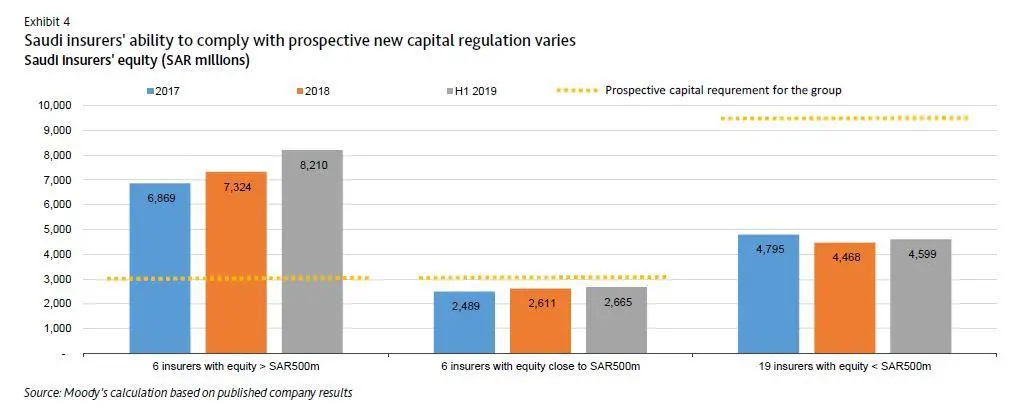

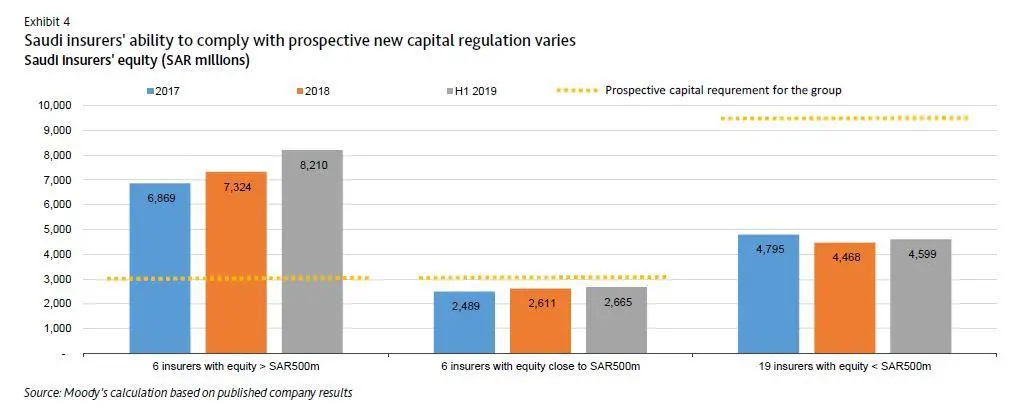

“The sector also faces a likely increase in the minimum capital requirement for primary insurers to SAR500 million ($133 million) from SAR100 million currently,” Moody’s said.

“Small to medium-sized companies may find it difficult to meet this fivefold increase from their own resources, given current profitability headwinds. Regulators have discussed the measure with the industry, although it remains unclear when higher capital requirements will take effect,” it added.

At present, only six of Saudi Arabia's 31 active insurers comply with the prospective higher capital requirement and a further six are close to compliance, while the remaining 19 insurers would face significant shortfalls, the ratings agency said.

Moody’s expects these 19 insurers to “come under increased pressure to consolidate or to enter in run-off.”

“Given the difficulty to extract merger synergies and generally low appetite for M&A, we believe that a good number of Saudi insurers will enter in run-off,” it added.

The ratings agency also expects premium growth to remain flat to modest over the coming year, adding pressure on profitability, particularly for smaller players with inefficient cost bases and little brand recognition.

(Writing by Gerard Aoun, editing by Seban Scaria)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019